Welcome to another installment of the weekly newsletter where we dive deep into which markets are moving and what is moving them. With just 22 days to the elections, there is a lot to unpack. Markets are setting up for massive moves ahead of a historic election cycle, and Santa Claus rally that traditionally we all look forward to.

Despite its myriad number of challenges, America remains the most premier destination when it comes to capital markets and long term investing.

Remain a long term bull on America, certainly I am. Dips and sell offs are something I look forward to, so I can buy more of the most desirable assets in the whole wide world.

Americans will, via sheer ingenuity and hard work, solve these issues and usher in new technological revolutions in decades ahead!

Let us dive into the event risk and then continue on to some ideas I like on my radar

So, this week was a bit of a rollercoaster ride when it comes to economic data. The FED must be scratching their heads trying to figure out what to do next. On the one hand, wholesale inflation came in lower than expected, which is great. But on the flip side, consumer inflation was stronger than expected. And food prices, well, they threw a curveball with a surprising 0.4% increase month over month.

Before this week, it seemed like there was a good 54% chance of a 50 BPS rate hike in November. But now, that bet has totally tanked, and most people think it'll be a more modest 25 BPS cut.

Personally, I still think we'll see two rate cuts this year, one in November and one in December. I'm not completely ruling out the possibility of a 50 BPS rate cut, but if we get another week of hot economic data, like with those retail sales numbers next week on Thursday, that'll probably seal the deal for a 25 BPS rate cut.

Levels for next week

Both 5715 and 5830 were the key levels for the week. I expected the market to sell down to 5715, as long as we remained below 5830.

On Monday, we inched up to 5810 at the open and then swiftly sold down to 5720s.

This was a rather quick move which was matched in speed by the upside move next session which took us back above 5800.

By mid week, we were knocking at the doors of 5830 again. This level held until Friday but then in Friday's cash session, the market was unable to hold the advance, and we broke out to fresh new all time contract highs, closing the session at 5850.

For levels for this week, let us review Chart A above.

This you can see is a clear breakout in technical terms. Ideally, I do not like this market now to retest any of these levels in Chart A above to favor the continuation.

Due to these reasons, my key levels on the week will be 5838. We are now trading 5850.

Scenario 1: If we remain supported above 5838 on the weekly time frames, I like to see a test of 5900-5903 area.

Scenario 2: If we close below 5838, and remain there, I like to see next support come in near 5778 for a move back into 5815-5820.

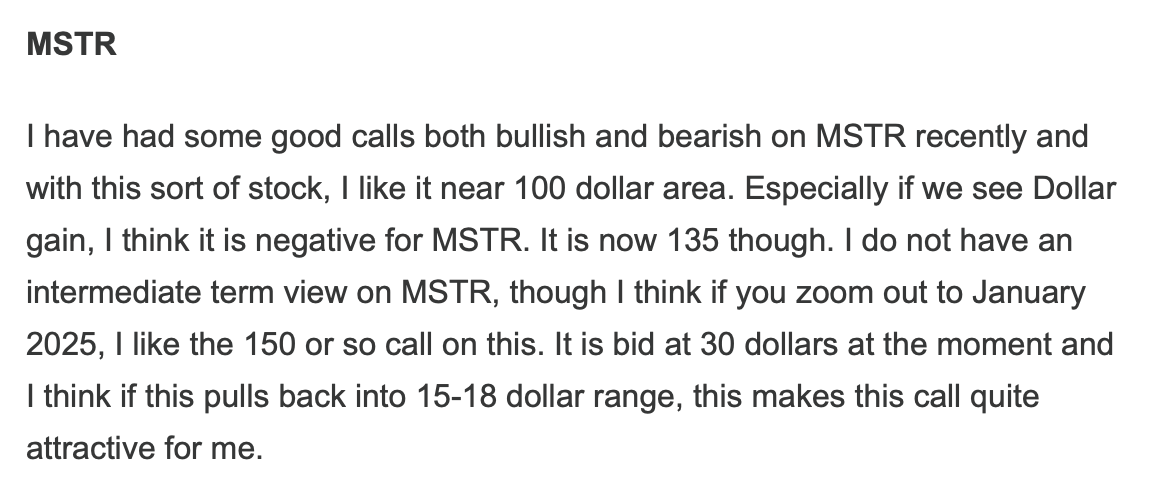

Let us talk about our friends at Tesla and what a week they had!

If you recall, less than 6 months earlier, the Tesla stock was in doldrums. It was making new lows weekly, all but a few had given up on this stock when it was trading 130s back in May.

But then, Elon Musk had a brilliant epiphany. He declared that Tesla wasn't just a car company; it was an AI company. He even flew to China, met with President Xi Jinping, and got some potential approvals for his self-driving cars.

This move worked like magic back home. Even though Tesla's profits and revenue weren't great, Wall Street loved this new vision. The stock almost doubled in value in less than six months, reaching 260 bucks earlier this month.

So, Elon went from being a car manufacturer to an AI company overnight, and his company's market cap doubled in no time. But now, he has to show something tangible for all the money that flowed in.

From my perspective, it is extremely hard to valuate Tesla at the moment but we can make some assumptions. I do not wanna make the mistake of assuming that Tesla is simply a car company. I do not think it is. If it were, the company will be doing more “car stuff”. It will focus on rolling out newer models, refine the interiors and make the exterior more appealing for the masses. This is what the other car manufacturers are focussed on right now. They are focussed on what is selling right now, oblivious to where the puck is gonna be in 10 years. You see this across the board- from GM, to Mercedes to Volkswagen. The cars are designed from soup to nuts, to appeal to the aesthetics rather than the functionality or with driver in mind.

Contrast this with Tesla and Musk. In Musk’s vision, there is no driver. There is only the bare bones car that takes you from Point A to Point B.

In fact so strong is Musk’s vision, that he even removed some of the hardware we take for granted in modern cars. There is no physical turn signal stalks for instance in the new Model 3. There are no physical Blind spot monitor in these cars. Instead all this is handled on the giant iPad in the middle of the dash. Musk believes, rightfully, if the car is going to drive itself, then who needs the turn signal stalks?

So key takeaways for me, when it comes to Tesla is:

I am not going to value Tesla as a traditional car maker. It is nothing of sorts.

I am also not going to say this is a 10 trillion dollar company like some of the others in the market are thinking.

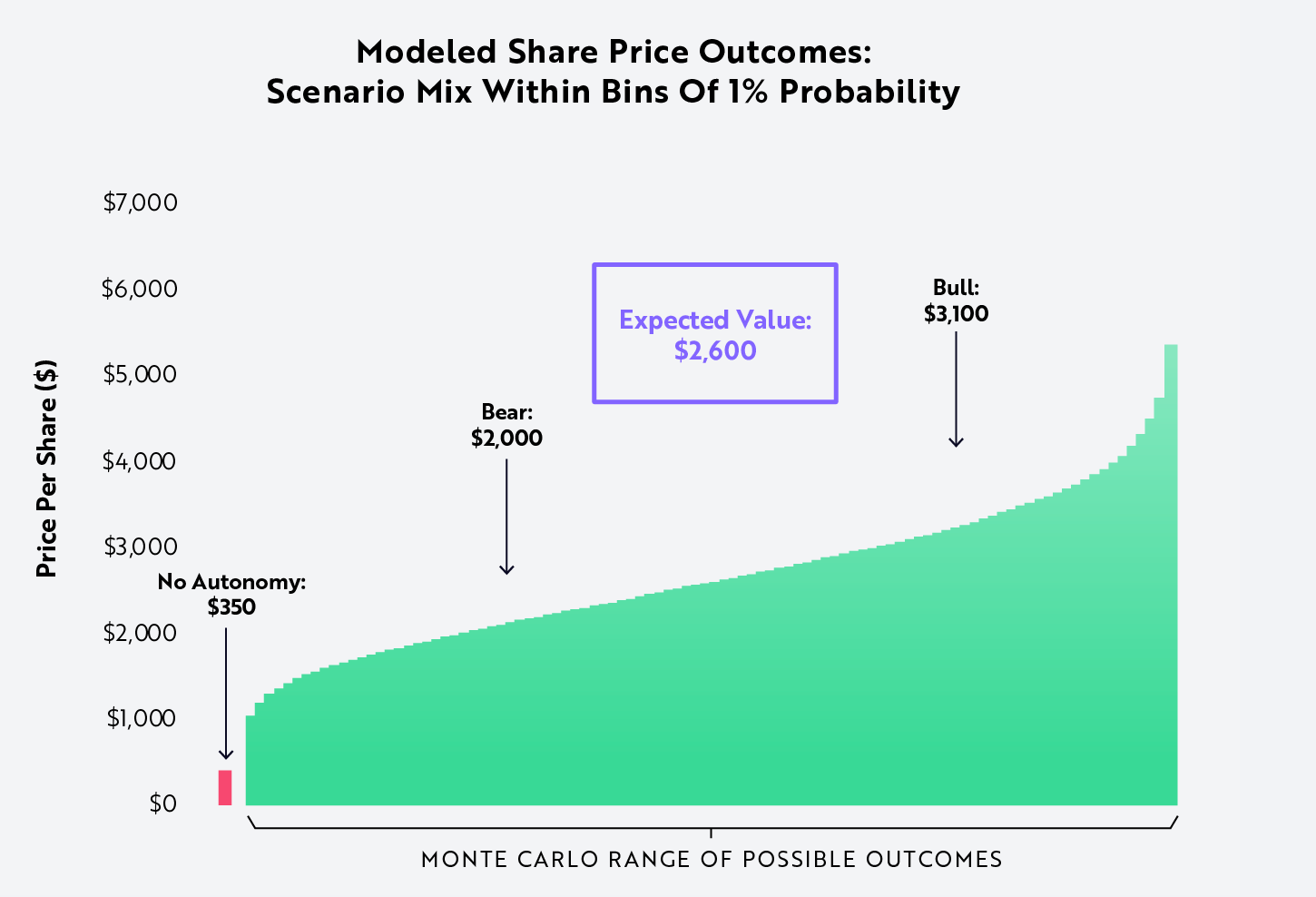

ARKK, for instance, values Tesla at $3100, or about $11 trillion dollar market cap by 2029.

A lot of these valuation models consider the average revenue from per FSD mile driven rather high, around 50 cents.

I think this is in fantasyland. I will question the assumptions made to arrive at the $10 trillion dollars market cap. First and foremost, these models excessively rely on number of FSD miles driven. These are incorrect assumptions and to understand why they are incorrect, you have to first understand traffic.

The most commuter miles driven in the US, and really anywhere for that matter are during 7-9 in the morning and 4-6 in the afternoon. Due to congestion, the number of these robotaxi trips will rather be much smaller than anticipated. The robotaxis will sit idle during most of the day. It is not like they will have same load day and night.

Then on top of that, you are not going to convince everyone to use Robotaxi. Seriously how much taxi do you really use on a day to day basis? Folks still are going to want to keep their personal car or cars for that matter, and not every one is going to go for the blander looking Tesla.

The value in TSLA is not in the car business or even the FSD in my humble opinion, I think the value proposition for TSLA comes from a couple things:

The manufacturing process or prowess that TSLA has over others. If you actually open up a Tesla car, specifically the newer models like Y and 3, you will be blown away by the simplicity and robustness of the design. This in essence makes the car making process very refined and less dependent on human error. Tesla has an enormous edge in this area. If FSD becomes a reality, they can easily ramp up manufacturing of smaller, more cost effective cars and that is definitely a big plus.

The other elephant in the room is the Humanoid robot itself. Move over the $3500 AR glasses from Apple, the Humanoid robot is the toy I am buying as soon as it becomes available for sale. I could use it to walk the dog, maybe keep an eye out on related markets as I trade the emini during the day and make me an espresso martini after a good day.

So while I think a 3100 dollar price target by 2029 is fantasyland, I have a more reasonable target of 1 trillion dollar market cap, if Musk solves the FSD problem, let us say by the end of 2026. Two years from now.

This in my view should send the stock to around 300 or so.

The market on Friday closed at around 210 in TSLA.

While these are some decent bullish assumptions, there are some good bearish counter arguments too.

In fact there are several counter arguments. Competition is a strong counter argument. We talked about how LIDAR potentially being a better hardware solution is a good counter argument for bears. Then you also have the whole fluffy quality to the Robot presentation. Like the Robovan had no windows or anything, the van was also extremely low to the ground, with almost no ground clearance. Albeit this is just a prototype, you have to question that is the designer behind this not really smart at all? Like it is a good idea to have windows in a van so you can see where you are so you can get off at your stop, or can break it during an emergency to escape. I myself don’t read much into these details but I know the skeptics and perma-bears do. I am sharing this FWIW. You can draw your own conclusions from it.

Now while these are longer term assumptions and projections, where do I see the stock go in the short term?

In the short term, there are various dynamics at play right now- the main being the relative strength right now in the general market itself. If the market continues to push higher, into 5900 and then 5950s, I think it organically creates a floor under all sort of stocks, not just TSLA. However, the stock may underperform the general market or some other leaders like NVDA for instance.

Let us say the general market actually softens in days and weeks ahead. This I think should add more pressure on TSLA, compared to its peers. With TSLA, you also can expect an outsized impact from the US Presidential elections in November. So now you can see that how many different variables can impact a market in the short term.

But if you logically pick up a couple of levels, let us say we pick up 230 which I believe is an important orderflow level, unless the bulls can close above it on daily and weekly time frames, I think this level could present resistance for the stock to move lower into 200 handle.

Now do know that, as I said in a previous newsletter, TSLA stock price of 250-260 was predicated on ASAP rollout of the fully autonomous driving. Elon himself on the 10th, pushed this out to atleast 2026. And that is being ambitious. This I think introduces a lot of uncertainty in the mix for TSLA. So this is why also I think that 230 level now is extremely important and if I am going to be a longer term bull on the stock, I need to see it clear 230 on the upside, else I think 200 may be a better spot.

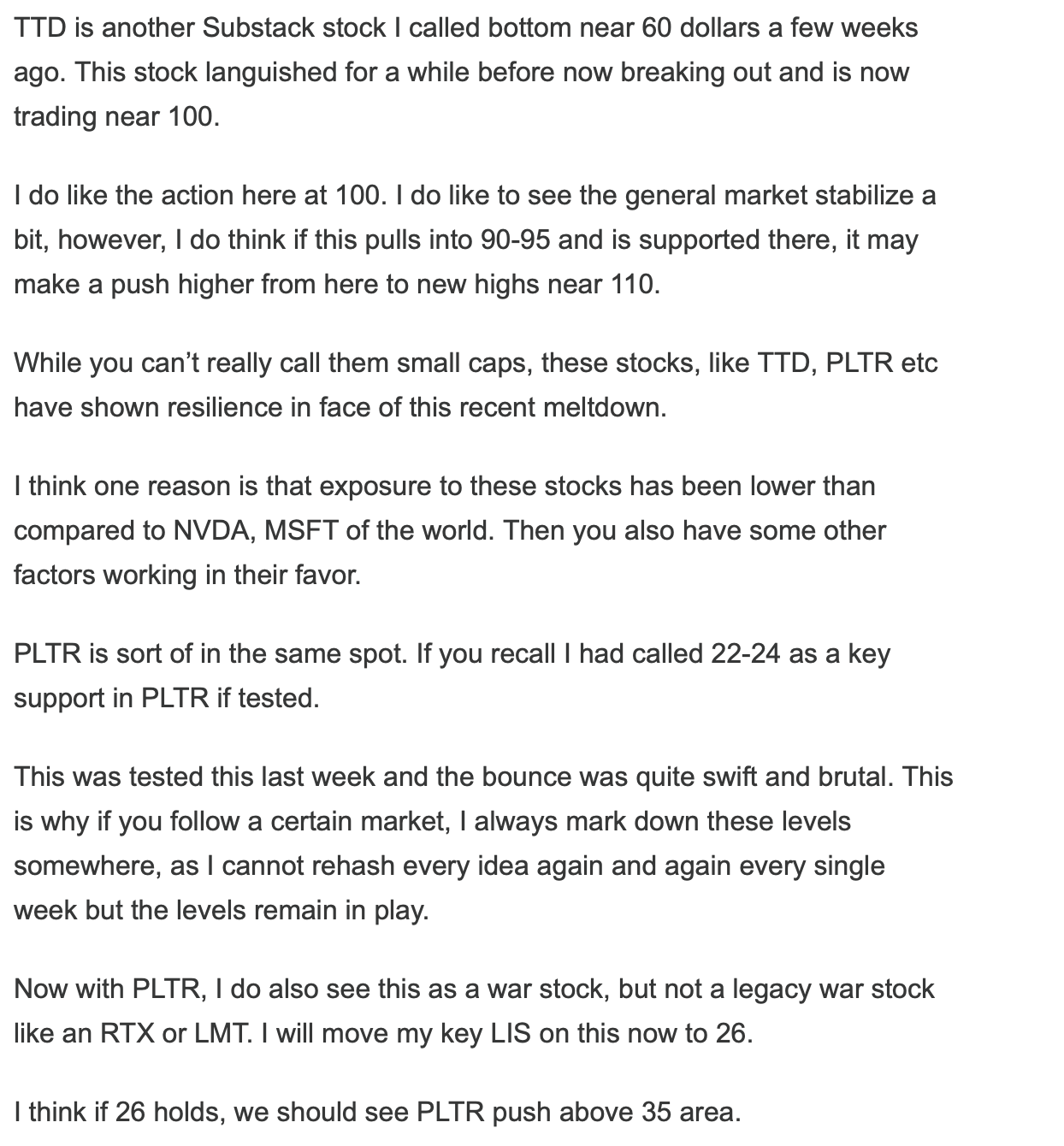

Ecosystem beneficiaries

One thing that the whole Robotaxi event helped crystallize for me was that the FSD fully autonomous tech is not yet ready for the prime time. Are there other companies in the ecosystem which may be closer to a real world implementation, Waymo for instance?

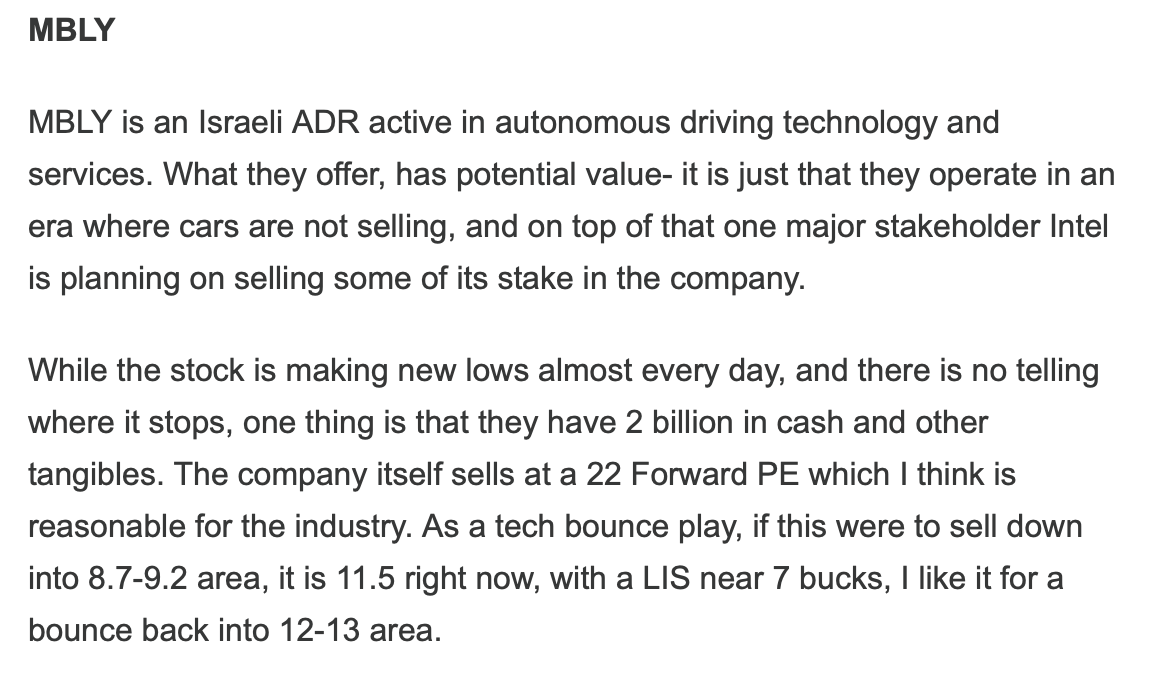

If you recall, I shared my bullish bias on Mobileye at $10 a few weeks ago and the stock has behaved generally well around this level, and has had a good month, up 20%.

But here's the thing—the Robotaxi event got me thinking about why it's taking so long for self-driving cars to reach Level 4 autonomy. Is it because the algorithm can't handle it, or is it a hardware problem?

If it's a hardware issue, could we solve it by using more 3D tools like sensors and LIDARs instead of relying solely on cameras?

Waymo is already up and running in some cities in the US, so I'm inclined to believe this isn't entirely a software problem. Maybe a better set of hardware could do the trick. It's like the Android versus iOS debate—we're not sure who'll win the autonomous car race, but both computer vision via cameras and hardware like LIDAR have their place right now.

That's why I think Mobileye as the LIDAR leader, is still in play and could benefit from the Robotaxi event (or fiasco?) last week.

I had a $13 target on Mobileye, but I'm bumping it up to $16-$17. As long as we don't see daily closes below $10, I'm staying bullish. It's currently around $12, so we've got some room to grow.

I think MVIS is kind of in the same boat too. However know that MVIS is literally a penny stock and I am not a fan of penny stocks. It is 1.2 now but I think if MBLY gets legs, this could help support names like MVIS also to push higher unto 1.5-1.6 area.

Got Egg?

A year or so ago, I shared my bullish bias on an Egg producer called CALM when they were literally giving this away at 50 bucks.

This stock has since rallied to 95 dollars. Recently the CPI showed an uptick in food prices- food prices are complicated. You have a combination of bad weather, you have higher oil prices which lead to higher input prices for farmers, then you have higher labor costs and then you have the consumer who is willing to pay a premium for organic, pesticide free foods.

This is where a smaller producer like Vital farms, based out of Texas comes in play.

Another part of my thesis is that in larger Texas cities, you have a lot of West coast people move in who tend to be more organic food conscious than other parts of the country.

I am liking Vital farms action here at 30-38. I think this stock could push much higher, but in short term my target will be 50 on this. I will reassess my target if and when 50 gets taken out.

Symbol is VITL 0.00%↑

SMR

SMR is yet another stock which I have been bullish in most recent weeks around 10 bucks and has since closed at 13 again.

I do think the technical pattern looks robust here to push higher into 20-22 dollar area. Generally, I do like these smaller energy plays as well as food names. Inflation comes in waves, and I do think that in next year, you can count on the admin to print more money to fight with inevitable slowdown. This should benefit consumer necessities like energy and food stocks.

SOX

On the SOX side, these are some strong looking auctions.

In particular for both AMD and NVDA, I have been now warning for over several weeks now that how this is not such a great idea to be fading them near the lows.

NVDA in particular I have had strong bullish views on when it was 104 just a month or so ago. My target was 130.

It is now 134.

Even the scandal ridden SMCI is now up from that 37 level I shared a week or so ago, it is now 47.

So this shows the SOX complex as a whole is looking strong and we can’t be bearish until we begin to see some of the support levels I shared before lost.

A short term set up on AMD, I like it if it holds 160-162 area. I want to see it push higher unto 180 area. It is now 166.

For next weekly OPEX, I like the 170 CALL as lotto if had for less than a dollar and half. It is about 2 dollars at the moment.

HOOD

Just a technical play I like. I also like it since Cathie sold it and bought more Tesla instead. BTW I shared it with our subscribers around 17 earlier in the year.

It is now 26.

I think this is headed into 30+.

For the weekly OPEX, I like the 26 call as lotto if can be had for may be 60 cents or so. It is now 90 cents.

~ toc

This newsletter is not intended to provide trading or investment advice but solely for general informational & educational purposes. It represents the personal opinions of the author, shared publicly with you as a personal blog. Engaging in futures, stocks, or bonds trading involves significant risk, and there is no guarantee of profit. In fact, there is a possibility of losing one's entire investment. Utmost caution is advised. Your account can go to zero. The author does not guarantee any profit whatsoever, and the reader assumes the entire cost and risk of any trading or investing activities undertaken. The reader is solely responsible for making informed investment decisions. The owners/authors of this newsletter, its representatives, principals, moderators, and members are not registered as securities broker-dealers or investment advisors with the U.S. Securities and Exchange Commission, CFTC, or any other securities/regulatory authority. Consultation with a registered investment advisor, broker-dealer, and/or financial advisor is recommended. By accessing and utilizing this newsletter or any of its publications, the reader agrees to the terms set forth herein. Any screenshots used are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Jigsaw, with whom the author has no affiliations. The information and quotes shared in this blog may contain inaccuracies, as markets are inherently risky and subject to unpredictable fluctuations. Additionally, the content of this blog is the intellectual property of the author, and its sharing or copying is strictly prohibited. By reading this blog, the reader accepts these terms and conditions and acknowledges that it is intended solely as a personal trading journal and nothing more.