Folks-

Let’s start with the usual suspects: today was primarily a trend failure day. We saw a decline in both the bonds and gold with the dollar receding again. Oil rallied hard- not the best combination for the intraday uptrend in the emini S&P500 to continue. I am quite surprised the Nasdaq bulls have not yet received the memo on TLT sell off and oil firming up. May be they (algos) do not check these correlations amongst other context :)

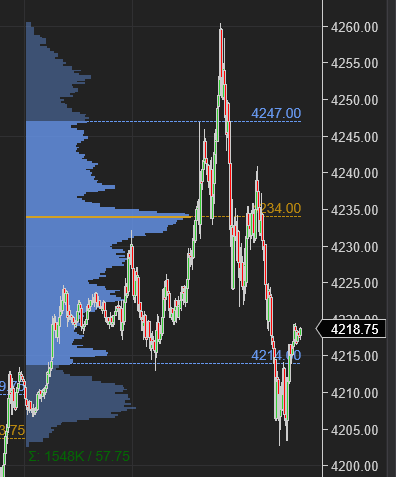

From my plan last night, my primary expectation was we may sell off at 4233 for a test of 4180.

Well, we opened above 4233 and traded up to 4260. I was waiting for the market to dip below 4233 and hold for the bearish continuation. This came about 2 hours into the session and once we traded down below 4233, we remained below it for rest of the day with one attempt to trade above it, failing and trading down into 4203. Support came in at yesterday’s POC (point of control).

In other news, the dollar has been selling off on yesterday’s CPI and today’s lower than expected PPI fanning expectations that the FED tightening is gone now . The dollar is now down more than 1% across the board . The dollar may get weaker another percent or two but I think dollar will find it hard to sell off below 103/104.

I will cover this in more detail over the weekly post, but in brief, the main FED challenge has been and will remain the structural price increases in housing, services and energy for rest of the year.

I am now looking at the FED event at the Jackson Hole, WY in late August (8/24) that I think has the potential to uncover additional uncertainties for the market . Right now the market seems to have priced in a rate of 3.25/3.5% into year end and I think no one expects rates into 3.9% or higher as many FED officers have suggested.

I believe FED may use the this opportunity of elevated asset prices to verbally jawbone a narrative of higher rates and faster tightening into rest of the year . This could be supportive of the US dollar and volatility as well. Longer term rates are not the only tools this FED has and I think they will press ahead with their planned balance sheet roll off- there is no reason not to. The asset prices are inflated, it gives them a good cushion to remain tightening.

On a side note, I have been a little irregular sending out these newsletters to folks as it’s late Summer and I am wrapping up some personal commitments , traveling internationally and some of my timing has been off due to these time zones and technical issues but I should be back to my normal beat soon, so thanks for putting up with this. Come rain or shine, I want to send out some thoughts out to folks daily regardless of my personal schedule. If you have not, use this opportunity to subscribe to my newsletter before the prices are inevitably raised. It is still cheap at less than a dollar a day!

So yes, I think we are about a week to two weeks out to additional new information that may emerge to add to the market calculations driving volatility.

I also think some of these markets just have been too unpredictable to call, and they are a basis of a stable trading/investing paradigm for me. For instance, look at oil.

In my weekly plan I expected the 86-88 zone to support oil market and oil has been up about 8 dollars of these levels along with oil stocks like $OXY. I think there are just structural issues on the market right now which are going to keep a bid underneath oil. At end of the day I think the markets (and the economy) is not too broken yet for the FED to go full easing mode and I think the economy is just strong enough to sustain demand for oil around 100 dollars a little bit longer.

I actually agree there is no recession outside of the formal definition of two negative quarters back to back. So this keeps demand for oil in play. But oil above these levels keeps a support under higher inflation as well. There is a big consensus that oil price crash will cause the CPI to come near 8% this month, I agree this is true if we keep oil below 90-92. However oil keeps hanging out here 95-96, that assumption IMO should be questioned.

I will also question gold market and the bonds. Bonds sold off again today- the yields are up again yet today. This is not supportive of the easing FED and this is also not supportive of easing in economic activity yet IMHO (in my opinion).

Now the question is why do we look at these fundamentals and related markets?