Traders-

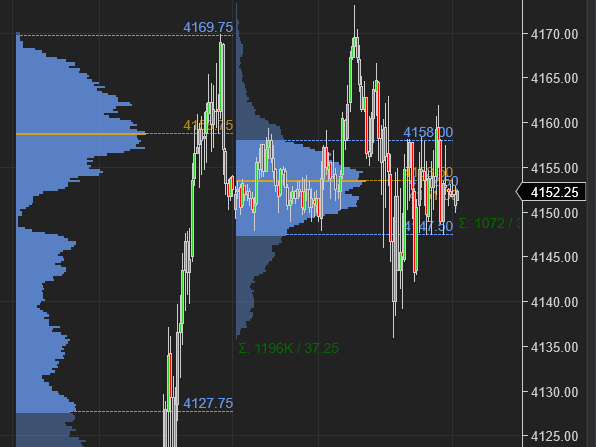

Today was perhaps the smallest range day in Emini S&P500 of all year! It was a perfect balanced day, see image A below.

From my plan last night, my level was 4126. On the upside, I expected 4170 to be the resistance. While we did not trade either level in the cash session, overnight, 4173 was high of the day.

We sold down to almost 4126 but stalled around 4135 and then traded back up above 4150. If you are a long term reader of this blog, and if you keep abreast of the continuous auction in the S&P500 market, you know the market stalled today near a key level from me this week at 4140.

The other name from my plan last night was SQ. Which I refused to chase at 90. My LIS on this before the earnings was 91 dollar and in fact the high of the day today was 91 bucks before the stock sold off to around 83, down 7% after hours.

Overall, very tepid auction today. Now these kind of small range days can indicate several things. The primary context for me coming in at near the recent swing highs will be that there is just not enough horsepower yet to break out of this range. Now, these days almost always are following by a large range day in 2-3 sessions - and those break outs or breaks tend to have a lot of volume in them coming out of this consolidation.

In other news, we saw TSLA stock split approved by its board today 3:1. I think this will take effect on the 22nd and stock price will be cut by a 3rd and I think the stock will be diluted to roughly 3 billion shares (if my math is correct). I think this may mean the stock could run a little more on this as folks continue to buy this anticipating a repeat of the results of last split back in 2020 when the stock gained 81% after its split. This is not 2020 however. The markets were awash with covid stimulus money and that split was almost a surprise.

We also saw COINBASE COIN stock rally almost 90% from its recent lows to above 115 but the stock then cooled down today to settle around 88.

I think this gap at 80 will eventually fill however as long as 86 level holds (wrong IF D1 CLOSE BELOW 86), I personally think we could see 98-100 again on COIN.

Regarding TSLA stock, I have been very clear that it is one of my favorite tech stocks and has been for a while now. It is now trading significantly above 800 which I thought could be resistance. I am not against TSLA stock , I just think I will be able to get this much lower than these prints currently. I personally think in any portfolio, I don’t have to be ON and OFF at all times or rather be bear or bullish. I can be bullish as well as bearish on different time frames and longer term I am bearish on these names as I do feel a name like TSLA will test 550 or below (~ 183 post split).

This is a FREE preview of my Daily Plan. Subscribe below to receive unto 5 such plans every week.

My levels for tomorrow

My key level for tomorrow will be 4120-4130.

Scenario 1: I will be curious to see if dips into 4120/4130 get bought for a retest of 4156 area from today.

Scenario 2: 4170 may break to target 4189-4192, I think if we open near or bid above it on strong Tic TOP readings. If 4170 is going to give up, this will be an auction similar to Wednesday’s auction where we opened and remained strong on Tic TOP. See the link in my weekly plan for Tic TOP indicator.

Here is a link to the plan from last night

In this plan above, scroll down to the comments section to see a TOS panel shared by Double Top which I think is pretty cool!

Normally, ordeflow levels which break or break out, can act as support and resistance in the same session - so there is always that. A break of support could become resistance. A break of resistance could become support just as we saw in the session today at that 4140. We last traded 4150 at time of this post.

As a reminder, there is no plan out tomorrow. I will be back on Sunday with more. Have a great weekend!

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

Thank you for sharing and congratulations on finding romance. You deserve it my friend

Musk literally just pumped the stock by

.. confirming buyback is on the table, another Gigafactory announcement by year end, and earnings will go up ..

This one is testing orderflow rules as the CEO keeps Pumping it up. Regardless I am positioned (hedged) for downside by 20%, although I'm a huge $TSLA Long long term HODLer from 2013.. it will go down, hard...