Hey guys-

The main expectation for this week was to see some resistance come in near 4500 and see some support near 4350 from the prior weekly close of around 4450.

Resistance did come in, but it came in closer to 4550 than 4500. The main reason for this was a very weaker than expected CPI as well as PPI reads last week, which fueled bets that the FED is done raising interest rates and will cut rates instead.

I have been in this blog predicting that the FED is done raising rates many months ago and that was a reason I cited in my swing time frame bullish bias at 4130.

Let us dial back to this 4500 zone again for a moment as it remains a key zone for me.

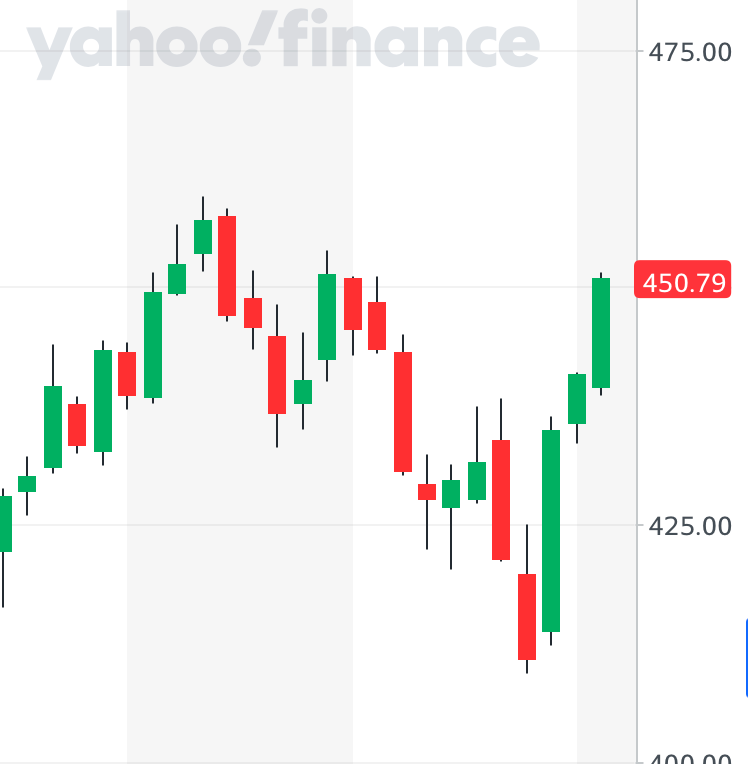

I am using a weekly chart below (Chart A) to illustrate why I think it is important.

Earlier in the Summer, we had seen this area where folks had all bulled up and I was a bear around 4600 in the Emini September contract before we saw a run off into sub 4200. At that time, this market carved out a lower-low and a lower high on higher time frames such as these weekly time frames.

Now this market is approaching these levels again in November. November tends to be historically a bullish month. From a structure point of view, the “lower low and lower high” story is still intact, atleast on higher time frames. Technically, this is a meaningful pattern. On lower time frames, right now we have a “higher high and a higher low” pattern.

The opposing forces to the bears of course are the tremendous strength of the mega caps which carry a lot of firepower to make or break the general market indices like NQ and ES. They have been super strong.

OrderFlow is a scientific methodology based on actual flow of the orders on both offer and bid sides.

You can draw conclusions from at bid and at offer trades and to confirm or deny those conclusions, I need to then see some trades below certain key levels. Let us say I conclude that I am seeing bearish trades at 4532, to cite an example. If this is indeed the case, then I shortly need to see some key weekly time frame levels like 4450 gone, like the one from last week.

If I see 4450 is never traded, or worst, we are now closing back above 4500 on weekly time frames, then my conclusions were either wrong or the bearish tape is being absorbed on the bid side. The latter could indicate higher prices.

This is a great example from last week. 4450.

If I am expecting some resistance to come in at 4450, but the morning of CPI we open above it and do not even test it once in the session, that is not a bearish tape. If it were, I will expect the market to trade down below 4450, not remain above it.

For a lot of folks who are new to this or heavy chart users, their mindset is focussed around predicting. OrderFlow is based on reacting, not predicting. When you are focussed on predicting, you are thinking 4450 is automatic resistance.

When you are focussed on reacting, you are observing what happens when we trade around 4450 and then react appropriately based on that observation.

My key levels for this week

This is a holiday abridged week. I expect market volume to taper off after Tuesday or so, with it coming alive following Monday. Thursday and Friday, the NYSE remains closed. Happy Thanksgiving!

So it is no secret I shared why I see 4550 as important level in the section above.

On the downside, my key level remains 4450.

From a news perspective, Canadian CPI on Monday, FOMC on Tuesday and Consumer confidence on Wednesday.

Scenario 1: I think if we are able to remain above 4510-4515 this week, there may be a tendency to test 4552 area. I do think there is a possibility of a range extension into 4586-4600 due to seasonality, mega caps etc.

Scenario 2: As a bear, I like to see some sort of failure of this break out above 4552 into 4600, either this week or the next week to target 4450. A failure can be visualized as a break above 4552 that then fails to hold 4552 and instead closes below it shortly thereafter.

At time of this post we last traded 4520. Levels are based on Emini S&P500.

To summarize: Current trend sees key levels at 4430-4450. Current trend may persists as long as these levels hold on the downside. On the upside, 4550-4600 is important resistance levels but the bears do not want this to be taken out and remain above these levels.

Longer term, this level here around 4500/4600 holds same importance to me as 4100-4200. I do believe if we take out this level, due to technical analysis 101, we are headed higher and this could become a support on pullbacks.

This is why I believe that for the bears this is an extremely risky, yet potentially rewarding if this holds as the downside targets if this holds could be back down to sub 4200.

I am a longer term investment time frame bear, despite the price action in mega caps due to below reasons chiefly-

Due to the unmitigated fiscal spend, and the fact that the real inflation is still high headed into the next election year, a few months away, the US treasury and the FED need to work closely to make the US debt more attractive to large buyers, which tend to be foreign sovereigns. This I believe keeps the floor on rates from going too low. This is reflected in TLT price action.

When TLT sinks to 80, some buyers step in thinking rates are high enough and the prices are low enough for the risk for next 10, 20, 30 years on some of these notes.

I will also say that the US banks are sitting on a ticking time bomb with their sub 3% mortgages and still owning billions of dollars of these bonds purchased in 2021-2022 which now have been cut in half and the mortgage rates have soared by 400% whereas the mortgage prices themselves have come more in line with the 2021-2022 prices. This is probably going to be an unmitigated disaster for these banks. Has any one stress tested for this scenario yet?

Then there is also the specter of QT. QT is a thing and the FED Chair is acutely aware that due to politics he may soon be reined in from shrinking it further. He also wants to deflate the FED asset bubble a little to get ready for next economic crisis which is inevitable. This is why I think he will continue to deflate the asset sheet bubble and this is not a great combo for stocks.

Remember when in doubt, “Inevitable is NOT imminent”.

Rest of the section I devote to discuss a few mega caps, like TSLA, plus some other context. Please subscribe and support the blog as it enables me to create and share more useful levels, like that 4515 low of the day on Friday. It costs less than a dollar a day and a small price to pay to have the pleasure of being a fly on the walls of market pits.

Also remember, due to out of the box, often controversial thinking on my part, my tweets are not always shown in your feed, as I have been shadow banned for over 2 years on the platform. This is really the best way to receive the latest alerts in real time as Substack has not shadow banned me, with me being one of their top publications.

To make it easier to subscribe, I am offering a huge Black Friday sale below. Do not miss it!

Some other stuff on my radar

CME

Regular readers know I am not a tremendous fan of large banks at the moment, in financials, I like a handful of names, for instance AXP and CME.

CME was shared earlier by me around 198 and it has now since traded up to 213. I think with CME, if the general market holds, it could trade higher into 240-250 area.

BMY

Bristol Myers Squibb is one of the largest pharmaceuticals in world with an annual revenue of about 46 billion dollars. That revenue has taken a hit recently when one of their star drugs called Revlimid started seeing competition from generic brands, undercutting the revenue from that line of business by as much as 30% YOY.

While the revenue from Revlimid slips, the overall revenue of the company has stayed almost flat- yet the market has been very unkind.

On an annual basis it has lost a third of its value, trading down into 50 dollars now.

Pharma companies can be extremely volatile, especially the smaller they are with swings of 50% or more not uncommon. However, when you have giants like BMY, there is some degree of stability with existing drugs which sell well, as well as future pipeline.

I think a lot of bad news is priced in near 50, but the main red flag for me for BMY is the debt it took on to buy Celgene. It owns about 45 dollars in debt which is quite a bit high for its size.

Regardless, I think if it starts approaching 40-45 dollar area, I think it looks quite decent from a valuation point of view.

TSLA

There are long term trends and short term noises when it comes to analyzing something like a TSLA.

Short term can include several factors like demand equation, current socio-political environment, current GDP, market valuations etc.

In the long term, you have to think about where the world is headed in 5, 10, 20 years. With a stock like TSLA, volatility is given. I think it is a young growing company and that comes with the baggage of volatility. Now for some, volatility is not a bad thing.

TSLA has some headwinds- for instance, the EV fever appears to fade. Americans like their trucks big, and right now TSLA does not offer anything that remotely looks and feels like a Ford F150.

Good thing they are a global company so they can sell smaller cars in Europe where folks love those.

In the long run, TSLA has a lot going for them. For instance, they can license their FSD to other vendors, they can become the only electric car charging network globally. No other car maker has spent more thought in designing and implementing the super charger network like TSLA has.

The stock has underperformed its peers recently but longer term I remain a TSLA bull. I think TSLA if it ever dips into 100 dollar area, sub 100 could be a major steal.

In the short term, it is now trading near 235 again. It has reclaimed 230 area. I think as long as TSLA holds 225-230, it may be headed higher into 250.

ENPH

ENPH is another volatility king. I have seen this stock do wild gyrations before which are not for faint of the heart. Personally I think it is at decent levels around 70-90 here now and could be headed higher. I like it long term, I think over the long run it will do well.

PLTR

It is no secret that I have been a Palantir Bull from 6 dollar area. I think PLTR is acting like a TSLA 3 years ago in terms of price action and I feel this stock could remain supported on dips into 15-16 which is my LIS and it may be headed much higher. It is about 20 right now.

PANW

I have been a long term PANW bull from 150 area due to their dominance in the cyber security world. It is now trading near 240.

I think if this stock can support itself when and if pulled back into 210-220s, I think this is headed higher and it can trade 300 which will not surprise me.

KRT

Last but not the least, I like Boba tea, and one of the players in it is Karat packaging which also offers to go food packaging for the restaurant industry. It is at the moment around 21 and seeing quite a bit of insider selling. However, I think 17-18 dollars may be a key level on this and if this pull backs into 17, it may be supported for a move higher into 25.

Have a great holiday weekend.

~ Tic

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Yahoo, Google. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.