Hey-

So, there is a lot of value in the intraday chat room which I am surprised still some of the folks do not have installed. It is FREE for everyone! Install it now. For instance, look at this intraday post I sent exactly near 4406 today.

Personally, I have been a little distracted due to some issues but I have been trying to send out any updates that I can.

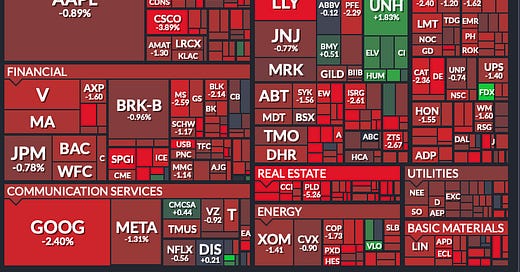

Amidst all this doom and gloom, one of my stocks shared many weeks ago near 120 had a great day. SPLK got bought out by Cisco and gapped up almost 25%.

Levels for tomorrow

Overnight there is quite a bit of risk from BOJ and other countries in Europe with key macro data. This could create more volatility tomorrow.

To be 100% clear, the chat context is mostly intraday moves, it is not for longer term or swing time frames which are mostly weekly plans.

For tomorrow, 4356 may be an important level. At time of this post, we last traded 4370.

Scenario 1: if I am bull here, I need to see a couple of days of balancing here between 4356 and 4400 to breakout to a move into 4450.

Scenario 2: If I am a bear, I need to keep pressure here below 4356 into 4300.

What is working for the bears are the technicals. They look good for the bears, especially after having taken out 2 key levels this week.

What is not so great for the bears is the related markets. Ok we have rallied in VIX, but it still sits here below 18. It needs to be above 22-23 IMO.

Dollar has remained subdued. Oil remains buoyant. So these markets need to also support the bearish case, which at least at this point in time they are not.

BOJ tonight could be important. The US and the European central banks have disappointed this market by surprise gestures and hawkish statements which the market was not priced in for. BOJ in recent months has made it a point to assert that they will remain dovish. If the BOJ also does an about face like the FED yesterday, this would create lot of volatility overnight. This action should be a case study for folks that these markets are finicky and extremely reliant on the Central Bankers. They have shed 200-300 points within days, just due to this reason. Imagine if an actual credit event or an actual recession came about- that would be quite a spectacle and prove me right what I have been saying all along by bringing us within an inch of my longer term levels.

Due to the overnight event risk, if I see a lot change from these levels overnight, I may send the chat update in the morning with new levels.

Until then, stay safe and have a great night. Will be back for the weekly plan.

~ Tic Toc

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Jigsaw. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.