Traders-

We had quite a day today both on S&P500 side as well as individual stock names.

Let us begin with how some of my picks did. For those in a hurry to get to S&P500, head over to Section C.

A) Tic Toc Tickers

Home Depot $HD had a massive day today closing at 392. I shared this at 350 (originally at 300). Home Builder confidence came in very strong at 83, up from 80 last month. This helped my other sector picks like XHB as well which I have been bullish on since 69; it closed at 84 today. I believe HD may have more juice left and 420-425 is not out of the realm IMO.

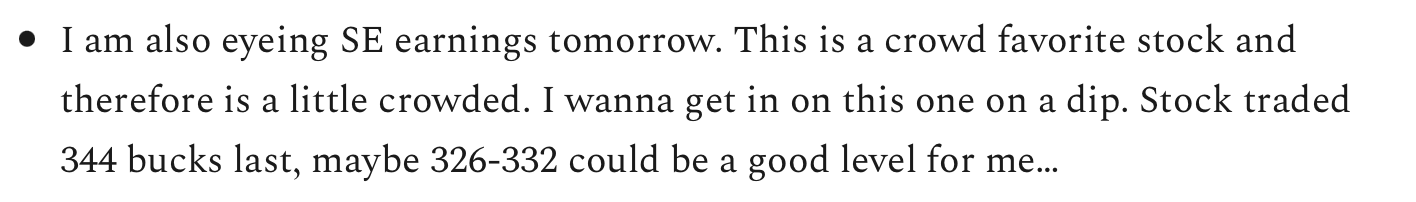

In yesterday’s daily plan, I had issued a warning regarding SE being too crowded at 345. The stock sold off and settled at 325 after missing earnings.

I left it alone for now, in anticipation of better prices at 308-311. See below from my trade plan yesterday about SE:

And as mentioned earlier, I ran a few scenarios on Palantir PLTR. I did not catch anything that is substantial to change my current opinion- that the stock is a little crowded and may drift off lower into 20-21 before making the next larger move. PLTR closed the day a few cents above $23.

Now I was quite bullish on TDOC earlier in the month before it jumped from 135 to 150 + . It has since fizzled out. However, I noted a relatively large number of short interest in this stock at a key support. I think TDOC represents some risk to the upside, if 131-132 were to hold. A view only emboldened by a Daily CLOSE above 137. The stock finished the day at 135 and change…

Other names like RBLX also had a huge day today closing near 120 , I shared this only last week at 82 bucks. This underscores the importance of waiting , being selective with the tickers.

B) Crypto Carnage:

Using the Carnage word with abandon though it is not SO uncommon for crypto currencies to shed 5% + in a single session. Any other asset class, this will be scandalous, but cryptos take it in stride 😉

Anyway, I have been bearish on #Bitcoin from 64000. Just from a swing perspective, I think a retest of 47000-51000 is not out of the realm. Bitcoin finally had a big move last night dropping about 6 % or so. Ethereum also has a decent support IMO at 3650 (now 4300).

The problem with #bitcoin is these moves are quite sudden as 97% of supply is owned by a handful (2-3% ) of wallets. This caused some volatility in mining stocks as well.

One such name that crosses my radar is HIVE. The stock is trading at 4 bucks and seems to be showing some accumulation patterns. The downside for me is this is a less than 10 dollars stock, which makes it easier to push around. Unless exceptional, I do not like sub $10 stocks. Regardless, I like this one as long as 3.25-3.5 holds.

C) And finally back to S&P500 ..

Order-flow did very well with S&P500 today. Most of my key levels worked well.

Starting with 4680. I expected sudden upside moves if we opened or bid above 4680. See Figure B. We opened slightly below at 4677, however within a few minutes of open, 4680 was overwhelmed on strong volume.

We did not look back and took out 4692 level within the IB period.

This prompted me to send this tweet within the IB period: Tic 4697/4710

I expected 4697 to give way at some point in the session. Beyond 4697, the only logical resistance was 4710. This turned out to be the exact High of the Day (HOD) this RTH session. Good for about 15 points off my 4696, on top of the fast moving zipper from 4680 to 4696.

The day wrapped up at 4696. Closing down 15 handles off 4710.

With this context and background, section D lays out a few scenarios I will be watching tomorrow.

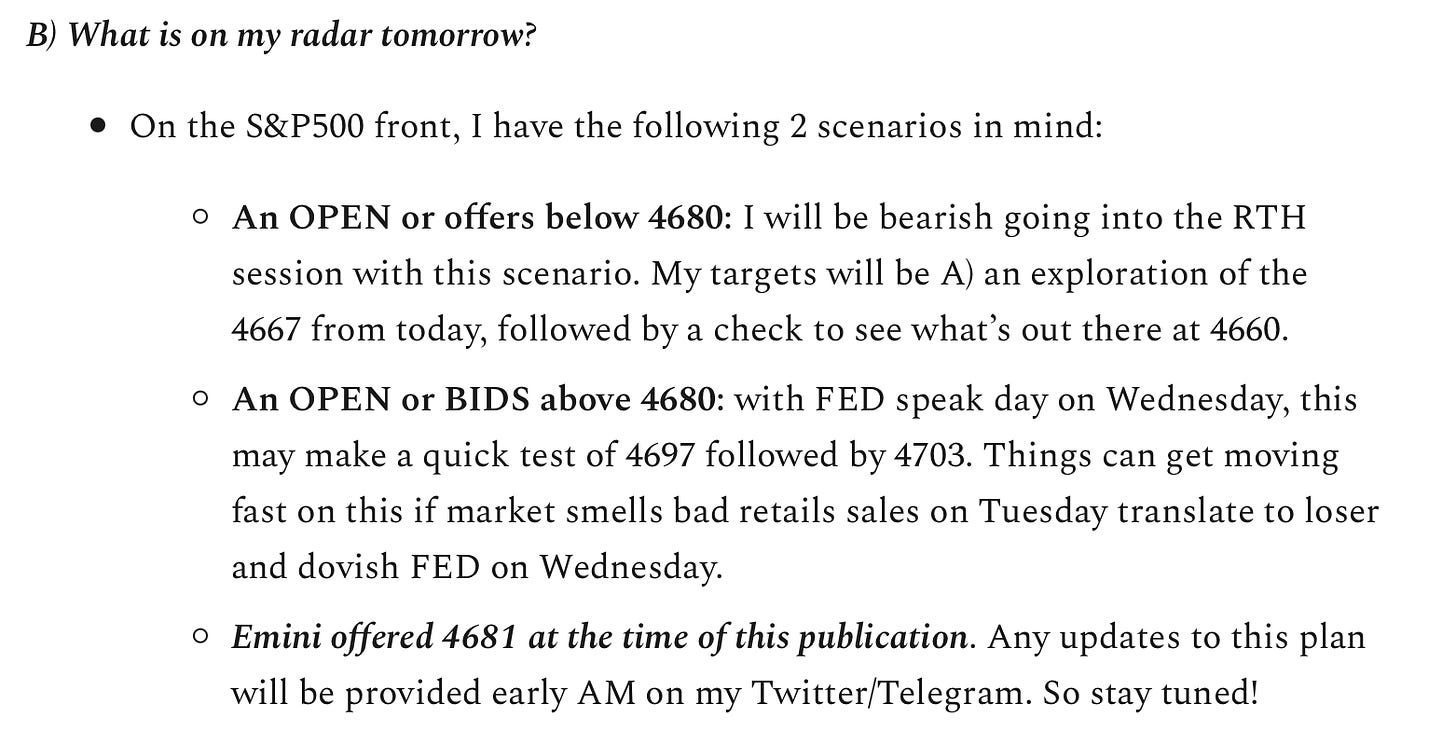

D) Scenarios and Levels for tomorrow:

My Primary level to work off is 4692. If we open or BID above 4692, I will expect another run made at the highs from today at 4710. A break of 4710 may guide to ALL TIME HIGHs 4750 and beyond as there is very little overhead resistance.

In case we open or offered below 4692, S&P500 may first address my order flow levels at 4668 and 4670 (potential support) before making its next major move.

Last few sessions the market has been pretty binary in the sense it is not fighting the opening prints much. So if we open below 4697, it tends to stay below 4697 and vice versa without much two-way auctioning. Let us see how long this trend lasts.

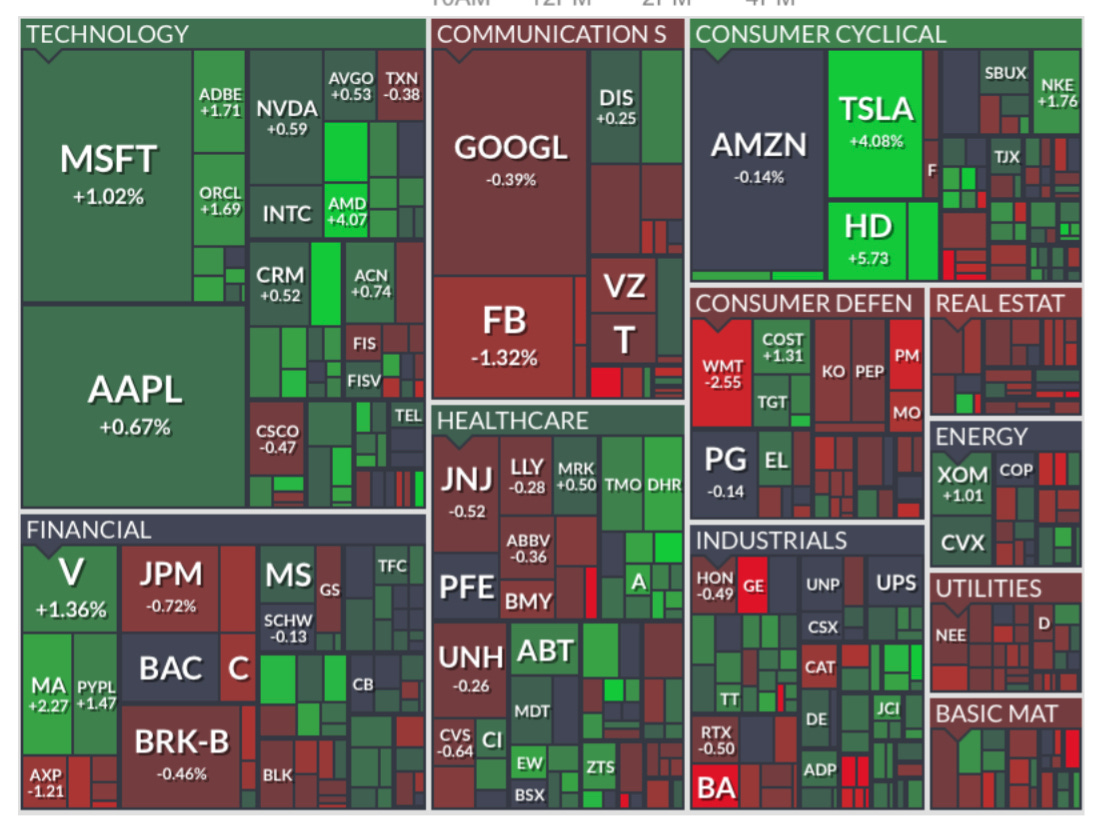

And one more thing since many folks asked me about bad breadth and current action in S&P500. So, today was yet another day with TRIN hanging for most part above 1 with only briefly coming below 1 for a few minutes. The NYSE and NASDAQ breadth was quite bad as well on pretty much all time frames from weekly to monthly with more stocks making new lows than highs. Yet, S&P500 remained bid for most part. See below link if you are not aware of TRIN: Intro to TRIN

I can only attribute this to the fact that S&P500 is now an index of top 5-10 biggest market cap stocks. See Figure C below for the S&P500 heat-map. Any time you have these massive squares (each relative to the market cap of the company) trending green, it makes it harder for S&P500 to sell regardless of any other breadth metrics. This is just what the market is in 2021 AND the reason why I always keep major stocks like AAPL, TSLA in a corner .

Speaking of TSLA, this stock had a massive bounce off my 980 level. Up more than 70 handles. It closed near 1060 and I think it may make another run above 1100, unless Bitcoin really starts coming apart. TSLA and Bitcoin have a strong correlation and something I never ignore.

This is it from me tonight. Will be back with more. If you enjoyed reading my newsletter, please share this newsletter and subscribe so we can each more traders, like yourself.

~ Tic Toc

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms.

Thanks for the commentary on TRIN... I think your observations are correct. I have 4692 as a key level in my own notes for the day as well. For the bear case I have potential pit stops at 83 and 75 before getting to the logical 68-70 zone.

See you at the open.

This newsletter is fucking amazing! I recommend it 100%