Trader friends-

A general index like S&P500 or Nasdaq QQQ in my opinion is an amazing way to get exposure to the market. It has a great depth of diversification, with 11 sectors, hundreds of industries and thousands of stocks. Investing in an index like SPX, QQQ, every now and then, often and with consistency, I think is an amazing strategy to become stronger and independent.

The only thing I wish was different for me was that I knew about this when I was starting out and that I did not spend a lot of my cash on frivolous pursuits like buying a German fast car. With that said, the general index has its own limitations. The moves on average of over a 100 years have been about 10% a year, which is not shabby but still it is only 10%. It is better than inflation rate, it beats the rate of births and GDP in the US atleast. It is a great idea, if you are consistent about it.

Now individual stocks on the other hand, before there were all these rules and regulations governing the stock markets and exchanges, and brokers and so on, used to be Wild West.

They still are but a little bit more subtle.

It is not unheard of for a trader to lose all of her or his investment in a given stock. It happens more often than not. When I invest in a stock, I assume the risk that it can go to 0. The maximum I can lose however is 100%. I cannot lose more than 100% of my money in any one stock. With the risk comes the upside. While any stock can lose 100% of its value, there is no limit to how high can it go. It can go up a 100%, a 1000% , a 10000%. Yes it is possible. You do not need a lot of these in your life. You find 2-3 ideas that have gone up a 10X, a 100X and you are set for life.

While I think 99% of folks out there do not have the discipline or the fortitude to sit out for a stock to move 10,000%, I have shared many ideas here that have gone up 100%, a 1000%!

In this past year alone, while the S&P500 has risen about 18%, below are some of the names that I shared which have doubled. Tripled. Even more. This is not everything that I shared but these do stand out in terms of velocity of the move. Note there is absolutely no guarantee what a stock will do. I always assume it is more likely to go to 0 than 100%. In fact most traders lose all their money trying to 10X it. This is a fact. But sometimes we get lucky.

NKLA. I recently shared this around 50 cents and it has now crossed over one dollar. A 100% move within weeks.

SMCI is a tremendous call shared by me at 60 dollars last year. It is now trading around 1000 bucks.

DWAC or DJT was shared by me 2 months or so ago at 20 bucks. The stock is now at 50, having retreated from 80 dollar high watermark on a couple of days ago.

MARA shared at 10 before it rallied to 30.

HOOD shared at 9 bucks and now its trading above 20.

COIN at 60 or so and is now trading above 250.

CCJ which I gave at 20 before it pushed as high as 50 bucks.

Several more like GCT, MNMD , GRND, XPO, CVNA which I am not reiterating here as I still think there is more juice in those and those are subscriber exclusive. What matters is not the quantity but quality. Most of these were shared when they were obscure. They were unknown names at the time I shared them with folks here.

Not only have my macro calls played out in these mid to small caps, but also I have been a contrarian bull on Oil, Oil stocks and Gold. I have been a consistent bull in these names, against the common sense consensus and results are for all to see.

No one really can predict if we will continue to have such moves in these markets. For all we know the markets could go nowhere for another decade. Subscribe now and do not miss out on the action while they are still moving.

With this out of the way let us jump into levels for this week.

This is going to be a crucial week. New month. New quarter. Going to be a tremendous week AND going to be a tremendous plan, before markets die off in Summer.

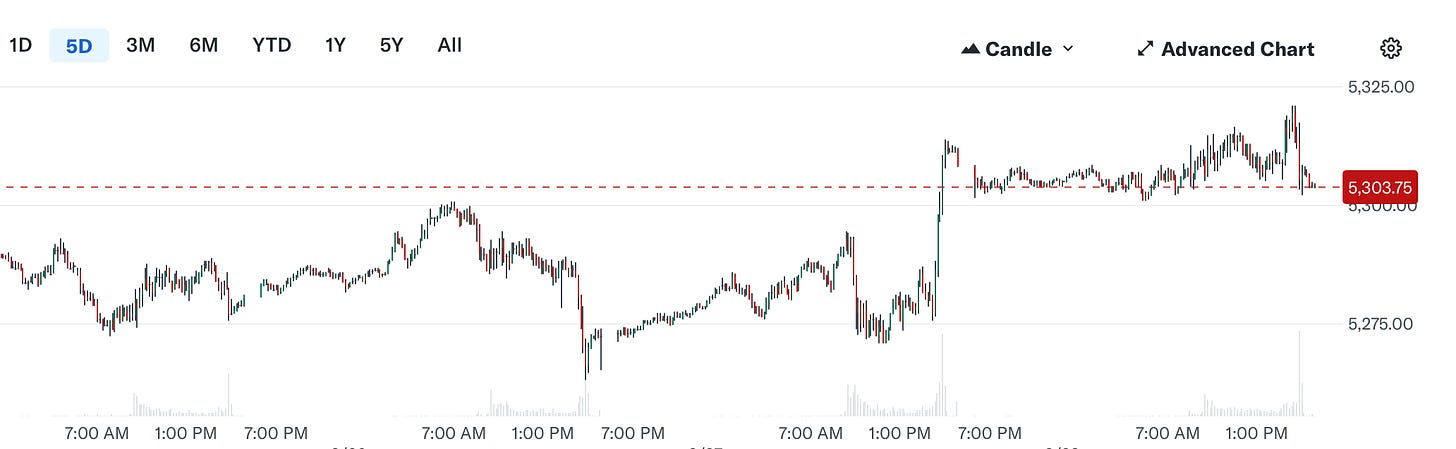

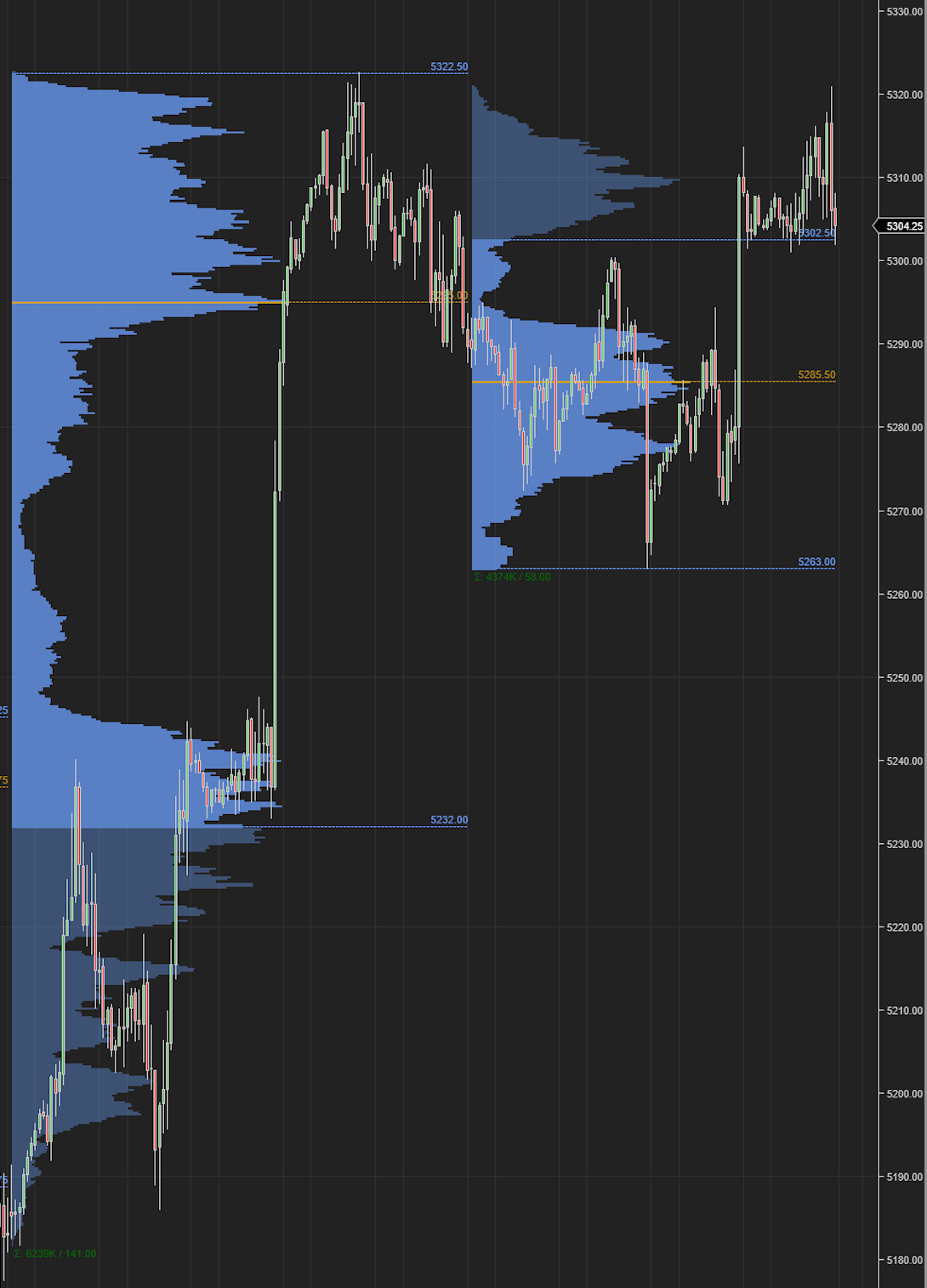

Now the overall context from last week was to see buyers emerge at 5270. This level was tested almost every single of the last 4 sessions and it held. At one point we traded down to this level and then rose about 50 handles on the Emini index to close the week slightly soft around 5305.

In auction terms, I like to see a level tested once or twice and then take off. In this instance we see 3 tests as shown in chart A below.

Then on top of this, you have the action in some SOX stocks like NVDA and AAPL. NVDA 890-900 was my key weekly level and we did see a small bounce of about 20 dollars from this level.

AAPL also saw a decent bounce from my support levels but then gave up these gains towards latter half of the week.

Then you have other related markets like Dollar which have relatively remained buoyant.

With this context, I expect some degree of softness in the week ahead but the overall context still sees support come in at the levels shared below.

There is still very little to read into these week to week auctions. I am not yet seeing a large shift in the orderflow when it comes to portending larger moves. Yes, I think the action in some of the SOX stocks is telling, but that becomes more meaningful if we were to lose 30-35% from recent highs in these stocks. A lot of my macro calls in commodities like Oil and Gold have played out well. The action in stock indices has not so. This begs the question can this rally continue higher?

There is very little historical data, atleast documented data, to rely on. Post 2020 world looks just very different. However you have some clues in prior pandemics that this world saw, going back 100, a 1000 years. The common theme in these pandemics in past always has been an increase in inflation via higher goods prices as well as higher wage increases for lower income workers.

In fact had it not been for the plague in 1400s in medieval Europe, the continent would have looked very different today. In many ways, the outbreak was great for lower income folks or as the aristocrats called them the peasants, who survived the tragic episode that wiped out half of population. For those who survived the period, they saw a significant increase in their wages, the peasants got more rights and freedoms from the aristocrats (modern day top 1%) and it was a direct cause of end of the serfdom.

Now, these aftershocks lasted for 10-20 years. The end result was the state powers putting a cap on the wages and goods which believe it or not led to even more inflation. Eventually this led to widespread social unrests culminating in the the end of existing Feudal and Aristocratic systems in Europe. Here in the US, there are some similarities to that period especially when it comes to an uptick in commodity prices as well as higher wage price pressures.

Friday’s Non farm payrolls report will just show this. It will show a higher wage pressure on average across the board.

I think it culminates in an eventual government cap on the prices of commodities like Oil, Copper, Cocoa etc as there is no more room to tighten in a system addled with 34-35 trillions in debt. Inflation in basic goods will soar and wages will either have to keep rising or risk a tumultuous phase for basics like energy, food and home ownership.

The need of the hour is for the nations to unite and ensure energy costs are kept down for everyone. Electrification sounds great on paper but is just not ready in practical terms to meet the demands of the system yet. It will take a bit longer to flesh out. For instance, a lot of heavy lifting in transportation and logistics, farming, mining, construction is done via heavy duty diesel powered machines. A well laid out EV plan will fund research into making larger leaps in battery technology so there can be a smooth transition over a period of 10-20 years. Instead we see half baked efforts to ram down misguided diktats to all of a sudden just eliminate a network of energy that has powered industry, farming and basic home energy for decades. I am afraid this will culminate in much higher energy costs for individuals, families and corporations and eventually lead to price caps and culminates in a big bust. We are not there this week or this month, but all the ingredients for this future are there.

Higher energy costs is the biggest risk I see to this rally. Once and IF, oil starts trading above a 100 dollar mark, you do not need any rate hikes (or rate cuts) from this FED, you do not need any recession, the higher fuel costs will take care of cutting down this rally.

This is not to paint a gloomy picture of the world. This is a rational analysis of where we may be headed so we can be prepared. The path that we are on is headed to higher and not lower inflation when it comes to the most important basics- food, energy, healthcare, commodities. It leads us down to a significant decreases in purchasing power of our local currencies. A lot of folks are focussed on how many rate cuts are coming this year.

It does not matter.

What matters far more is that the FED has declared defeat against inflation. There is now no room for additional tightening, this is what markets like Gold, Oil, Copper are informing us.

Folks on a side note, if you have not yet, consider subscribing. Use the coupon code below to get in now before subscriptions prices are raised significantly.

Up ahead my weekly Emini support levels, my views on MU, my take on NKLA, CMG, LULU, TSLA and a lot more!