Traders-

Nimbleness and preciseness is important in trading and this is what OrderFlow was able to achieve last night when most of the FinTwit became very bearish below 3900.

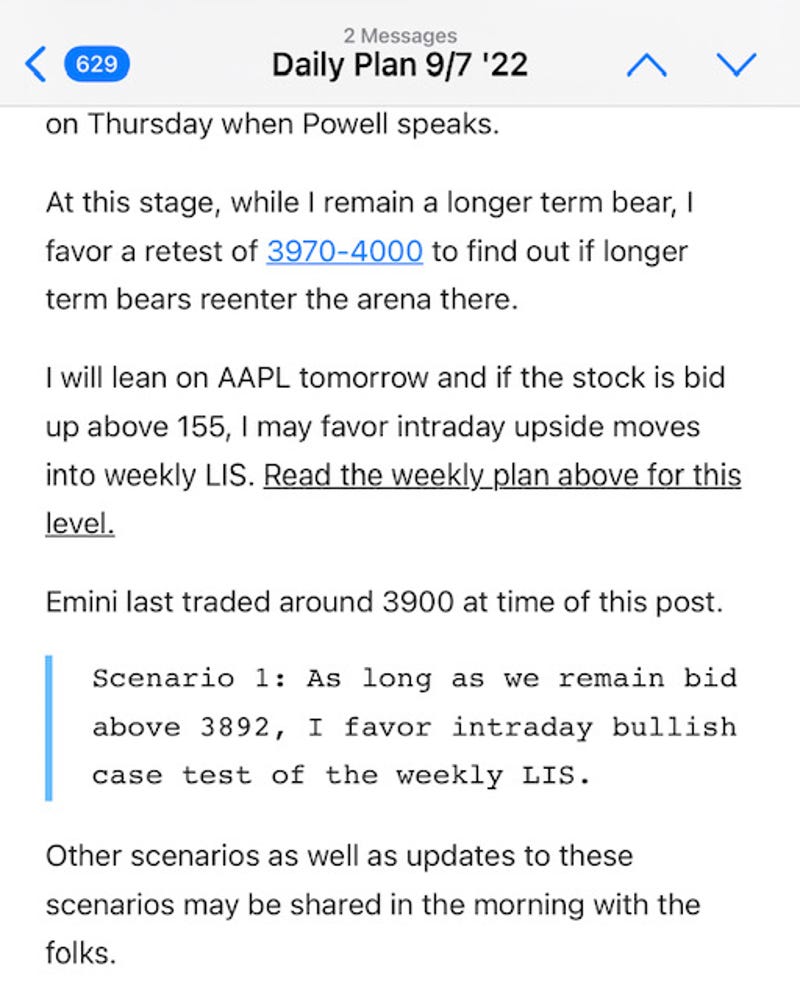

I was not at all buying it and I issued my key levels and scenarios stating that I could not be a bear above 3892 and I expected a retest of the weekly LIS, possible even 4000 on this extreme short term bearish sentiment. In fact the sentiment was so bearish, I only issued one scenario. Such was my confidence in the levels.

See below.

This is the link if you want to review.

This turned out to be a very good scenario indeed as all night we were not able to peek much below it. At the open we just took off and never looked back. It was a tremendous one way trend day and we traded my targets of 3970 shortly thereafter, almost reaching for 4000 towards end of the day.

Emini was not the only good idea shared by me.

In light of the AAPL event, I was also expecting a bounce in GSAT off 1.8 into 3 dollar range and this turned out to be the case.

See below.

My levels for tomorrow

My key level tomorrow will be 3970.

I think the bulls have a task cut out for them:

Open above 3970 in the cash session tomorrow.

Have an IB session that closed above 4000 to target 4030.

Minus these 2 happening, S&P500 may come under pressure.

As promised by me, if you are a Substack member, use the below link to get a special, one time discount. Share this post so other traders may be able to get in OrderFlow at discounted rates.

Scenario 1: Cash session open or offers below 3970 may target 3934 orderflow level.

Scenario 2: Open above 3970 but no IB close above 4000 may be a neutral scenario for me and may be range bound for me, unless/until we see a close below 3970 which could target 3934 or a close above 4000 which may target 4030.

At the time of this post, we last traded 3980.

My 2 cents on oil auction today

Oil had a bad session today. It broke below my 86 LIS on inventory built up and dropped to 82 and below.

I also suspect a lot of energy company liquidations may be causing pressure on oil.

I think 83 dollar is a key level which I need to see a Daily close above for oil to stabilize to 86 and above. I do think we may see stabilization in oil once/if we see that close above 83.

What else

On top of these my utilities plays like PCG did very well today , rising 4%, shared weeks ago with folks. Healthcare also like the CAH stock.

One of my favorite stocks ENPH also had a very good day today closing near 316.

If the general market does not stink, we may see a 330 on this IMO (in my opinion).

I think I want to see it pull back to 302-306 which will also be my LIS on this.

LIS means Line in Sand which means the stop loss, i.e I am wrong if we close below it.

IB means the first hour of the trading when NYSE opens at 830 AM CST.

Any other questions, let me know below.

~ Tic Toc

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

Tic, you saw very little buying below 3892 as of the issuance of your note yesterday afternoon. Overnight we ended up trading below yesterdays RTH low.

Obviously your read was right and the buyers were incredibly aggressive until at least 3970-3980 when we started to see some meaningful red on tape.

I’m struggling to understand how you had conviction in today being a strong bull day as it was.

Appreciate any additional color you may provide. Honestly if you’d consider putting a chart or two with volume profile together to illustrate how you came up with yesterdays plan, that would be much appreciated ✌️

Wonderful analysis, I longed ES and made 80 points , still AAPL long . Thanks tic!