Folks-

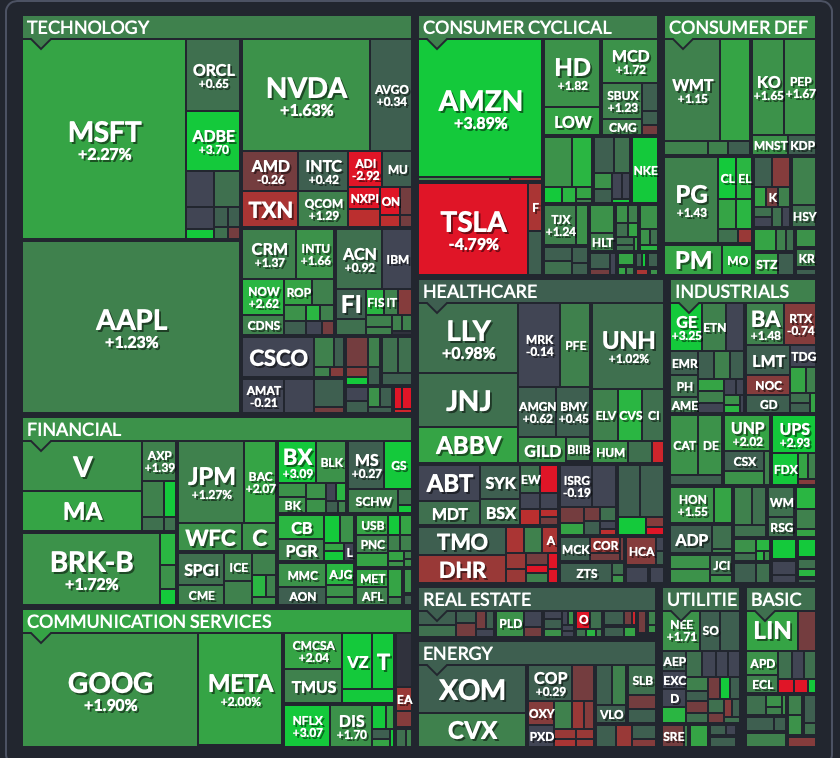

See below image.

A picture is worth a thousand words.

This is the power of OrderFlow.

In my newsletter last night, I was a bull on many mega caps, except one.

TSLA.

While we saw impressive rallies in most mega caps, the TSLA stock cratered today to as low as 196.

I was also a bull on the main index and I expected a test of 4200 today, whereas a lot of folks were bearish at the lows near 4120.

What do we see? A face ripping rally.

Founders will also appreciate, I hope, the ETF indicator I shared last Tuesday.

This indicator was up better part of 1% today and it was the backdrop against the Emini index being supported on dips all thru the cash session today. I like to share such insights with my subscribers whenever I get hold of one, if you have not, please subscribe and get in the know.

Key level tomorrow

My key level tomorrow will be 4200.

Scenario 1: Unless we are able to take out 4200 in the cash session, I think this level may present resistance, and we may sell down to recent lows near 4150.

Scenario 2: If I am a bull here, slightly longer term, I do not mind this action. I think this is balancing and it gives me comfort knowing we are not dropping below 4150. This is why I will be on lookout for support coming in near recent lows for more balancing.

Folks, I also had few targets met on my long term call in O 0.00%↑ . This is a massively popular retail ETF due to its yields.

I am not liking O 0.00%↑ yet.

I became bearish on this at 65 dollars and I expected a test of 40-45 on it. I shared this a couple of months ago and today it closed near the lows around 45.

You wanna know what I like instead?

I think PSA 0.00%↑ is better deal than O. It also has a dividend. I also think this is a growing industry due to the general conditions and I feel if we hold 220-230 on it, we may see 270 area on the storage unit issue. What you think?

As if that was not enough, I also shared a bullish bias on ETF PINS 0.00%↑ around 25 dollars. This stock has rallied 15% today. Each one of these shared with my subscribers here.

Should I go on?

XPO 0.00%↑ was up 15% today which I shared around 60 dollars here in the substack.

If you would like such ideas published when I see them, please help the channel grow by liking, sharing and thru word of the mouth as this is a small publication and more engagements I get, the more I share with like minded folks in these recessionary times.

I will continue to share as long as I feel folks get a value out of such level 2 based educational content.

Have a great day.

~ TTT

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Jigsaw. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.