TWNK

AFRM

PLTR

XPO

INTC

AMZN

TSLA

QQQ

SAVE

That is the plan for the day. BYE.

No! JK!

But you can get such ideas delivered in your inbox every day almost. Just subscribe and get started. Many guys have said why I do not increase the price to 100 outright? I like to think everything thru first. Price will go to 100 but I need to first figure out how to deliver the Option information. For instance, I shared the 25 cent TS option and 80 cent SAVE option yesterday. Before that I shared the 9.15 AMZN OPEX for 145 strike around 130. Once I figure logistics out, price will increase. Believe me it will be more than 100. May be 200. What’s the hurry? Enjoy low prices while it lasts :)

My levels for tomorrow

To be frank, I am a little dazed with all this rollover stuff still. It happens to me during this week every 90 days. It is what it is!

In the AM, I gave 4520 which was support of the day before a large rally towards end of the day.

I will try and explain again- on rollover days, you could have several large accounts who want to rollover but rollover such a way that it does not impact their net position much. So If I am short the September contract, the contract will cease to exist in a few days. So I buy back September and I short December. In future, a contract is created out of thin air. This is not like stocks where a share must first exist.

In futures, a contract is created out of thin air when a buyer is crossed with a seller. You could do this all day!

So such a rollover trader wants to have minimal slippage. So they do this during the most liquid time of the day, at the most liquid levels.

Is 4470 and 4490 from last week liquid levels? You bet they are.

This is why I said 4520 was important. Whoever is stuck in bad shorts from last week, they will probably want to rollover near 4470 by buying it at that level (because it is liquid hence minimal slippage) and then may sell a little higher or even at same point in December at 4520 (because it may get them better entry via better Avg price).

Hope this made sense. If not, I can do a more detailed explanation in the weekly plan. Just let me know.

On TSLA side, I had an exceptionally well call. Old timers will know I was a bear on this last month but I warmed up after price cuts in the product around 220.

We then rallied to 250 where I remained bull above 240 with a target of 280.

Today we came near an inch of that 280 target and it may be attained shortly me thinks. Remember while I have been bearish and bullish on this in the swing time frame sense, my long term target on this is near 100-135 bucks. There are folks out there who have a 15 to 24 dollar target on TSLA. For us to get there from 280, we will have to shed more than 90% of market value of Tesla here. I do not see that happen in my lifetime unless Elon were gone somehow as it is a visionary based company. Without vision, TSLA could perish.

KVUE

I am interested in November-December OPEX for this KVUE where I have seen one interesting ordeflow near 20-21 strike puts which are now offered around half a cent.

Remember volume by itself could mean many things or it may mean nothing. Large call or put volume could also be selling call or put volume, it is not always the buy volume. It is just one of those option mysteries. It could also be spread volume (non directional). But once we notice abnormal order flow, I think it is important to investigate what is going on with these options. Sharing FWIW. Let me know what you find :)

As far as SPX goes..

See below from last night’s plan. Right off the bat, we were above 260 in TSLA from open and stayed there for most of the session. In my view, a lot of folks do not read the whole thing. They just read what they really wanna see and that is not the right way to read or see.

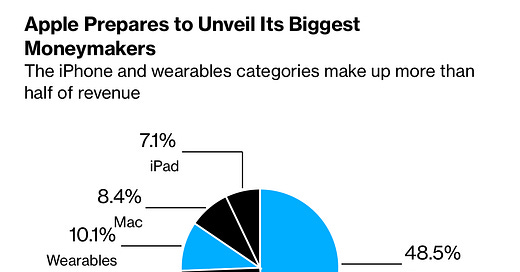

Remember there is the AAPL event tomorrow. This could be make or break for AAPL.

My key level tomorrow will be 4550. This is for December. This means 4500 in SPX.

Scenario 1: 4550 may present resistance for a move back to 4510-4520 as long as we remain below 4550 in the IB session.

Scenario 2: 4510/4520 if visited could show some support.

For me, the edge case tomorrow will be above 4550 or below 4500.

Have a great day.

~ Tic

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Jigsaw. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.