Traders:

Stocks had a good run on late Friday and ended making new highs, achieved our 4600 target, called in our Telegram back in September here: 4256>>4600.

As I prepare for my trading next week, I want to share my thoughts and levels.

Let’s first go through how we did in our Friday plan:

A) Session recap: Friday’s plan which was issued on Thursday at close called for a retest of 4565 if we open/offered below 4580. See here: 10/29 Plan

4565 actually traded over night as volatility picked up after AAPL and AMZN EPS.

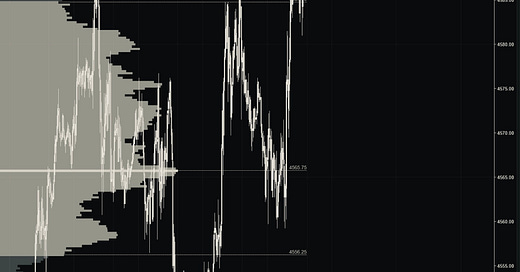

About 2 hours before Friday Chicago open , we sent an update to our plan (AM Update).. this update was cognizant that we were very closed to recent swing lows in AMZN, AAPL etc. which are heavy components in S&P500 and called for potential support at 4556-4559 and 4582 as resistance. Well, we opened at 4560 and 4559 was Low of DAY (LOD) and was not revisited for rest of the day.

About half an hour into the open, a Telegram update was issued at 4577 for a retest of 4585-4590 after we observed bullish order flow on tape. See link attached here: Tic Toc 4577 . Eventually, we ended the day testing 4585 as well as 4590. And then closed at 4603.

To summarize, we expected volatility below 4580, overnight targets hit 4565. After observing overnight conditions, it was not safe any more to be bearish so close to 4560. Results were to see: a close full 45 handles above 4560!

B) Market Generated Information: now before we hypothesize some levels for tomorrow, let us review unbiased information generated by the market itself before we dive into probabilities for tomorrow:

The volume point of control has shifted up from the previous week to exactly 4565 which was my order flow level throughout this week.

A late afternoon surge parked emini S&P500 right above multi session highs of 4590 from Tuesday and Thursday.

Important stocks like HD, COST, TSLA are making new HIGHS.

With this context let us build some price scenarios which may provide high probability setups tomorrow.

C) Tomorrow: this is the most subjective part of the equation. However having recapped the session from Friday and having documented Market Generated information to the best of our knowledge, we can try and create some meaningful scenarios.