Hi traders-

Last week was another week sandwiched between my levels with little to no activity outside of my levels shared in the weekly plan earlier.

The week itself was fairly event packed with conclusion of Jackson Hole, as well as major speeches by both the FED Chair Powell and the ECB President Christine Lagarde.

Wednesday, Thursday and Friday were the most active sessions of the week with very large ranges, particularly on Friday the large ranges extended both to the upside and the downside.

Various economic data came in weaker in shape of the Manufacturing and Services PMIs, not just in the US, but globally that showed contraction in both manufacturing and services sector activity.

On the related markets front, major markets like Bonds saw a bounce, yields dipped lower and Dollar softened a little bit with nice rallies in both Gold and Oil from the lows.

This was also an excellent week to see some examples of technical levels playing out as they should. If you remember, last couple of weeks we saw the OrderFlow weekly Line in Sand dip down, making a lower low near 4500 after months of sustained higher highs. High of this week was very close to this 4500 level before selling off about 150 points from this level. This sell off coming after we rallied about 150 points higher from some of my lower weekly levels shared last week.

Volatility itself increased this week but it is still nowhere near some of the 2022 volatility levels. I like to see about a 200 dollar weekly range as optimum st trading range, and this week we came close to it, but not completely there yet.

NVDA Ceases Sizzle

Welcome to another installment of my personal journal in form of this blog. In this weekly installment, I will be talking about where I see next 150-200 points come in the emini Index, as well as my thoughts on if I see a bounce or more sell off in some names like NVDA, TSLA, SMCI etc. I will be sharing levels in LULU for its earnings. I am also introducing 2 new AI names which are on my radar. To read about this, please subscribe now and receive posts like this almost every day in your email.

NVDA in particular flopped spectacularly on the weekly time frames after gapping up at one point above 500. It lost about 10% of its value this week from that high carved out on backs of its ER and CEO Huang AI comments. It was set to close the week below 450 but it did manage to find some bidders on Friday.

On TSLA front, the levels shared by me last week were excellent. They were resistance and represented high of the week for most part, often times selling down whenever approached throughout the week.

However on Friday, I shared my bullish bias on TSLA as long as 220 held. This was around 229 and the stock rallied about 10 dollars to close the week near 239 on Friday.

Of late, TSLA has lost its luster to the likes of NVDA- NVDA for instance has captured the imagination of market participants as it appears to project that it has captured the AI market in its entirety.

This may not be the case as I see very stiff competition in the AI space. It is just that NVDA just happens to be the very first one of the companies to strike it rich in the AI race. However, it will not be the last and certainly it will not be the only one!

In the chips industry alone, the action has been fairly positive but I think other industries will also catch on to the AI bandwagon and AI generated profits should start showing up on their earnings sooner or later.

My levels for next week

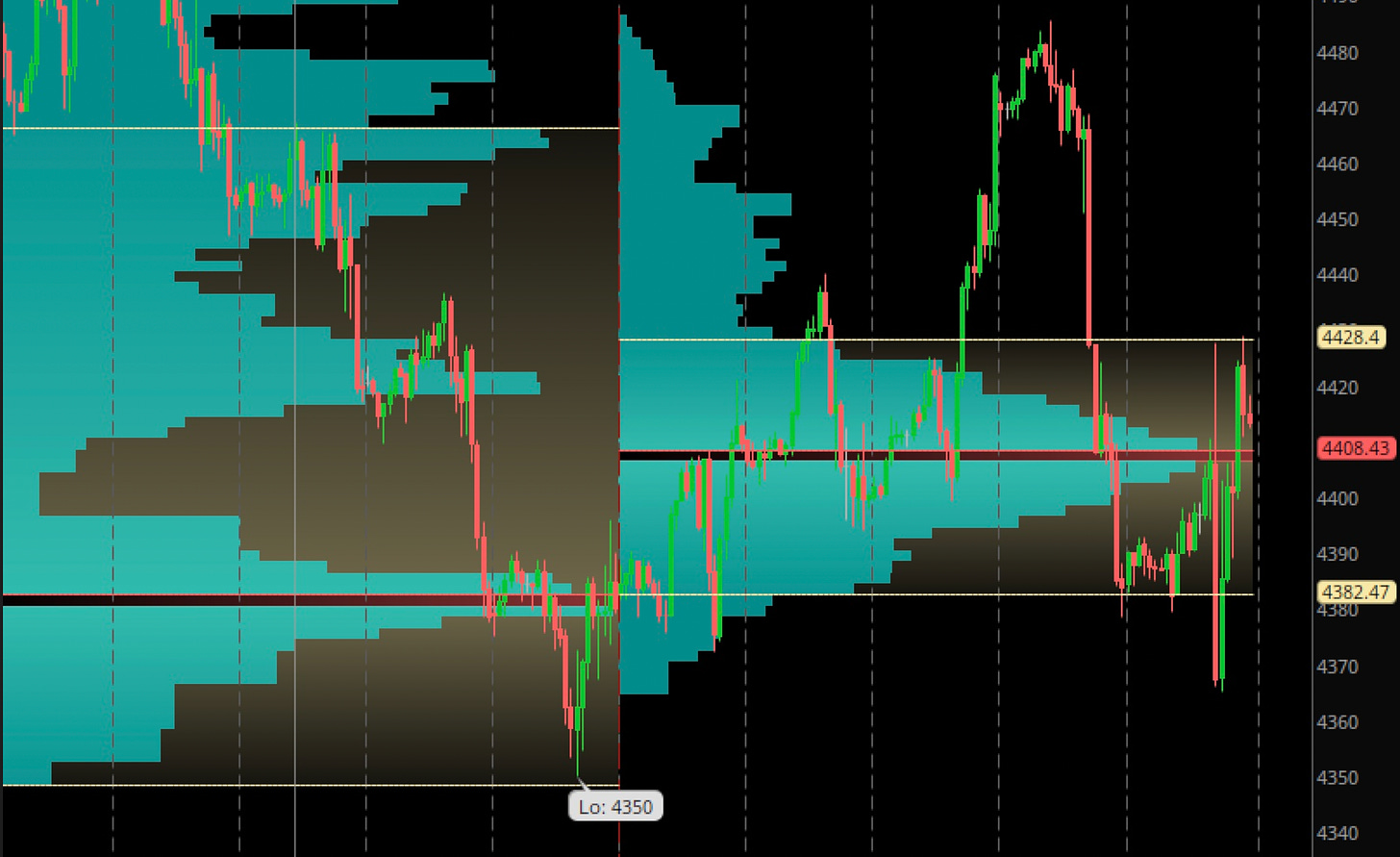

Technically, despite the chop and volatility last week, the week itself was not very interesting with a well defined, rounded balance area towards the lows of the week.

See Image A below.

This type of consolidation can often precede a break in volatility, unless these lows are taken out.

This sort of an auction profile is good news if you are a bull and not so good news if you have been expecting lower prices. More on this later in a bit.

On the related markets front, Gold was supported at the levels I shared earlier and at one point it rallied about 50 points from those lows.

Gold is a good proxy about hawkishness or perceived dovishness by the FED. I believe it really does not matter any more if the FED is dovish or hawkish. I do not understand why folks pay so much attention to what the FED says when clearly they have been behind the ball from last couple of years. May be it is out of habit.

FED in general and Powell in particular have limits to what they can and can not do as far as being uber hawkish is concerned. The FED is meant to be an independent, private organization from the US government branch. However, it works very closely with whoever happens to be in the admin at any given time. This is why it becomes very hard for this FED to remain uber hawkish with only 3 months now left to go full swing into the US Presidential election year campaign. Powell is going to come under enormous pressure very soon if the US starts slipping into recession. Right now he is taking an aloof stance and sounding firm, however it will not take a lot for him to be singing an extremely different tune.

This market smells that.

This is why despite his hawkish stance, despite the claims about “higher for longer”, no one really believes him and this can be seen in prices of various things, like the S&P500 at 4400 or TLT at 90!

If Powell is really serious about bringing inflation down to 2% or lower, I will challenge him to shrink the FED balance sheet, which still sits at 9 trillions to below 4-5 trillion where it was right before the 2020 craziness started.

This will never happen of course, because it will be a truly catastrophic event for risk on assets. In fact, I predict this balance sheet to grow and double. I predict the FED balance sheet will exceed 20 trillion at some point.

Others realize this too. For instance, globally a lot of Central banks understand this and are stocking up on physical Gold as they prepare for an eventual decline, and then demise of the US dollar. This is obviously not going to happen tomorrow, however, if we give it a decade or so, the odds are high.

If you do not believe this can happen, consider the case of Sterling, the currency of United Kingdom.

At start of the 20TH Century, the Sterling was the main reserve currency globally with about 100 % of all reserves held as Sterling pound. The empire was strong and in some cases still expanding.

By 1950, this share of Sterling as World’s FX reserve was down to about 50%. This decline happened with the UK fighting endless wars and imperial doom & gloom in form of important erstwhile colonies in Asia, Africa gaining freedom.

Today? The UK Sterling is down to about 4% of global reserves and declining every year.

US dollar will also suffer a similar fate. It is not if but when.

The rate and speed of the US dollar decline as Global reserve currency is directly proportional to the FED balance sheet.

What will take its place to facilitate trade?

I am not sure yet but as regional power centers emerge, there may not be a reason or a need for a global reserve currency any more. Right now the world only has one super power, but once it declines, there may be room for 5-6 regional, continental powers each pushing its own FX. May be with advancements in technology, it will be a crypto currency backed by tangible asset like Gold. Too early to tell.

Inflation is cumulative.

The US media, admin and the FED like to tout inflation coming down from 9% peak in 2022 to near 4% now. But almost no one talks about the fact that the inflation is cumulative.

It may be 4% now, down about half from 9% it was a year ago, but that does not mean that the price increases that have been already attained in housing, food, fuel, healthcare, insurance are about to roll back any time soon. Those price gains are now permanent. For instance, the average new car prices are now 35000 USD despite inflation in that sector being almost 0. Average new car prices only few years ago used to be 25000 USD. You could buy a decent daily driver for 20-25G only 5-6 years ago. Now you need 30-35G. To go back to old prices, it will require about a decade of deflation in the US.

This is why I never understood a 2% inflation goal when the average salaries barely grow above that rate.

In my view, the inflation goal should be 2-4% below average wage growth rate. So if the wage growth rate is 4% in the US, then inflation rate goal should be 0%. A few years of this will help reset the higher prices and make affordability great again.

If this ever happens, I may cut the prices of this publication too. However, until then, I plan to keep on increasing the prices to as much as 100 dollars a month. Subscribe now, and do not be left in the cold while the prices are still so low! If you have already subscribed then ask your folks to subscribe to gain unique insights not available anywhere else.

Back to my weekly levels

I said last week that I do not see much directional clarity unless we were to take out some of the weekly levels from my plan last week. This has not changed this week either. If you have not already, I recommend you read up on my weekly plan from 8/20.

This means my key levels this week remain 4350 and 4500.

Scenario 1: There may be support near 4350 if this level is visited for a bounce higher into 4500 level.

Scenario 2: The bears need to take out 4350 and keep the Daily level closes below 4350 to target next support which could come in near 4200. Minus such a close below 4350, we could see this level supported for a test of 4500.

At time of this post, we last traded around 4410.

These are emini levels for September. For SPX levels, take out about 15 from these levels. For SPY, divide by 10.

Slightly longer term, beyond this week, I think if the general market remains supported here above 4400, what I read into the action of NVDA and AAPL is that this market could rotate from mega caps into smaller caps. Smaller caps are generally much more sensitive to moves in underlying economic data and if the economic data remains supportive, this could be good for these small caps. Oil prices are one of the things I personally use to gauge the economic health. With Oil prices buoyed here above 80 level (WTI), this shows to me that the economy is not dead yet and this could be supportive of these smaller caps.

Image B below with Russel IWM small cap index.

I think if we are able to hold this 180 support, we could see a retest of 192-195 on IWM ETF.

With the new quarter starting next week, if the general market remain supported above 4400, it could entice some funds to rotate back into these small caps as the moves in small caps are larger due to, well, their smaller size. This could help offset some funds some of their losses from earlier in the year. So, in other words if the S&P500, which is a very large index were to rise 5%, the same move could translate to a 10%+ move in Russel and even larger move in some of Russel components.

Below are some of the names which I think could do well if this thesis were to play out.

XPO

Now XPO is not strictly a small cap as with tremendous returns this year the market has propelled it to almost 8 billion valuation. However compared to the likes of your typical S&P5 or S&P7, it is a baby. I had many weeks ago shared 60-63 as support on this before it rallied to almost 80. That level remains unchanged.

So, with XPO support around 60, I think it can rally to almost 100. Now the context about this remains that the general market also remains propped up here. IF we begin making new lows in the general market, then this context is also not valid, though I will still like XPO but it could the trade lower prices below 60.

SMCI

If you read this blog for a while now you remember my bullish call on SMCI near 60 dollars at start of the year.

It rallied almost to 400 bucks but then fell down to trade near 250 now.

Do I think it can rally back to 400-500 now?

This stock reminds me of a similar name I was bullish on during 2021: CELH.

I was bullish on CELH at 30! But only long term readers will remember that who have been loyal readers for over a year + now.

Same way there is a lot of volatility in SMCI now. When you take a small cap that goes up 500% in a few months , it is to be expected.

However I think SMCI may be forming a larger range to retest some of its recent highs above 350.

I think it could remain volatile in months to come; however, closer it is to 200, nearer in my view it is to support. It is about 250 right now.

The reason it could be supported is the same reason I shared about IWM Russel above. The recession has not yet arrived in the US. Even if it is here, the people in charge of measuring recession have now changed the definition of recession like the math behind CPI calculations was changed in 2022 when it hit almost 10%.

This means if you are poor hedge fund who has only made 1-2% this year and you saw your friend make 200% on her NVDA longs alone, then you are thinking about how to catch up. One way to catch up for this guy could be to jump into these smaller caps which could run more than the general market, IF the general market starts limping back. If this is true, then we could see some life come back into names such as SMCI again.

If you enjoyed the free preview of the plan thus far, please consider liking, subscribing and sharing the letter with folks like your self.

Join the chat room for cutting edge updates every morning before the session even opens.

What else is on my radar?

Quite a bit but let’s talk about TSLA for a second and then new AI names.