Traders-

What is the secret sauce behind the greatness in the USA Technology sector? Yes, the tech created by these companies itself is magic and it improves our lives every single day, in a lot of aspects.

However, is it fair to say that the market should assign a multiple of 50, even 100 in some cases, to some of these stocks, purely based on the magic of technology?

While tech stocks have been one of the greatest investments in last 2 decades, this was not always the case. There have been periods where the tech did not outperform the other sectors.

One school of thought is that the formula behind astronomical rise of the tech sector is nothing but the near zero interest rate regime (ZIRP) since 2008. It is hard to argue against this. Big tech companies today, at one point used to be rather small. AAPL, MSFT, META, GOOG, you name it, in their infancy were midsize companies. AAPL, at end of 2008 stood at a 75 billion valuation. A far cry from almost 2700 billion today.

While near ZIRP has certainly helped these companies grow into the giants they are today, I would argue that these companies were able to achieve so much technologically due to the magic of near ZIRP.

Why?

When you start a tech company, it barely has any assets. It is but an idea, many times that comes with a visionary founder. The company in its infancy has barely any employees, has virtually no assets, has no tangible value as such, except that it solves a problem. Often times it is a disruptor in an existing but ineffective industry. For such companies to even survive, they have 2 major sources of funding - they can either go for private funding, where they issue preferred stock in the company to private investors. Or, they can borrow.

And in some cases, borrow a lot.

Borrowing is a lot easier when the interest rates are near 0. You barely have any borrowing cost when you have to pay very little to nothing in interest. Ask this to a guy who has a mortgage at 2.5% versus someone near 8% now. The difference can be thousands of dollars a month, in interest alone.

So, you could make an argument that the ZIRP made it easier for these companies to borrow at much easier terms. Which in turn, can be argued, helped these unicorns to grow into the giants they are today at a tremendous rate. Whether that has been a good thing or a bad thing in long run for these markets is a different topic and beyond the scope of this blog.

So, we have now established low interest rates are great for growth companies, which most of the US mega caps are.

Fast forward to 2021.

Things are looking great, per some pundits, stocks like NVDA are on pace to be the first 5 trillion dollar company. Almost everyone is fully invested in stocks, bonds and crypto. However, by mid 2021, this pesky little problem called inflation appears out of nowhere. So much so that within a span of few months, gas prices jump from 2 dollars a gallon nationally to 4 bucks. Rent for a midwestern studio apartment doubles. The White House celebrated a 16 cent year over year drop in price of turkey.

This forces the FED, which was asleep at the wheel only a few months ago to aggressively raise rates from almost 0% to where they are now, pushing 5.5%. This has been the fastest rate of change for such a magnitude, ever.

So here we are now. In the Fall of 2023. We have seen some wins against inflation. And we have seen it raise its head again in last few months. By December of this year, many predictions called for inflation back under 3% and the FED funds rates to be closer to 2.5%. Yet here we are closer to 6%.

Inflation target touted by the FED is 2%, however, it stopped going down many months ago and the core part of it is sticky now around 4%.

I share this to highlight that this is a problem. By several measures, the FED funds rates close to 5% are closer to long term averages. However, when you look at the market valuations, by several measures, whether that is the gold to SPX ratio, or GDP to S&P500 market cap ratio, by really any of the long term ratios, the market valuations are still about 70-100% higher than most of these longer term averages.

This is why if you look at the S&P500 YTD gains, most of these gains have come from may be 10 or so companies. The remaining 495 or so have not really much to show for the year. Now don’t get me wrong, some of this is not without merit.

I would say there is a legit reason for NVDA’s rise. For GOOG strong performance. For TSLA to rebound from extremely oversold levels. But I must ask myself, can this continue for these companies. Will these 7-10 companies be the only game in town or are there other potential candidates which do not have such nose bleed valuations?

To answer that question, I have to build a few assumptions. These key assumptions are below-

The post pandemic economy has fundamentally shifted from long term trends. Primarily, the pandemic dislocated a lot of workers and there is an endemic shortage of workers, at-least in certain type of jobs. As a result, the wages have risen at the same time the supply of labor has shrunk in certain industries.

The Machine Learning technology has crossed a threshold from where there will be exponential gains in the level of sophistication of AI driven systems. This will further create labor dislocation and will force the governments globally to pay an income in form of Universal Basic Income.

The political situation in the US will remain focussed around one party rule for some time and this could favor certain policies over others, for instance energy and foreign policy will continue to head in direction of current momentum.

The world will become more fragmented with multiple power centers, allowing for a separation from a Dollar denominated payments in multiple industries, especially in oil.

The FED, despite its hawkish stance, will not be able to sustain higher rates for longer as both the private and the public sector in the US are laden with debt never seen before.

If all 5 of these assumptions turn out to be correct for a number of years to come, this may benefit few themes over others:

The AI haves and the AI have-nots will continue to diverge creating lopsided positive returns for some while others languish.

If the dollar begins weakening, this will keep inflation pressures higher on the US citizens. Remember, a stronger dollar blunts the force of inflation as the US is a consumer country and imports most of what it consumes.

Geopolitical fragmentation will lead to a more volatile world and hence a more expensive energy regime. As growth slows down, the energy costs may remain high, causing a double whammy for growth assets.

So this leads me into the next section where I share a few names which I think can benefit from these trends.

Energy

Energy is an extremely cyclical sector. For a long-long time the floor under oil was closer to 30 bucks and the ceiling on oil was closer to 60 bucks (WTI). For instance, even after a major recession like the one in 2008, oil found succor near $30.

I personally have strong reason to believe this has been upended. I think the new range in oil is now 60 to 100 to the barrel. This is what was a primary reason for me sharing 66 as potential support in oil before it rallied almost by 50% last few months.

If this is true, and we can agree that for the foreseeable future, the anti-fossil fuel policy think will run high in the West, then I think few companies can benefit more from this than the fossil fuel producers.

For instance, the Biden admin goal is to have 50% of all passenger vehicles transition to EV by the year 2030. This is a lofty goal, and gas at 5 dollars a gallon helps hasten this goal whereas gas below 2 dollars a gallon, hampers it.

So, whether that is BP, XOM or OXY of the world, I think they can benefit from it for some years to come. I shared bullish bias on these near 25, 60 and 30 respectively and at time of this post they are now trading near 40, 110 and 65 respectively.

This is the reason I think XOM could have a floor under it around 90-100. When you look at some of the ETFs focussed on energy, like VDE with ultra low management costs, they could have decent floor under them near 110-120 etc.

Now one argument is that a severe recession in the US or aggressive rate cuts by the FED could nullify it.

I would agree that a deep recession in the US could bring a sharp sell off in the oil.

However, when you look at my assumptions above for next few years, that 60-65 area could again provide a longer term support for the oil, thus supporting every one else that depends on it. Even a 60-70 dollar oil for a long term is NOT a great news for global growth as it sucks out much needed resources for growth.

Now, assume there is no recession but the FED cuts rates in its infinite wisdom when the oil is above 60 bucks, I think that makes no impact to the oil. If anything, that may be good news for the oil market.

Now when I say that the Exxon Mobil could be the next largest mega cap, this does not mean it will become a 3 trillion dollar company, though you never know. There are a number of ways to get there, for instance if it even doubles to a trillion dollar valuation and some of the high flying stocks get cut in half, that could take us very close to that target.

Another aspect of this is that what effect will widespread EV adoption have on the Central government budgets globally and end consumer pockets.

Personally, I believe EV is not the best solution for cleaner air. At end of the day, input energy for these clean EV is not clean, and mostly comes from coal and gas burning plants. Until that changes, this is a quixotic fight.

Some of the alternative solutions, like the hybrid engines make much more sense to me. Many of these hybrids can generate a 40-50 MPG equivalent mileage which is very decent, when you compare the other downstream impact of mass EV adoption-

Stressed and aging power grid.

Environmental pollution caused by lithium mining.

Dependency on foreigners for lithium and graphite.

Higher insurance costs, higher financial and environmental cost of faster wearing tires.

Last but not the least the toll these cars take on existing, dilapidated infrastructure.

If you are still with me thus far, it tells me that you are serious about this stuff. If you find this content helpful, then help me reach wider audience by liking, sharing and subscribing.

Now the other side of this coin is the question that is all tech bad?

I do not think so. While I think that most tech stocks will face drawdown with a drawdown in the general market, I do think in a few of these names, the drawdowns could be shallower, compared to their peers.

What are some of these?

Not a lot but before we go there, let me share how often some of the longer term calls work out.

When Moderna was trading at 500 dollars (almost), I shared a bearish call with a target of 65 dollars. Mind you, this was more than 2 years ago.

My bearish thesis on this stock was met with lot of skepticism, and I will admit it was not a straight line down. Lots of ups and down where this stock had rallies of 20, 30, even 100% from the lows.

However, at the time of this post, we are barely 20 dollars away from the target. A sell off more than 400 dollars on this stock within 2 years! A calamitous decline!

This is the time frame of my longer term calls. A lot of macro thesis based calls can take an extremely long time as the value in that call is not immediately clear to the majority.

Eventually, you have the majority which is always the laggard, catch up. However, the early adopters and leaders by then are way ahead of the laggards. This principle works in lot of other aspects, not just the market.

Now note that if I make these calls using charts and traditional technical analysis, it will make no sense! This guy is bearish on Moderna at 500 which is up almost a 1000% in a year?! This is why I do not give much weightage to traditional technical analysis but I use contextual analysis which is based on macro themes plus technical analysis.

For most part my observations are based on level 2 analysis of bid and ask data which can be extremely time consuming. If you note my call on TSLA on its earnings day, it was based on offer and bid data, not some charts. These type of calls are inherently very time consuming. If you want to receive more such updates, consider subscribing to my newsletter. It is just a different way to look at things, and not conforming to a world full of chartists. To help make the transition easier, use the offer code below. Valid only for a couple of days.

So, now back to my post about the tech sector..

With the current mix of heady oil prices and yields topping 5%, it is very hard for me to like stuff in a world full of 50-60 PE ratios. Very hard.

But if I were to hold my nose and pick something, I think GOOG could be a good name.

GOOG has a lot of powerful coding capability. I think it is the best coding shop anywhere in Silicon Valley, perhaps better than META. They do not have costly CAPEX projects like a TSLA may have or cyclical nature of products sold like NVDA may have.

For this reason, I do believe that dips in GOOG could be shallower than its Big Tech peers. I see GOOG solve a lot of future problems with software and for this reason I think it is a winner for me.

PLTR

Palantir is very deeply embedded in the government sector and for this reason I think this could go higher and it is able to showcase its abilities to the military procurement teams. It is 16 and change right now but I believe that it has seen lows around 6 dollars which I called last year. I think if it dips into 12 area, that could be a good support for this name.

I think this could head into 26-30 area before a run higher.

Some other ideas as well but will be shared as they approach more favorable levels and shed some frothiness. Stay tuned.

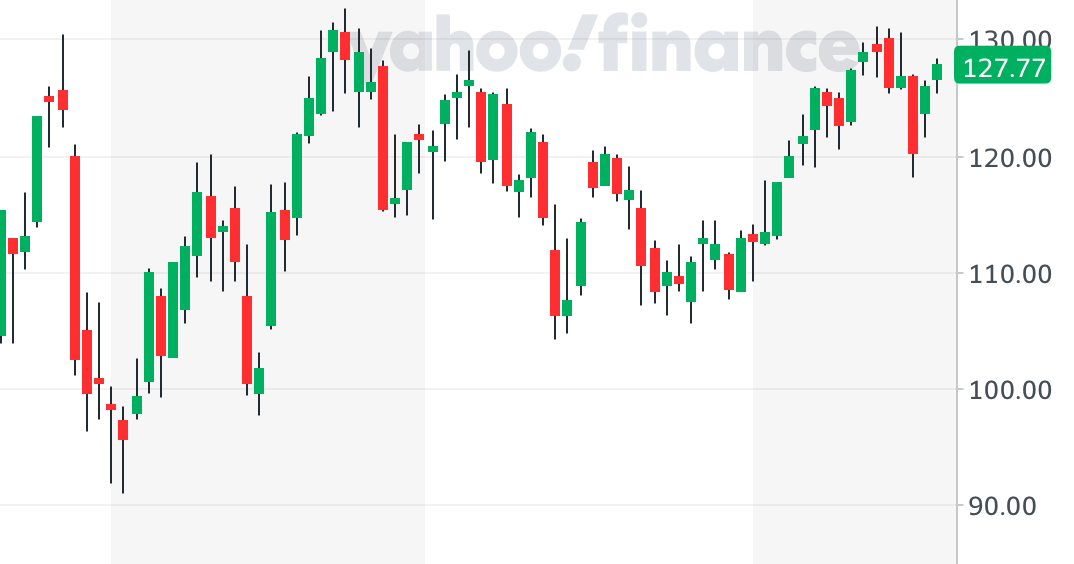

TLT

I called for a test of 80 TLT levels once it broke below 90 key level. This also coincided with more longer term softness in the SPOOZ. Now so close to the 80 level, I do believe TLT is in a longer term bottoming process. I personally do not think the FED will be able to keep a hawkish stance for the long haul and will be forced to fold, regardless of the inflation situation. The main risk to the bonds in the US is not from a continuous hawkish stance by this FED but by the ability of the Federal government to borrow. It is all good as long as the US dollar remains accepted as the global reserve tender. However, if and when that changes, we will be living in a different world.

TSLA

Short term support could come near 200 for a bounce into 225 area. We are now trading near 210.

My levels for this week

This was a bad week for stocks. Is there hope?

Nothing changes expert opinions faster than price action. Only a couple of months ago, the market was in an uptrend, new highs were in store, and the macro did not matter. Today, the experts say there is absolutely no reason for this market to be going up. What changed? The macro scene has not changed much at all in last one plus year. Nothing really have changed except price action which in turn causes the so called experts to change their tunes.

So, on the S&P500 side, in a sea of doom and gloom, which most of us already know what is, I will list a couple of factors which are a silver lining IMO:

I think the Dollar looks weak.

I think the yields are close to a top.

At the start of the week, my main thesis was that there was an imminent escalation of Middle East situation which will lead to a hoarding of the US Dollar and a spike in the oil.

Both were true to some extent but here as I wrap this newsletter and my research for next week on this Sunday morning, that has taken a backseat I think.

The focus will now shift to the mega cap earnings. TSLA has proven what I have been saying for several months now- if you are in a business of selling expensive cars, and the yields are now 7-8% on a new car loan, this is not a good place for you to be in.

But is that true for a GOOG? Is that true for a MSFT? For SMCI?

Some food for thought there.

So, my key level this week will be 4200. At time of this blog, we last closed at 4250 on the emini S&P500. For SPX that will be 4225 Friday close.

Scenario 1: I think that based on Friday close, the technicals appear weak in the short term and I will not be surprised if we are able to dip into 4200 area.

Scenario 2: However, as we get into Wednesday and Thursday, we have the mega caps like META, AMZN, GOOG, MSFT etc report. IF by Wednesday, we are treading lower near 4170-4200, I think these dips could be bought for a retest of 4300.

On the topside, I do think the bulls need more work to take out 4300 if they want to see 4450 in the intermediate term. In the intermediate term, I am not yet ready to give the bears an all clear personally, UNTIL I see a couple of daily closed below 4170/4200. I think until this level stands, we could remain in about a 250-300 point range in the S&P500 index. Let me know your thoughts.

To summarize: In the short term, I see more volatility at start of the week with VIX pushing higher into 24 area (it is 21 now). I could see an impulse move down into 4200s in the emini index.

However, for the market to crack into 3900s, I will like to see a couple of closes below 4200.

Now slightly investor time frame context, I have intraday accounts, I have medium term accounts and I have long term accounts.

If we get 4000, will I buy some in my retirement account? Probably Yes. 3900? Yes. 3600? Of-course Yes. But then again, this is the money I do not need to pay rent this month or next year for that matter. So there is that. In the very long term, I do not think any one can time these cycles with any good accuracy, so I personally believe in a DCA (Dollar cost average) model. I buy when I can, not when I have to. Now the general market itself, in the US, right now is priced in at about a 20 multiple. Is this a great price? I do not think so. Is this a good price? Again, I do not think so. I have personally seen the general market trade near 10 which is in excellent price IMO. Now what I do not know is when will we get there, if we ever get there. May be in a world of 40 trillions dollar debt, we never get there.

So, relatively speaking, a 20 multiple is better than 28 where we were a couple years ago. A 15 is far better than 20.

These weekly plans are more geared towards 1-2 week time frames. The daily plans and chats are geared towards intraday time frames. And where noted, some posts are geared towards 2+ year time frames.

Have a great week ahead folks.

~ Toc

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Jigsaw. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.