Traders-

Wrapped up yet another awesome day using the OrderFlow levels and context today.

Starting from last night’s trade plan, I had keyed in as 3960 as an important level and my weekly LIS.

This level was the over night high. We could barely trade above it in the night.

Then, we opened around 3940 and rapidly sold down to about 3880. We missed my target by a few points but we rallied sharply to 3940.

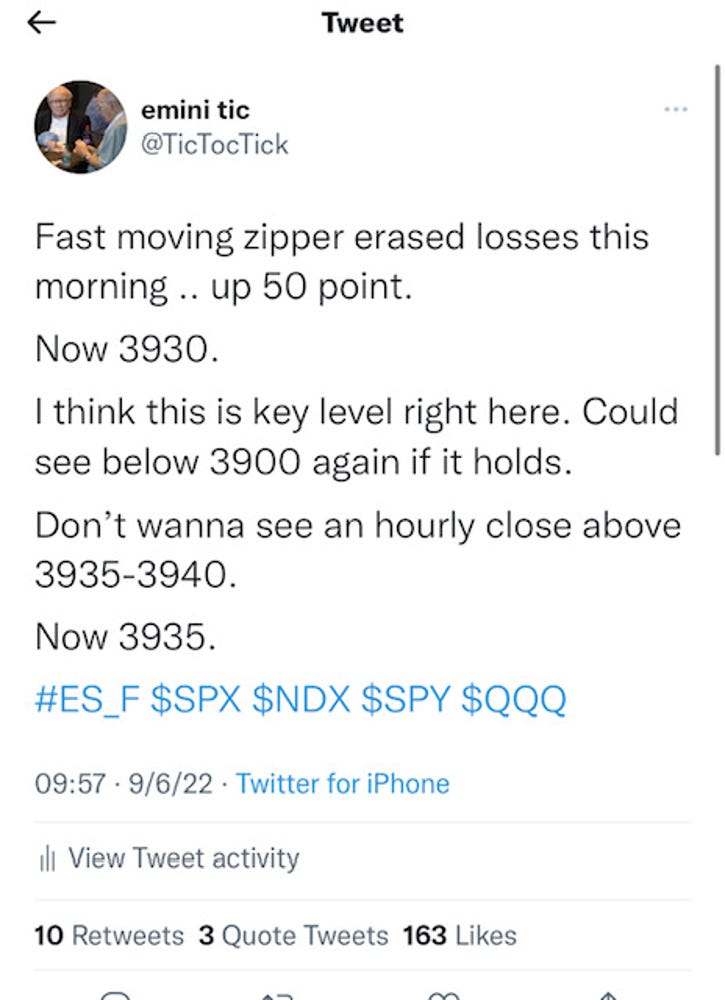

At this point, I sent the following tweet.

As if by magic, the market stopped going up as soon as I identified this as the key level intraday, stalled and sold down all the way below 3900 to settle the day near 3900.

Indeed good action intraday and very good levels.

No only was the emini levels spot on, we also had good action for instance in TSLA.

The stock suffered all day at my LIS shared last night and could not get past it and sold off several time from this level throughout the day.

AAPL suffered the same fate and was not able to recover beyond my LIS today.

Click on this link to read my Weekly Plan and my levels on AAPL, TSLA etc

These are all subscriber special levels, if you do not want to miss them and learn from them, then consider subscribing to my Substack below. If you are already subscribed, then feel free to share this preview with your folks and help them read the message of the tape!

My levels for tomorrow

There are no noticeable risk events tomorrow with the exception of some FED speak. The key event is on Thursday when Powell speaks.

At this stage, while I remain a longer term bear, I favor a retest of 3970-4000 to find out if longer term bears reenter the arena there.

I will lean on AAPL tomorrow and if the stock is bid up above 155, I may favor intraday upside moves into weekly LIS. Read the weekly plan above for this level.

Emini last traded around 3900 at time of this post.

Scenario 1: As long as we remain bid above 3892, I favor intraday bullish case test of the weekly LIS.

Other scenarios as well as updates to these scenarios may be shared in the morning with the folks.

Stay tuned. Have a great rest of your week trading these markets!

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

Also, I am curious why you favor a test of the upper weekly LIS? Is that just because of what you are seeing on the tape? Or is there more to it? Cheers!

3900 seemed to hold the line so far. I agree with Tic that upside seems favorable in the short term