Folks -

The primary expectation today was to see support come in near 5030 and selling some in near 5100.

While these 2 levels did not trade to the tick, we did ping-pong close to these 2 levels. Note that most of the large traders who trade 100 or more lots, will not place 100 lots at a single level. They split it 5-10 lots here and there using programatic order fillers.

If a 100 traders place a 100 lots at one single level, that is 10000 lots at a single level. Possible but likely?

At least no one does it at the exact same time. They may either split it by lots or by time. When was the last time we saw a 10000 lot order hit the tape on Emini ?

Recently I saw one for 5000 at 5310 but I think that was max I seen in a long time.

Now the natural urge is to buy the open because it opened strong and retraced up to 5095, and sell the 5030s as we came down to this level about 3 times today, however if we have these Orderflow levels like I share daily, we are careful. In fact the right thinking is to see bears emerge at 5100 and bulls come in at 5030- as the session showed today.

Another highlight of the day was the action in NFLX. Wild moves.

About 10 days ago, I shared why I will be bearish on NFLX for its earnings when the stock was near 630. I shared that we can sell down into 570s. Despite good earnings, the stock slid. It added 9 million subs but that was not good enough to appease the Street. In many ways today was an inauspicious start to the Big Tech earnings.

Main catalyst being cited for the sell off is that they have decided to stop sharing subscriber data and ARM (Average Revenue per Member), starting 2025.

ARM or Subscriber number is a very simple method to valuate growth- if I add 9 million subs at $10 apiece, that is a billion dollars in annual sales. Very easy, no guessing.

Now with the company deciding to withhold this information, it makes the Valuation game a tad harder. It makes it more opaque.

My personal take on this is that the company probably thinks they have ended password sharing as much as they could. I think they feel there is not much low hanging fruit available to pluck, so why bother?

Still the company generates a significant amount of Free Cash Flow at end of the day, which I think will come under pressure once the bear market across the general index takes hold.

Even though the stock has now sold off about 50 dollars from my level, I am not interested in it at the moment. I need to see the general market firm up before I start looking at NFLX. Given such a context, I would not be surprised if NFLX were to sell down a bit more towards 565-570 area.

Speaking of earnings, one name I like is LULU.

It is no secret that I am a huge supporter of LULU mission and its products. They do not report until later in May, but I am going to watch this stock now with signs of stabilization in general index.

I think this whole 320-350 zone is quite important and if it were to hold, I favor a retest of 380-400.

Other ideas that I shared that did well were Bitcoin bullish st idea at 60K which today almost crossed 64K.

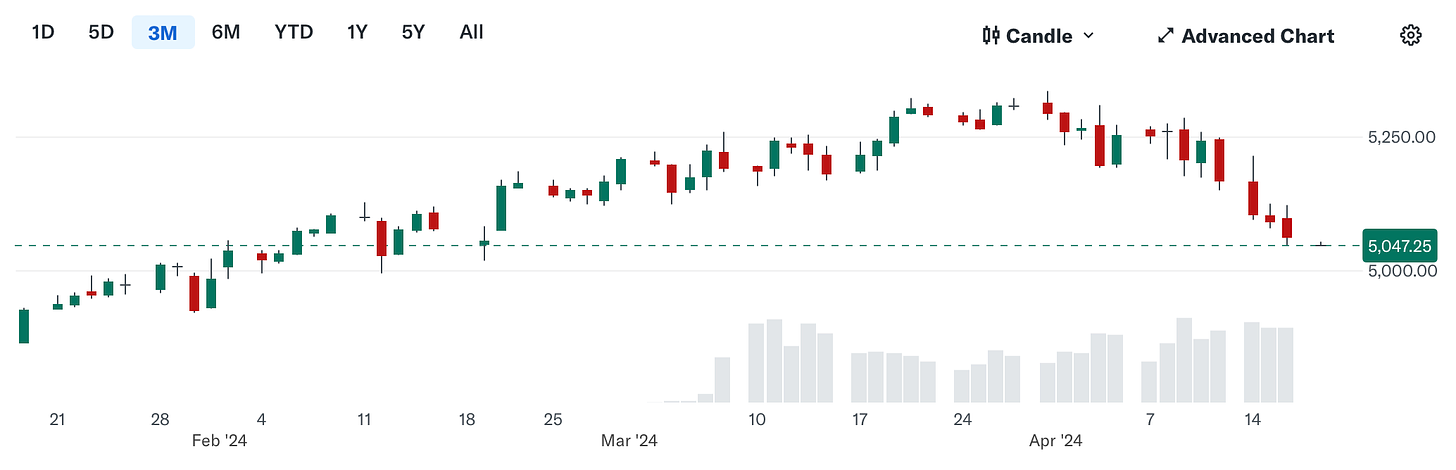

For my emini levels for tomorrow, look at Chart A above.

What do you see? After that initial drop lower from my weekly levels on Monday and Tuesday, the downward pressure has stalled. It is one thing to cover 200 points in 2 session and then another thing to stall and not able to take out lows 50-60 handles below in 3 sessions. This does not mean they cannot be taken out but it does tell you that a lot of folks have been stuck in these shorts near the lows. The range is very very narrow of about 40 handles between 5030-5070 or so.

So what is causing this market to stall here?

Look at the left side of Chart A above. This chart offers important clues about next couple of days of auctions.