Hey folks -

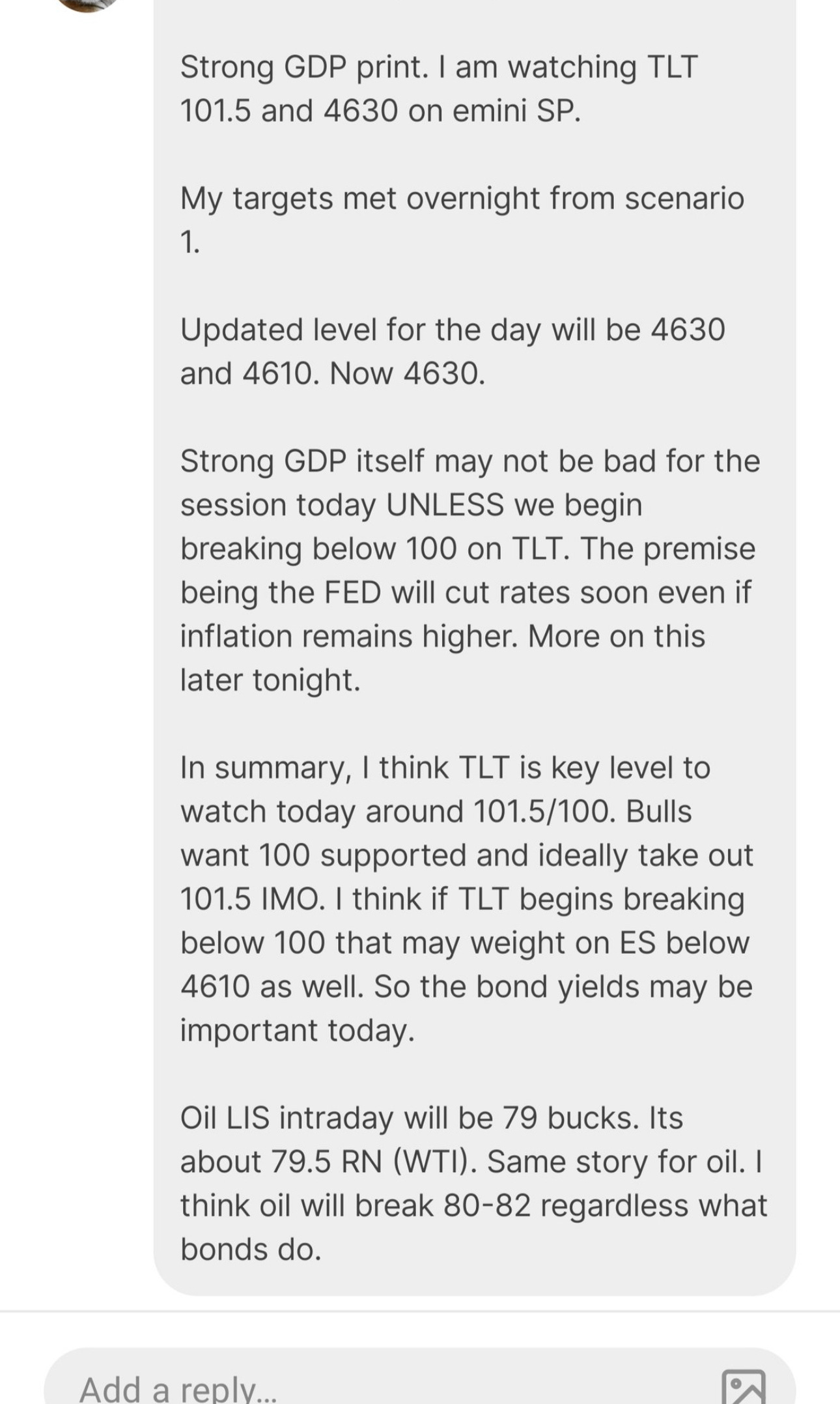

So at the open, I sent the below chat room update.

If you do not have these chat access, I ask that you install the Substack app and turn on notifications. This app is free for every one.

Now after I sent this out, the market balanced between these two levels for several hours. Once that 100 level broke on TLT, the flood gates opened. Sell off began and we traded down about 80 handles lower from highs of the day which coincided with my level shared this AM in the chat room.

Coincidentally, my levels in Oil at 79 dollars were also the low of the day in oil market and we ran about 150 handles from there.

Now you could have several theories what caused the sell off. My personal take on this is that a lot of folks had assumed yesterday’s comments from Powell to be dovish, particularly in second half of the presser. They thought rate cuts are soon going to be coming but when the bond yields started spiking, that myth was shattered within minutes at the open.

How stunning was this reversal?

Well the Point of control barely budged lower demonstrating to me that a lot of folks had positioned pretty strongly for a bullish move today and they were left holding the bags with this fast auction to the downside giving any one barely any chance to rebalance.

At any rate, this auction today marks another failure above the Weekly LIS. The buyers failed to hold the market for a second day above that key LIS - this is going to be important if they are to advance beyond 4600-4630 area which is a key zone from 2021/2022.

Two other names from OrderFlow did well today- both INTC which was shared near 24 by me and ROKU shared near 40 and then 60 were up about 8% after hours on earnings today.

In some other ideas, on the growth side, one way I look at this equation is that if I look at these mega cap tech names, they have run a lot already with some mega caps up in excess of 150-200%.

Can these go up still?

Ofcourse, as I believe any thing is possible in market. However, I also think if for whatever reason, the general market holds and these stocks continue to go up, they will probably not be up another 200%. I personally think if I were to have some exposure to growth, I feel more comfortable with some of the crypto names.

Now hold on for a second - when I say crypto, I do not necessarily mean Bitcoin or alt coins. My approach is much more nuanced. I like names like the miners, payments, infrastructure, exchanges etc. So in that sense, your names like COIN, MARA, SQ, PYPL. I own some of these and I shared these levels way lower for instance, at about 10 in MARA. However, if they dip, I may add more. So I have some exposure long term in these names if the growth continues to outperform.

But then to balance this out, I do also think value type names are still not as extended as some of these mega cap names. So that would be names in the energy sector for instance XOM, OXY etc. If the market slips, I think these may hold better than the others. If the market goes up or holds, I think then also these may do well.

Then the third leg I like is agricultural commodities, agro producers. For instance names like ADM which was shared by me around 75-80 bucks. This would be your names in a fund like FARMX by Fidelity. Now these 3 that I talk about are in context of long term views not necessarily day to day trading.

What makes me think that my thesis about value is wrong? I think if inflation were to collapse to low 2s and the FED were to begin cutting rates aggressively, with deep recession measured as negative GDP, I think then my thesis may be wrong on energy specifically.

My main energy thesis is based on the fact that inflation may remain perched here above 3% for a while, the FED funds rate really do not matter as long as the GDP remains supported here on a flat or slightly positive trajectory. In fact ideally, the GDP remains strong, inflation remains stable and then even if the FED cuts rates, I think energy prices only have one way- to go up. This may be true for food and agro commodities as well.

The problem as I see with Precious metals is that I believe there is some value in the miners. However with Gold still below 2200-2300, the high cost of mining is a drag on profitability for these miners. Now if oil remains above 70-80 and gold also remains above 2100 or so, then the miners’s margins improve and they could make new highs as well.

My levels for tomorrow

This 4550 area has been a problem child for the bears from a couple of weeks now so will be my focal point tomorrow.

On news front, the core PCE number comes out tomorrow. At this point, I personally do not think any of these inflation numbers matter much. Powell for most part yesterday alluded the inflation numbers may be soft going forward. I think it is a given that the FED will begin rate cuts soon after waiting 2-3 months to see if inflation stays here at 3 % or not. They have to. The US government is now paying about 1.5 trillion dollars in interest payments alone which is almost the same as next 2 big ticket items combined - defense and social security. The have about 4-5 trillion dollars more to spend thru debt ceiling suspension and they do not want to spend half of that paying interest on existing debt which rolls over to higher rates from near 0.

This is not a problem they can easily escape by printing more money. If in an election year, growth collapse, the incumbent party risk losing an election. And if the growth remains robust and the FED embarks on more QE, then the inflation could really take off. So this presents a complicated challenge for these policy makers. In this context, I think the FED will soon cut rates and manage the inflation part of the equation thru QT while at the same time trying to juggle 3-4% unemployment rate. From Powell’s perspective , he is happy as long as inflation remains here around 3% and he can tout his policies are working. However, let us assume the FED keeps rates now unchanged at 5.5% thru September and in September -October, we see inflation peek its head above 4%. He is not going to like this. I think no one is going to like it. And I think this is one reason why there is a bid in these risk assets. As I said before, inflation is only a problem when the FED is pretending to fight it. If the FED surrenders to inflation, then it is not a problem for most assets which are denominated in dollars as dollar weakens.

Scenario 1: If I see strong downward auction below 4550 within the first hour or so of open, I think we may be able to test 4520.

Scenario 2: if the bond yields stabilize with dollar weakening (dollar proxy via Gold above $1960), and 4550 area holds within first hour or so, we may retest 4580-4590. At time of this post, we last traded around 4560.

~ Tic

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Jigsaw. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal and personal opinions.