Folks- some folks informed me that they are not getting the Daily Email.

Perhaps, check your app settings. Does it say deliver to both APP and Email? Or only the APP? That may be why some of you may not be receiving it.

The primary level today was 18334 in NQ. See Chart A below.

What do we see?

We see an attempt made at this level early after the open that fails miserably.

A second attempt is made. It fails to take it out too. We sell down some 90 points below this level.

Look at the solid black line on Chart A carefully.

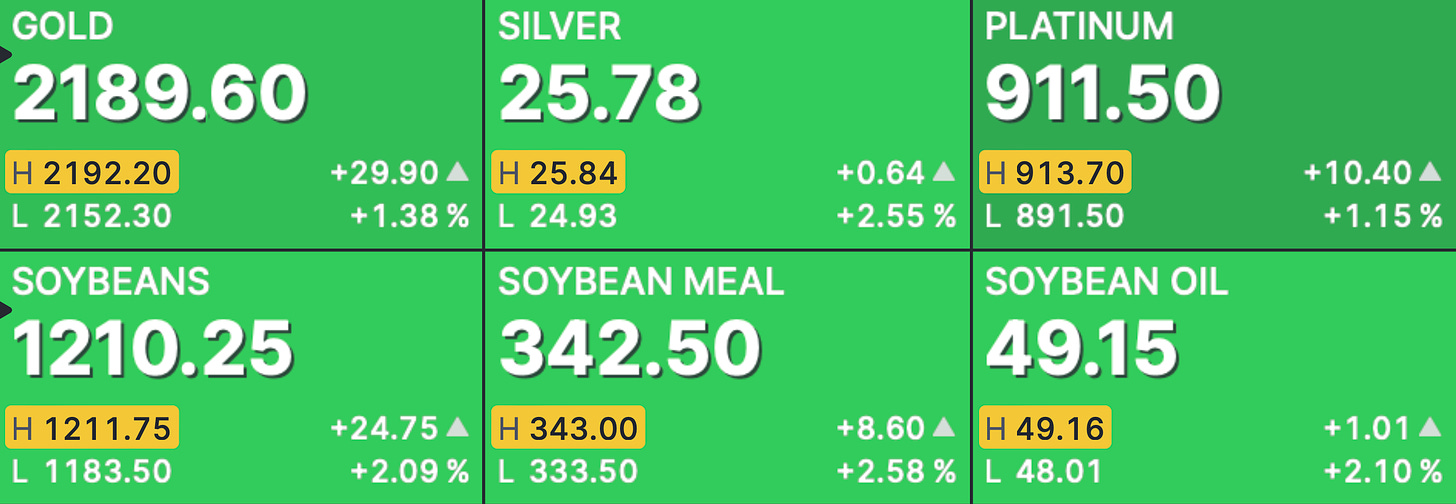

I am not going to go into the details of the FOMC, as everyone already knows what was said and what was not said. But I will add that the actions of Powell today just made every day products and services for the average American more expensive. The cost has now increased for every single one of us. See below. Numbers do not lie and this is the end result of whatever was said and whatever was not said. There is no way to put a lipstick on this piggy.

Bottomline is as soon as Powell started to speak, we took this level out, and once we took it out, look at the auction here at these levels.

Are these bearish bars? Go back and look at Chart A again and tell me.

These are some hard conversations for many of the folks who refuse to grasp how dynamic and alive these markets are . They have a very firm bias and will not allow any new information to change that bias. We can try but it is hard to change their view point. However the majority of folks understand this. They do not come to this market with a strong bias.

You have to sear it in your memory - to grasp the concepts of rejection and acceptance from auction markets firmly. For some it may take a few weeks, for some it may take few years.

And if you want to come to this market with a strong bias, then give me credit where I said just this Sunday, a couple of things have to happen for this market to sell off, else dips may be bought-

NVDA needs to dip and remain below 860.

AAPL needs to remain below 170.

How convenient it is to form a bearish bias and forget everything else that has been said with regards to the related markets?

The reason I am reiterating this is because I want us all to learn and get better at these markets. At reading the price action. If we are not listening to these related markets, we are missing out on key messaging by this market.

Instead of selling off what do we see in related markets?

A 50 dollar rally in NVDA from my weekly support.

A 10 point rally in AAPL from my level shared on Sunday.

A massive rally in TSLA from my support level shared on Sunday. Now 176.

The importance of $SPX 5110 or ES 5180 as a solid support, as stated half a dozen times last week?

On top of this, from last couple of weeks alone, when I look at GRND, I look at DIS, AXP, I look at HOOD, VDE, XOM, CVNA, ORCL, CMG, MNMD, MSOS, I look at tremendous number of runners. Great value.

So to trade these markets just based on “technical analysis” is a sucker’s game. We need context. We need related markets. We need orderflow. Then alone we begin to march in the right direction. You may ask how do I know? Because over the yearsI have literally tried and backtested every single chart based indictor out there. Spared none. This blog is for those who are open to learn these real time, level 2 based methods. If you think some history based indicator, set in past tense alone will get you results in intraday markets, then good luck :)

On my part, I have shared several dozen tools with folks here in the Substack. These are not historic past tense indicators but real time market momentum measurement tools and methodologies. Check my archives for these tools and subscribe as I am always sharing new educational ideas and I am always improving upon existing methodologies.

Levels for tomorrow

Now if you look at the auctions from past few weeks, today we had a clean break out of 5250.

Normally these levels do get tested at some point but not sure if that some point will be tomorrow. If indeed it gets tested tomorrow, I think it may fall back inside the balance area, rather than hold it.

In my experience of auction theory, the longer this market now takes to test this level, the stronger support this can be. Inversely, the sooner this gets tested, the more likely is this breakout prone to fail.

Scenario 1: If we remain supported above 5266-5270, then this level could be supported and we may see a continuation higher into 5300-5310. At time of this post, we last traded 5290.

Scenario 2: Generally I think if 5250 is tested, we could get a weak bounce of about 10 dollars, but ultimately this will be a sign of weakness to retest the lower bounds of recent breakout at 5200.

To sign off, the markets are based on logic and context. Related markets drive flows. This is not rocket science but it is not easy either. You have to be observant and watch related markets, and things will make sense. Sooner or later.

~ tic

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Jigsaw. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.

Thanks a lot

Thanks much Tic!