Folks-

Today I am sharing a MOM trade, or in other words the Mother of All Meme trades in light of current meme frenzy. But first, a 10000 feet view of where we are in the current cycle.

The US simply has no peers. No peers- when it comes to the ease of doing business, innovation and financial markets.

It took the US over 200 years to get here. Some of it was intentional, some of it was pure chance.

It is a Goose that lays the Golden eggs. It is up to the custodians of this country, every day folks like you and I, if they want this good fortune to last for a very-very long time or get greedy and kill the proverbial Goose.

There are a few fundamental attributes in the US system that allow for this Goose to exist at the first place:

Free and Fair system of governance and law- No country is perfect but over time, the US has turned into a better place to live and prosper for more and more of its citizens. It has progressively improved and learned from its mistakes as it goes along. The law, for most part applies equally to everyone. Now, some of this has come under attack in last 2 decades with domination of the Big Tech and consolidation of assets and power in a few hands. Big Tech has gotten in bed with the political class and has over the years tried to censor thoughts and opinions that differ from the ruling classes. This is a major risk that I will list to the well being of the Golden Goose.

Relatively low taxation- Believe it or not, the US does have some tax advantages when compared with other OECD countries like Canada, UK, Germany etc. Low taxes are fundamental drivers of economic growth and prosperity. Nearly all advanced societies and cultures have had a very simple and fair taxation regime. As taxes increase, so does the misery. Citizens either flee to favorable tax regimes, or stop the hustle altogether as they get bogged down by predatory taxation.

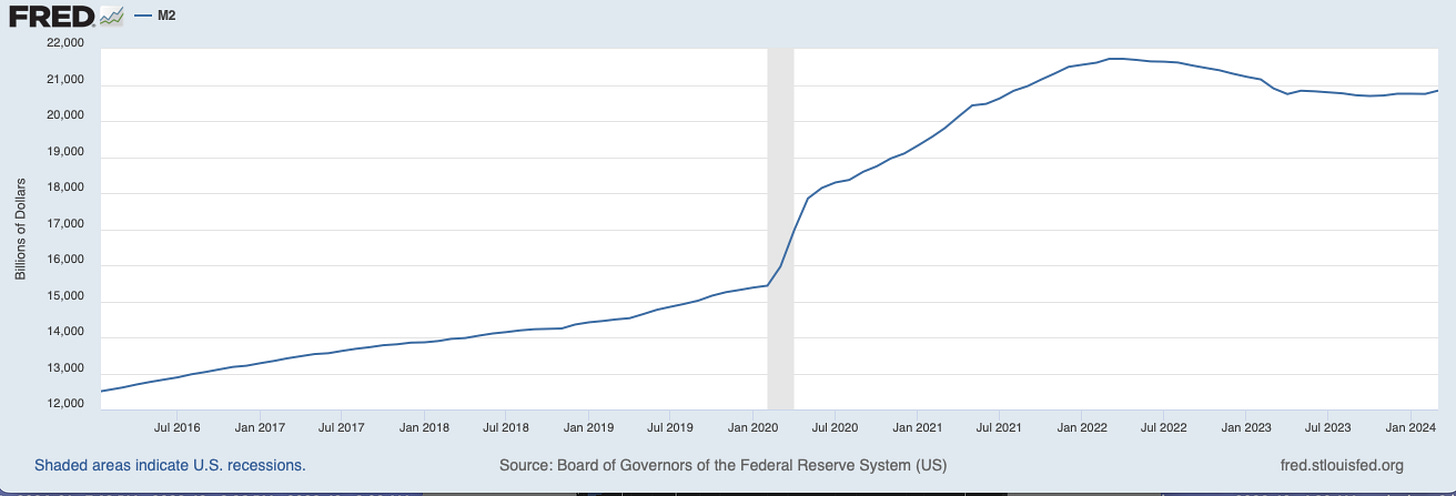

Reserve currency status- this is the backbone of the Golden Goose. The most important reason why the US is exceptional. Having a Reserve FX status means the world needs to buy and hoard US dollar currency so they can transact. The price of the commodities, Gold, Silver, Oil, Wheat in international markets is denominated in the US dollar. Having US dollar at risk is also the biggest risk to the health and wellbeing of the Goose.

Ease of business- opening and operating business in the US is extremely easy. Unless you are in a handful of few badly run states, for most part the US welcomes new business owners and the Americans are supportive patrons of new ideas and businesses. This is under threat now by increased level of scrutiny and regulations that some states impose on new business owners and stifle existing large businesses.

Stable population growth- The US has had a relatively stable growth of population. This is both organic based on natural birth rate from the citizenry, as well as external, which is fueled by immigration. Over decades and decades, people have wanted to migrate to the US in search of a better life. This is the BEST destination for immigration. Historically, such immigration has been of the high skilled services’ class labor based on merit. In such an immigration system, the immigrant can start adding value within a 2-4 year period after finding employment and begin contributing financially by their spending and paying taxes etc. The US always has welcomed refugees and those who are persecuted, but the process to admit such migrants is stringent and there is an elaborate immigration law-system in place to adjudicate such cases. Bottomline- immigration is an ingredient in success of the Goose as long as the immigrants start to add value within a few years to the system and do not rely on the Goose for support for a few generations.

Now why did I share this? This is to share my views on what has made the US markets so resilient and bullish over a 100 year plus period. These factors I listed above are the main factors that contribute to the growth and success of industry in the US. What happens when these factors come under attack? Well, the Goose gets sick and dies. Is this happening now?

Here could be some clues if this if this is happening now-

Slower growth that shows up on the GDP. GDP contracts.

Higher prices for basic necessities like housing, energy and groceries.

Layoffs and unemployment rises.

The price that the US pays to service its debt skyrockets.

So yes there is some evidence of this happening even now. If this course is not corrected, this will mean only one thing- even slower growth and even higher price that the US Federal government pays to keep the lights on (in terms of debt payments).

In my view, things will get worst before they get better. I have 2 major calls right now which I think will play out between now and 2025-

I believe the US is in recession. This is not going to be reported by majority of the news media and government agencies as they do not see it in the “numbers”. Well when you see it in the numbers, it is too late to prepare and respond.

I believe the inflation is over and we are headed towards a price spiral down. So in that sense, I think the FED should be cutting rates now instead of waiting till June or September or whatever their crystal ball says.

What does this mean for the stocks? You have economic contraction which is coupled by sky high interest rates which mean the US government and the private businesses spend a fortune on interest payments alone- this stifles spending on other areas. Which means even more downward economic activity. Now this is not a short term call. I have no time frame for this as I do not have a crystal ball but I am personally prepared for this when this happens. If I am one trade a year investor rather than a 0DTE or Weekly time frame trader, I am going to be prepared when this happens.

CAN ALL THIS BE AVOIDED?

Yes. If we continue to get 4-5% per year GDP growth then the US can sustain debt and FISCAL deficits. How likely is a 5% growth in next 5 years? It is very unlikely. I will give it a less than 10% chance. What you need is a very pro middle class and business policies. This means reduction in energy costs, it means a massive reduction in basic spend like housing, so the households can spend more on services and discretionary items rather than food, housing and energy.

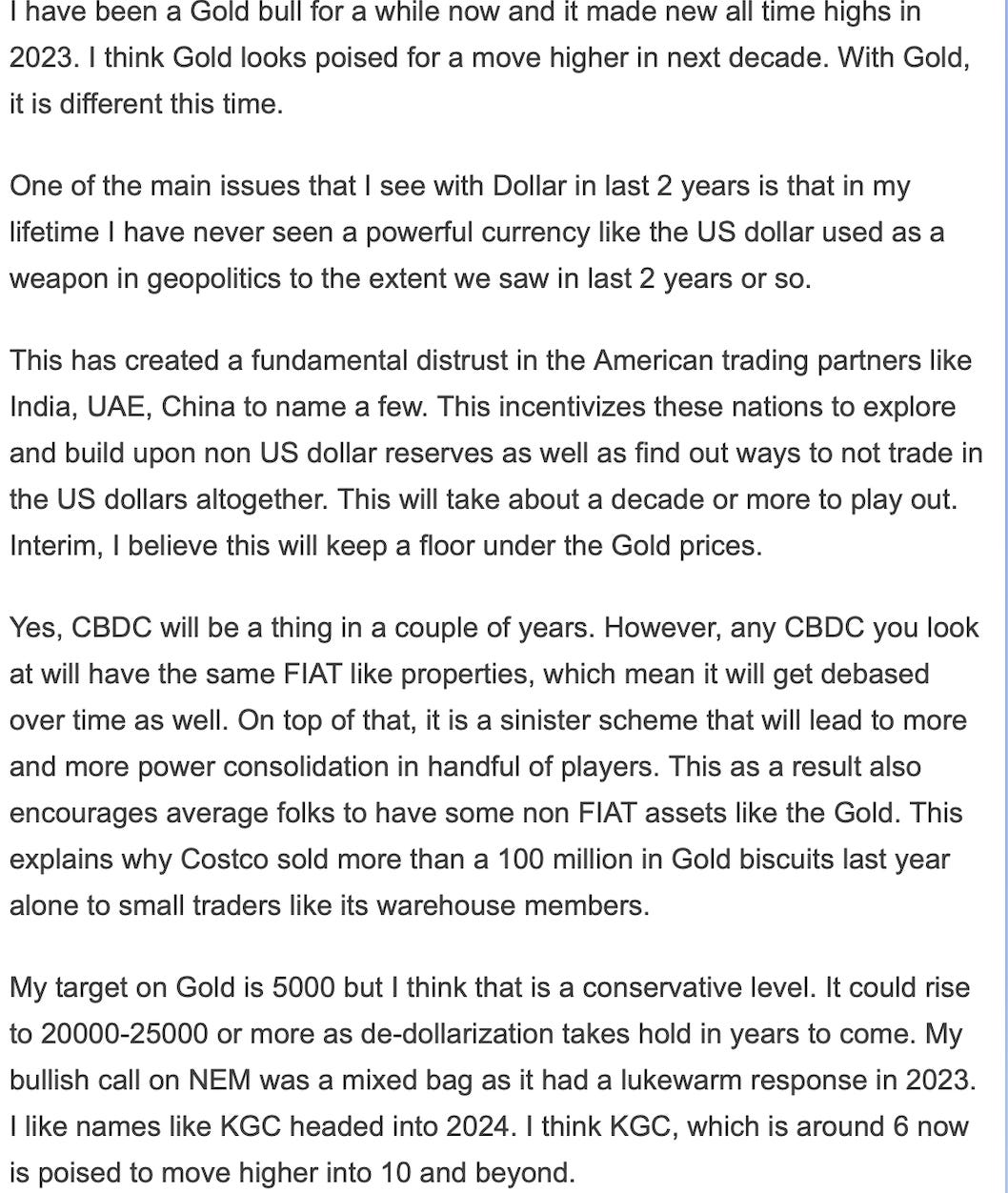

GOLD/SILVER

As fas as related markets go, I have been a Gold and Silver Bull from several years now and shared in this substack when Gold was around 1600 and SLV as a Silver proxy was at 17. They are now 2400+ and 29 respectively.

Another name I shared earlier was KGC. This was shared back in January and is now trading near 8 dollars. See below.

This suggests two things. One is that good ideas can take some time to play out as more and more laggards in the market catch up. Few folks realize the value first and then as more and more realize it, the price jumps out of the accumulation zone.

Then this also shows that the most value out of this Blog is long term. Jumping from one furu (internet expert) to another furu in search of Holy Grails rarely pays off. The chances are that your furu is also a subscriber so what you are receiving from them is second hand information. Go to the source!

Now with commodities, what’s at play is that the market also senses what I have been saying that the US is likely looking at a deflationary period. This is normally bearish for commodities like Oil and Copper etc. However, this topic is complicated in 2024.

This is an election year.

I think Dollar has peaked at 105-106 as I have been saying for a while. And then I expect the FED to cut aggressively soon. These factors in their totality favor the commodities at the moment, even if inflation is set to drop.

Due to these reasons, I remain positive on Gold and Silver. As well as Oil. Look at the Dollar chart. I think if it heads lower into 102-103 area, this should help Oil. Oil is now 79 dollars. I think this could try another push higher into 84-85 as long as recent lows near 77 hold.

As far as KGC goes, I think this stock could rise higher into 9-10 dollar range. Once this starts consolidating here above 8-10, I think we can see a test higher of 12-13 dollar area.

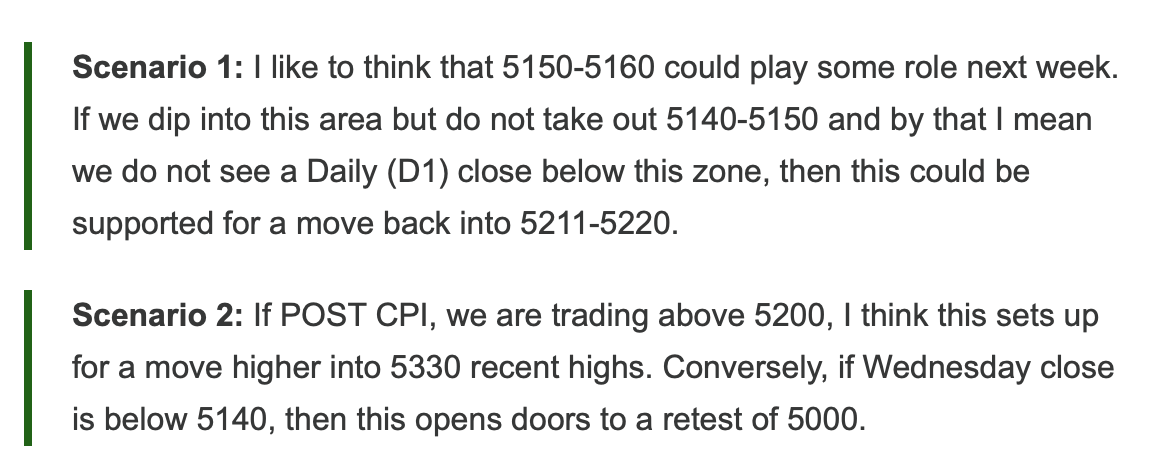

Emini levels for the week

Now as far as the emini levels go, my main expectation last week was that if we saw a sell off due to CPI into 5150, then we may see dip being bought.

This never happened, as we barely got a dip into 5200 before markets rallied.

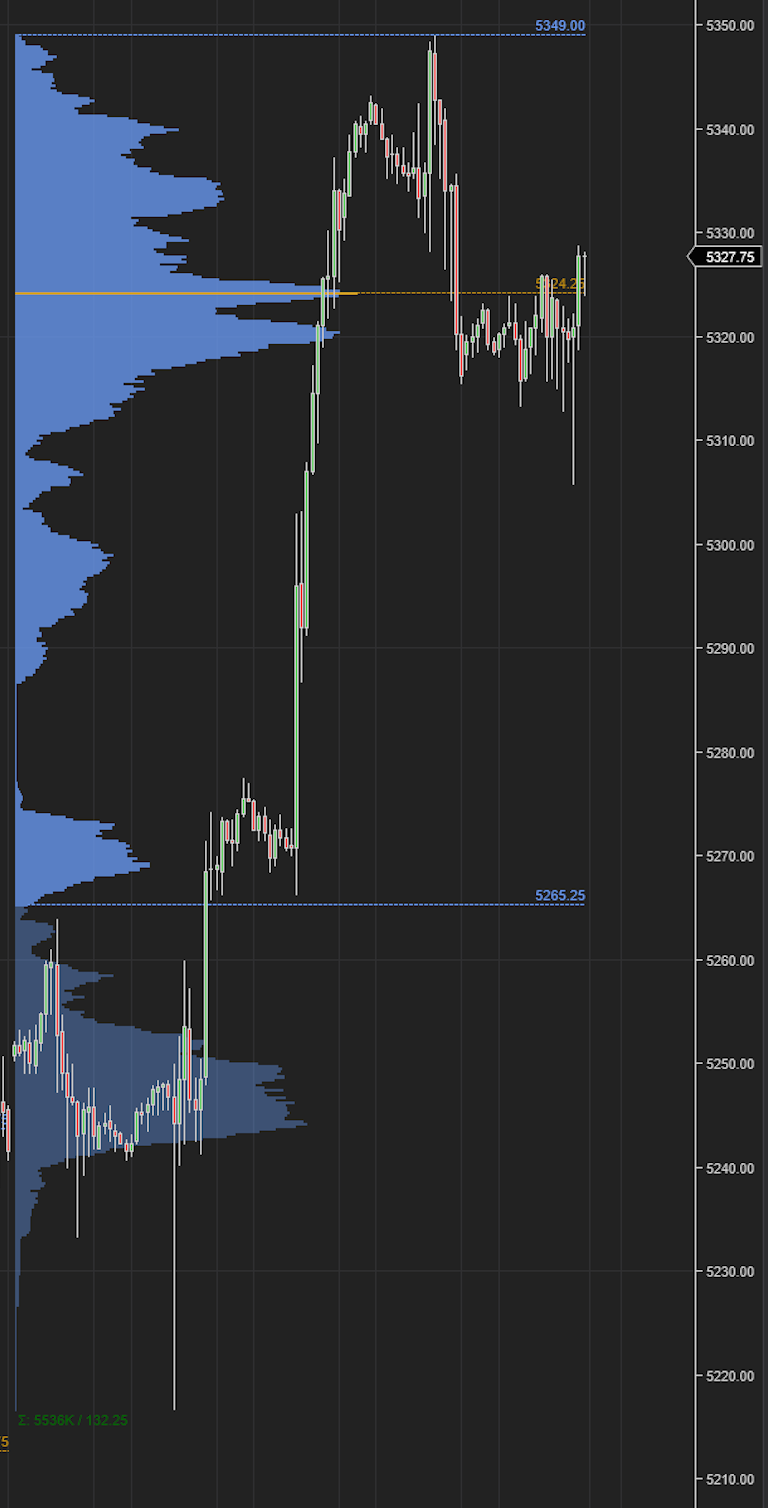

My second assumption was that if by CPI day, the market remained at 5200 or above, we would head higher into 5330 which was the case indeed. See below.

Look, a lot of guys want to read what they believe is the case and they subconsciously shut down any other information the market is providing them via price action.

Price action is the language of the markets. This is how markets communicate. The markets cannot speak, or write but they subtly communicate their intents by expressing price action.

Now this week, the emini market has carved out a P profile shape. There is not much of news this week but some FED speak Sunday night and FOMC minutes along with NVDA earnings later in the week. I will share NVDA options play after earnings so stay tuned and subscribe to get the email when I share it.

Normally, I am not a big fan of P profile shapes and they are almost always bearish, except this one thing from last week. Chart A below.

If you look at the Friday auction, this is a sharp rejection near 5290 which is an important level for me.

Due to this reason, 5270 will be my key level this week.

Scenario 1: I think as long as 5270 holds on the week, we may be headed higher to test 5330-5347. We are now around 5327 on the June Emini.

Scenario 2: The bears will need to take out 5270 and remain below it for a further raid into 5210.

As a side note, I have received some feedback that since there are two scenarios, it means I am neither bullish nor bearish and I will be right in both scenarios.

I am not sure how to address this interesting comment, but I will try- if I am an experienced trader and I am reading the above 2 scenarios, to me it is crystal clear that Tic is saying 5270 is the support, if tested for a move into 5330s. As an experienced trader then I see that Tic is saying if we close below 5270 then this bullish bias is voided. If this happens, then 5270 may become resistance.

The only way I could be clearer is if I only shared one scenario. When you share only one scenario it offers some sense of security to newer traders, I assume. But that can be a fake sense of security. Having only one scenario means I am certain what the market will do next. I am not. Being certain means you know 100% what the market will do next and that is really silly to think in those terms. We need more scenarios to be prepared, not less.

Other things on my radar

GME

GME was a stellar call by me here in the Substack when I called the short squeeze in March 4th newsletter when it was 12 dollars.

Along the way I also shared several important updates -

Avoiding FOMO at $70. Before it falls to $30.

Support at $33 before moves to $42.

And recently resistance at $40 before it was cut in half over Thursday and Friday trading days.

Look this is a 5-6 billion dollar company that has probably led to tens of billions in losses for both retail and institutional traders. At the same time, it has made profits also for savvy traders.

These short squeezes have wave like behaviors. A lot of folks may be thinking it is the retail traders doing all this havoc on institutional traders. I beg to differ. Retail makes very little impact on overall scheme of things. It is the institutions versus other institutions. Based on my interaction with retail crowd, I think retail is not much interested or active in GME at the moment. Which means they did not cause the short squeeze at the first place. Which means they have little to no role to play in next week or so of GME action.

So, I think if $20 holds (it is $22), we could retest that 32-33 area on GME.

Some one super new to trading will instead like to read this above statement rephrased as “GME will now trade 33 dollars. To the moon. All in!” :) ! It is simply not gonna happen. This is not how any of this works. You have Reddit for such 100% guaranteed insights. Sorry to disappoint anyone expecting certainty in a fundamentally uncertain environment ;).

However, ultimately if GME begins to find acceptance above 32-33, I believe this stock could run higher above $40.

TSLA

You cannot talk about MEME frenzy like AMC, FFIE and GME without talking about TSLA.

Tesla is the Biggest Meme of them all. It is the Mother of all Memes.

It has had a roller coaster ride in last few weeks and is now trading near 175.

My Line in Sand on TSLA is 170. I think as long as see 170 hold, this is headed higher into 190-195 area. If the Meme frenzy takes hold again in next week or two, I think TSLA option IV is quite underrated at the moment. As these IVs are repriced, this could lead to an increase in price of underlying calls in TSLA.

ZIM

ZIM is another candidate for “meme frenzy”. It is now 18 dollars or so. I think 16 dollar level is important on ZIM. If 16 holds, I see ZIM trade into 20 and a Daily close above 20 could lead to a test of 22-24 on this name.

This is it for now. Have a great week ahead!

~ tic

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Jigsaw. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.