Hey-

We opened and ended the day pretty much within the 2 levels I shared last night. The high of the day was at my weekly level and the low of the day was also about 6 handles from my weekly level to close the session near 5190.

Imagine a crazy week like CPI week and yet here we are trapped between two levels I shared on Sunday night, almost 5 days ago! Such is preciseness of these orderflow levels.

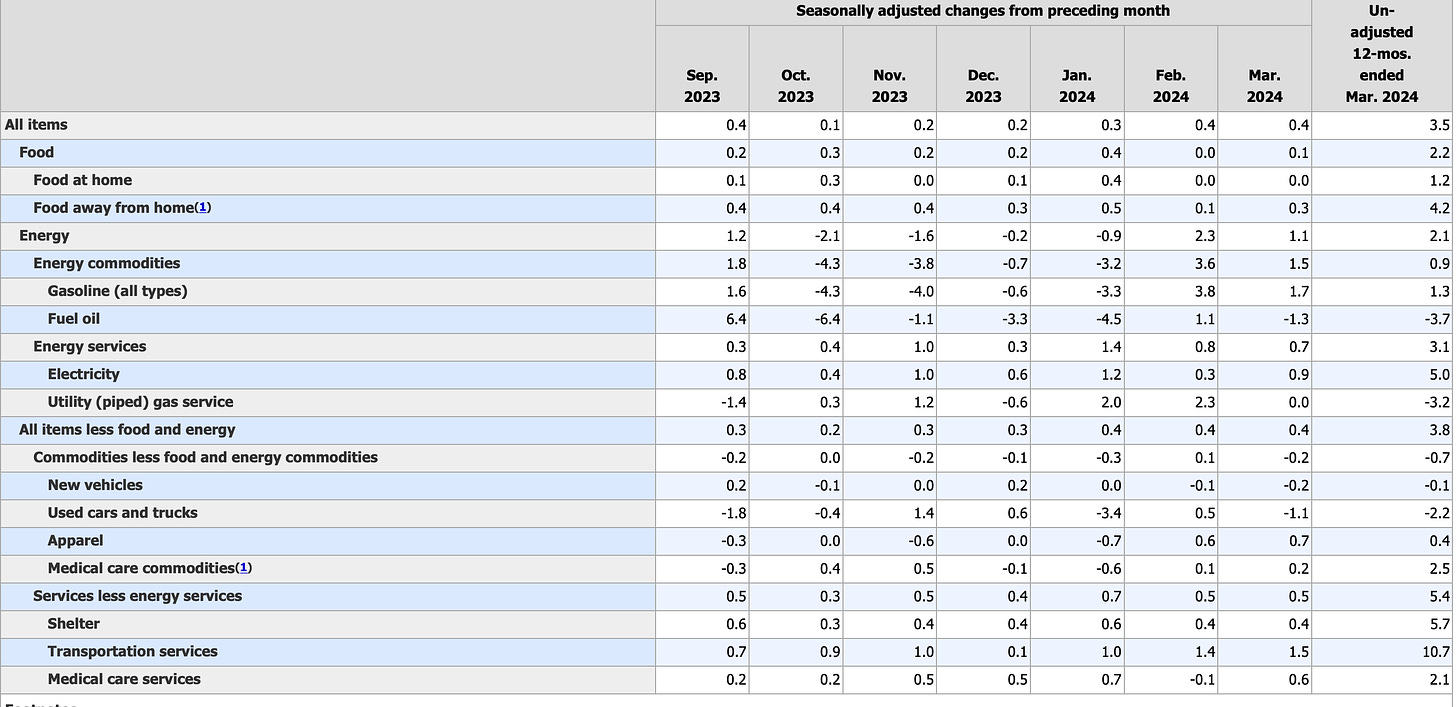

The backdrop of the move was CPI data which came in very strong. Stronger than expected. See table below.

Let us dive into this table and see where the inflation pressure is most extreme. It is in 3 areas-

Electricity prices.

Shelter prices

Insurance costs

Insurance prices are thru the roof and are in fact up 10% year over year. This has nothing to do with supply and demand but it is pure and simple price gouging. There are some factors like many insurers have fled states like Florida and California, leading to higher inflation in those states, but overall it is an endemic issue in the US and elsewhere. This just shows there are some very greedy companies which are taking advantage of their customers and there is very little the FED can do to rein it in. This has to be at a legislative level.

If you take out insurance costs alone, the inflation now is at 2% or so, year over year. Yet the FED being behind the curve will use this report as an excuse to delay rate cuts in June. This will be a tremendous mistake.

My view is that the FED should cut rates now. This will in fact help lower the inflation. If FED waits too long now to cut, the system is at a breaking point and will do overall more bad than good. Do you agree with me?

Numbers do not lie. These numbers prove inflation is now within target but there are some laggards who are deliberately or may be unwittingly abusing their customers like State Farm and Geico are some really bad actors.

In the short term however the market is running with this narrative that the inflation is running hot again. This means we could still see some short term volatility ahead which could lead to nice swing time frame long set up. In markets we are waiting for market to make a mistake. We saw this when I became a bear at 5330 two weeks ago. We saw this again when a lot of folks were chasing 5280 this week. I think this market has a probability that it will read this report as too hot and will take a misstep which could lead to a nice set up, it is not here at the moment but we could be there soon. Once I feel we are there, I will send an update for subscribers.

With this said my key level for the session will be 5211. We are now 5200. This is from June Emini.

Scenario 1: As long as we see 5206-5211 hold on the upside, we could see some more volatility to trade down into 5156-5170. Unless we take out 5155, we could see some support here for bounce back to 5206.

Scenario 2: If we open and remain below 5155, this could mean some more volatility which could escalate down to next orderflow key level at 5080-5090. I will share an update in the chat room if this scenario plays out.

~ tic

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Jigsaw. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.