Traders-

The FED has raised interest 10 times in last 15 or so months but left them unchanged in June.

The upcoming week is packed with event risk. There is a significant volatility which could come on heels of the events- particularly on Wednesday and Thursday.

However before I share my prediction for the FOMC, let me quickly recap the week.

TSLA

I was a TSLA bull at 280 at start of the week and I had expected a test of 290-300 due to TSLA earnings. This was a good call as we floated up to almost 300 before trading lower from my target.

NVDA

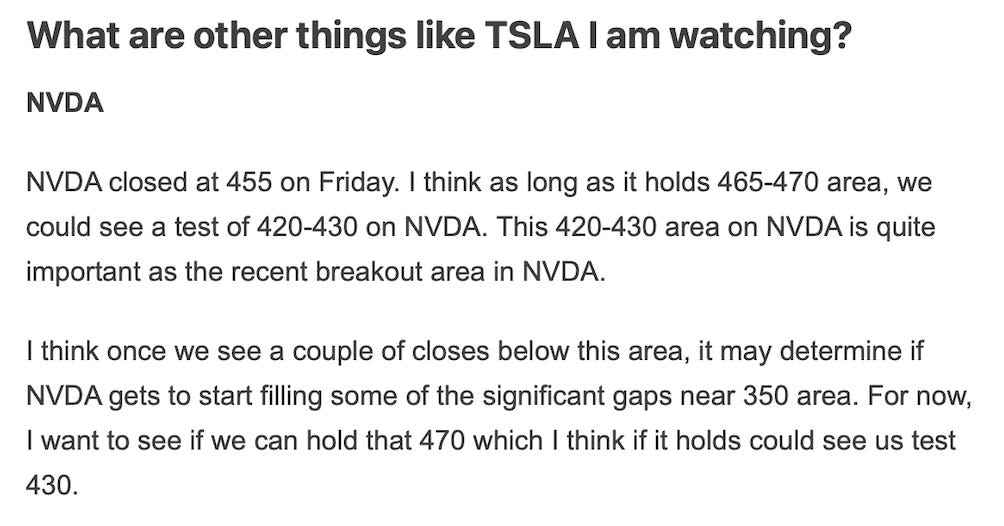

I was a NVDA bear and had expected a test of 420-430. This was not a great week for NVDA as we saw it sell off from almost 470 to down to 440. See below.

GOOG

I was also a weekly time frame GOOG bear at 125/126 and we saw decent selling pressure in GOOG on the week.

Emini S&P500

On the ES side, my 4556 level was an important level though I did not see a test of the lower level this week. This level was resistance turned support. We broke out of this resistance early in the week and then we retested this on Thursday, before rallying back to almost 4600 from here.

Then we sold down from 4600 which was shared by me as an intraday resistance, to close the week a few points above this level.

Going back to the FOMC next week

With the July inflation report coming significantly lower at a 3% YOY, the expectation from many participants is for the FED to not raise at all on July 26th. The July 26th FOMC event will be followed by the QoQ GDP print on Thursday which is expected to come in around 1.7% after having seen the GDP grow by 2% the prior quarter. Based on my own analysis, there has been slowdown in a lot of industries so I expect this number could come in slightly lower than the expected 1.7%.

As far as the FED funds rate goes, the FED is looking at the same thing that we all are. The FED is looking at lower inflation but at the same time they are looking at the jobs market which has remained strong, as well as wage inflation in certain sectors which has held up remarkably well. I think this puts them in a precarious spot - stop hiking at 5-5.25% and risk inflation taking off again or continue raising rates and damage the economy more than their mandate bargained for.

Amidst this backdrop, given recent commentary by this FED, I think they will raise by another 25 BPS on Wednesday bringing the FED Funds rate to near 5.5%. This may be followed by a jubilant press conference but could leave the door open to another 25 BPS. In any case, I think this will be a major mistake by this FED to raise the rates again on July 26th. In my opinion, the activity has softened in several of key industries within the US- whether that is trucking & transportation, freight imports, certain retail, certain services. I think this FED should instead focus on ramping down their balance sheet rather than keep raising interest rates on these FOMC days. An aggressive balance sheet rolloff will have same or even better impact on inflation than just keeping rates higher- this also positions the FED to act decisively when that next crisis hits, which inevitably will hit at some point. When they keep raising rates, it just makes it smaller businesses and many zombie companies to finance their debt. Even average households suffer due to higher interest rates on debt.

Contrast this with the FED balance sheet. It has much smaller impact on small businesses’ ability to borrow and it certainly has almost no impact on the average household. However, this FED , when they keep interest rates higher for longer, but keep the balance sheet bloated, unwittingly they end up helping the larger companies and speculators, who view this phenomenon as some sort of stealth stimulus. With this regards, I think it is a big mistake to raise rates again when you own almost 9 trillion in assets on your balance sheet! If you look at the Big 5 companies in the S&P500, they have almost 0 debt- they do not have any problem refinancing what little debt they have. However, majority of the S&P500 companies are not that fortunate. They do not get the same terms when it comes to credit. So I would say if this FED is really serious about inflation fighting, they should may be start by a faster unwind of QE.

I hope some one asks this question to Chairman Powell on Wednesday!

Regardless of what happens on 26th, I think the FED will soon start cutting rates as well.

This should have interesting after effects. I have polled this question many times. Will the FED rate cutting cycle be bullish or bearish for the risk assets? The obvious and common sense, popular answer seems to be that this will be very positive for stocks and other assets, like home prices.

I think the reality is a little bit more nuanced than this. A FED unwind of interest rates may lead to below scenarios -

A dollar decline which even at 100-105 is quite chunky. If Dollar declines to 89-92, this may potentially be good for precious metals like Gold and Silver, as well as some commodities like Oil which are already exhibiting positive pressure to the upside.

Increased supply of residential housing. Right now the number of homes being sold are at a 15 year low. I see the supply explode once rates begin coming down to 3-4% range. Lower rates also get the buyers out, who have been on the sidelines thus far. This could see the home prices rise at first and decline later. Home prices, even when you compare the current prices to the craziness we saw post covid, have barely budged. Some areas have seen larger declines but on balance, the prices are within 10-15% of highs. These are unlikely to auction lower, unless and until we see an uptick in unemployment rate IMO.

I personally do not think a FED rate cut cycle will be good for other risk assets, like growth stocks. I think it may still help some value names which I have been sharing but it may be negative for extremely high growth names. For many of these stocks, the inflation has allowed them to charge higher margins for their services and products and if we are really in disinflation, then I see those margins shrink pretty fast as well.

My levels for this week

Levels for this week has to be seen in context of the the event risk nature of this week. In particular the FOMC and the GDP. This may mean we see larger than standard deviation moves this week.

Outside of this, another important thing to keep in mind is the tech earnings. The tech earnings vis a vis NFLX and TSLA have started off to an inauspicious start.

For next week some big names reporting are MSFT and GOOG on the 25th and that should play a role in volatility as well.

MSFT is considerably stronger in its position within the enterprise segment. Now it is selling subscriptions to its AI product offering - both to the retail as well as to the enterprise customers. Longer term, I believe MSFT is relatively expensive using my own proprietary valuation models. However, in the short term, due to these factors I have listed, I think it makes it harder to get a hang of where MSFT may land on the 26th. I would say if it were to dip 3-4% or more, I would guess due to recent momentum it may even get bought due to these factors I have mentioned earlier. It closed at 343 on Friday, so I guess if it fell to 326-330 area, may be it can attract some buying there in the short term and I do not want to be super bearish if it were trading at 330 some time this week.

Definitely, AI will create the haves and the have nots. It is very near and dear to me and I am also learning the ins and outs of AI, if for nothing else to develop more market based systems.

We will see who wins in AI space, however in this very moment the direct beneficiaries are the likes of NVDA and MSFT. Not a lot of folks talk about it, but TSLA is a clear leader in AI as well with its FSD. That is one real world example of AI. Some of the stocks I have been bullish on recent like ISRG at 290-300 level are also AI leaders in their own field.

Now traders must keep one thing in mind - they need to evaluate if the sheen is coming off AI. Why?

You saw AAPL jump into the AI bandwagon with their own version of iGPT or whatever you want to call it. However, the market did not care about it and sold off regardless. Similar thing we saw with the TSMC results. The market did not consider it as a plus and sold off.

I think once AAPL, GOOG and MSFT earnings roll by, we will have a clearer picture on how the market is evaluating these earnings and their impact on the general market. I will share a key level in a bit which I think may help set the tone for next several weeks to months.

Another high flyer that reports this week is META.

META has been a tremendous runner this year. I was one of the very first people on FinTwit to call a bottom in META, back in October around 90-100 dollars. Please see my bottom call in META and ADBE below, from October last year. This was followed by my bottom call in META at 100 and ADBE around 260.

Main issue is a lot of folks are very short term oriented. In my experience short term, unless it is in intraday time frames, does not work. Only long term readers will know and remember these calls and other folks are only interested in day to day action which really does not work in my opinion.

Here is my call on AMD bottom near 55. This is around same time I shared SMCI and NVDA. The only difference being I do not chase AMD at 120-130 but I wait for more favorable levels like the one below I shared with Substack readers almost one year ago.

Below is my bottom call on home builders like Pulte. This was a time when no one wanted to touch home builders… PHM has now more than doubled. I am sure folks are bullish on it now ;)

These are but a handful of examples. I have several similar examples, whether NFLX, TSLA, SQ, GOOG at 87 etc.

If you also do not want to miss these key inflection points in similar names, make sure you subscribe to me and get an email almost every day covering my thoughts.

META ER

I actually find META earnings to be far more interesting than that of MSFT and GOOG even.

Of late, META has floundered in its core business which is really harvesting user personal info and selling it for ads. YOY profits have collapsed to the tune of about 35%.

The company leadership seems directionless and has thrown money at a myriad of concepts, some legit, some outlandish- from AR, VR, to now its own AI models. I will like to see what hat the CEO pulls out on 26th but regardless I think on short term time frames, my key level on META will be 300-303. It is 294 now.

I think if 303 holds on META as resistance, we could see 276-280. Above 303, if it were to give up, I see resistance come in near 320.

So back to my levels for this week.

As you can see the complexity around event risk, major earnings, obviously technicals. I wish I had a similar way of looking at just a head and shoulder chart and be able to predict some outcomes ;) But I will try regardless.

Continue reading for my views on very exciting DWAC, SNAP, DIS and SPY.