Traders-

Sunday night I issued my weekly plan with bearish LIS at 3851 and weekly target 1 at 3750. This escalated rather quickly and we saw a high of about 3851 last night before tumbling down to my weekly target of 3750 today in cash session.

After 3750 traded, and this is the level where this buyer that I mentioned on Sunday below has been. He or she was able to fend off the bearish raid again and we traded up to 3800 as expected by me.

It is what happened above 3800 that I did not expect. My expectation was to find sellers at 3800 and trade down to 3700. This never happened today and in fact we floated right back above 3830. I was surprised and not in a good way.

The good part is the order flow levels are holding up. The bad part is I did not get more sell off that I wanted. And I think I was not the only one caught in this as a lot of folks were expecting lower prices as well.

My levels for tomorrow

Before going there, let me tell you about a couple of conflicting signals which I am observing:

With strong rally in the stocks, EURCHF has barely budged above .9940. Red flag for me.

The close I think was indeed strong coupled with good Econ data.

So the levels and contexts ahead must be seen in the light of this conflict that I have.

As far as the data goes, the following data prints are indeed very nice for stocks IMO (in my opinion):

The core PCE that I mentioned earlier last week is indeed very good for stocks

The sell off in commodities and energy today may be seen as deflationary

The factory orders easing up today also demonstrates easing pressures on vendor and supplier supply chains

Chart A below shows a strong auction in NQ.

My key level in the S&P500 for tomorrow will be 3800.

This is a free preview of my daily levels. If you want up to 5 such plans every week , consider subscribing below. Basic membership is 100% FREE and gets you basic levels.

I personally think the current economic data is creating a narrative that the inflation has peaked and we may see some support in the markets between now and the FOMC later in the month. Note I personally do not believe the inflation peaking story, but I think if enough folks believe it then it does not matter what I think and I don’t want to be in front of the momentum.

My scenarios are listed below. Meeting FOMC minutes will come out at 1 PM Chicago time tomorrow. Emini closed around 3830 today.

Scenario 1: I think any dips into 3790/3800 may be bought for a test and break of 3851 to trade 3900 shortly thereafter.

Scenario 2: If we open or offer below 3790 , especially the FOMC, we may test the 3750 level which may see buyers emerge as long as these lows hold.

On the NQ side we closed at 11800. I do think as long as NQ remains bid here around 11800/11900, we may be looking at a test of recent levels like 12300. My LIS on this will be 11625. I do think NQ may get supported on dips as long as that 11625 holds.

To summarize, the market sold off heavily from my levels published on Sunday and tested the lower end of my targets. The factory orders came in very strong today thereby cementing the theme that inflation may be peaking and thus we saw a strong rally. If this is indeed true, I expect to see a softening of dollar. Which may support some commodities like Gold as well as oil. This is why I am thinking any dips into 3800 post FOMC may get bought if this theory gets legs. A key component for this story to stick will be to expect dollar weakness. Ideally I want to see dollar weaken so the market remains bid and is able to target that 3900 again. Note that I do not personally believe inflation will materially weaken but I also do not want to get in front of the momentum if this story takes hold and dollar begins to soften. Even if temporarily, this scenario may be supportive of the equities.

In other news

Some of the beaten down e-commerce names like ETSY and SHOP also did very well today.

I think if the general market holds, these names may have legs to do a little bit more heavy lifting. IMO These names are quite sensitive to high CPI and any nudge that the CPI may be peaking could offer these ARKK type names some lift.

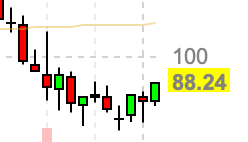

For instance, ETSY below. I think if this holds 85/86, it could retest 100 dollars.

RBLX also is kind of in the same boat for me. I think if it can hold that 35 mark it may have some more juice in to try and trade 44-45. Now 39.

On the large cap side, I also liked GOOG which is traditional free of Chinese influence as well as inflation. I think if it pulled back into 2250, it may find some support and could be readying to target 2300-2330.

I also do want to share my 2 cents on the oil carnage today. We have sold down some 1200 ticks off the highs last night and did not even pause at 106 support level today. A lot of this carnage was caused by news out of Gazprom but I also think the market was a little extended close to that 112.

I think as long as this 96-98 holds on crude, we could revisit those 106 area levels. I think unless you believe we are in recession, I do not buy the oil being below 100 story yet.

Also Gold which sold off quite heavily today as per my newsletter last night, has some support at 1750. I think this is a good support and may be able to provide some comfort to this key precious metal which has been on downtrend due to excessive DXY strength.

~ Tic Toc

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

Thanks Tic, I decided not to sell at 3850 because I expected a possible retest in the cash session, but price was quite far, fortunately I could buy 3750 and lock 70 points. Such great levels. Only one Tic.

Great levels Tic, wow oil sold off $10 below $100? Where did that come from. I don’t get that unless there is a lot of premium in the oil market due to traders.