Traders-

The markets are in an extremely emotional state at the moment. This is extremely fear drive market at the moment. How much so ? Well for beginners now both NVDA and TSLA are down 30% from recent highs. This is unthinkable!

Only a couple of weeks ago if you thought this was possible, you would have met with tremendous scorn from AI bulls. How much drama and emotion has been generated in last few days?

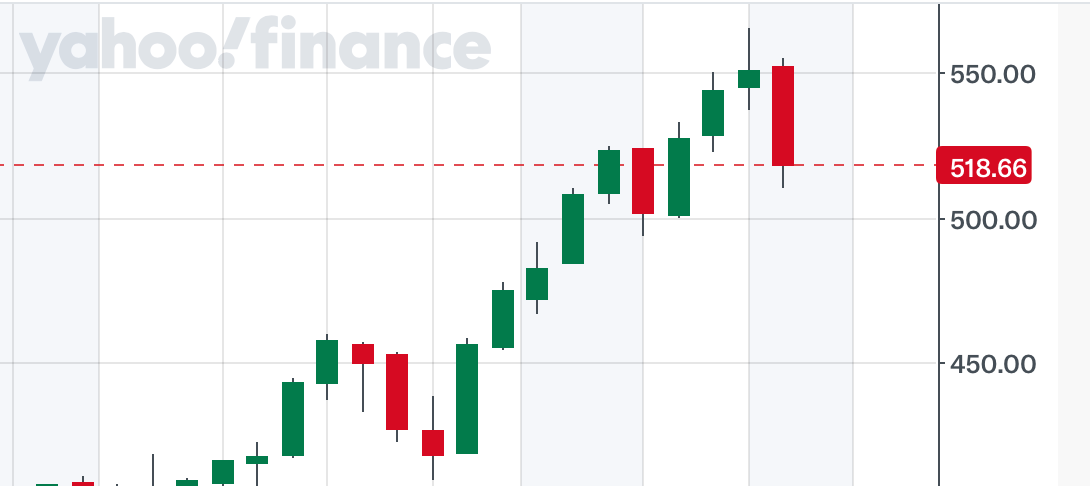

Look at the monthly auction in this chart A below.

Contrast this month with recent auctions. This market has barely dropped 600 dollars from its highs, and it has created a ginormous amount of emotion and volatility.

If you think about this, this drop is a drop in the bucket. No pun. This is not even a blip in where these markets can drop to if we do get a genuine bear market going. What happens when a bear market gets started in the earnest? And by that I mean week after week of selling, lower lows, lower highs, weak months. This current bout of emotion will look like a trailer. It will be a never ending horror movie.

This is why picking your levels is key. Most of this selling is coming from those who have bought at the top because they were in FOMO mode. Or it is from those who have taken profit or started new short positions. I wanted to share this to just show that be aware that volatility exists. Else volatility will force you to be aware that it exists- as we are seeing now.

I was bullish last night at 5230s and I expected a test of 5350s today per my plan last night. No surprise there as overnight we rallied into 5300s before finding a wall of sellers at the highs today at 5350. This 5350 now has been a proven resistance for several sessions.

Levels for tomorrow

5192-5200 still remains my key levels on the day. We are now trading 5200.

The thing that remains to be seen is what does the Asian and Europe sessions bring. In this context, 5190 needs to hold without much activity below it for a move back into 5230 which will be other key level on the day tomorrow.

We have the payroll data tomorrow which will be important for the US dollar. I like to see US Dollar retake some of the 103-104 handles to indicate back to normalcy.

Now personally I favor a test of 5400s first before going lower below 5100 on swing time frames, which BTW we came pretty close to test today. Thus far this week this market has held these lows around 5130 which were mostly a liquidation event. However with the overnight session, the risk below 5190 will be extremely tight and any bulls will not want to see much trading activity below 5190. Based on the cash session today, I think there will be a tendency of momentum to try and break below 5190 to see what is out there, it will be key to see if it holds.

Scenario 1: If we open and remain above 5230, I favor a test of 5266 on the session.

Scenario 2: 5190 if supported could see us retest 5230-5240 area. These are emini September levels.

If you are a bear here though at 5250, you do not wanna see a higher low carved out here this week, which means you do not want to see this market NOT retest the 5130 level and instead hold this 5190 area and then close back in vicinity of 5300.

This is it for now. Additional scenarios or levels may be shared in chat room below.

~ tic

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Jigsaw. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.