What a day! And a day that underscores accuracy of OrderFlow levels even on a day like FOMC day!

We will come to this in a bit. However, I do want to share my 2 cents on the FOMC today. This is slightly long but an important post with my longer term thesis, try not to miss it.

A lot of folks today spent a lot of time anguishing over Powell statement and his Q&A. The truth is it really does not matter what Powell says (as we saw today). He does not know any better than many of you already know. For most part, he is looking at the same data, though our interpretations of this data may be different. For instance, his call today that there will be no recession or his assertion that the economy is very strong.

I personally think he just loves to hear himself talk, he talks too much and really does not say anything. He is a classic technocrat and bureaucrat.

In strong economies, credit card debt does not make new highs on top of a trillion dollars every month! But at end of the day, these are just opinions.

Let us get the opinions out of the way first and focus first on the facts.

What are the facts?

The FED funds rate is now 5.5%! A lot of guys said this will not happen but I predicted another rate hike today! This is a 22 year high in FED funds rate in the US. Last time we had rates this high, we were having dot com bubble collapse and many stocks will not recover for another decade after that!

There probably will not be another QE any time soon and there will likely not be a QE if the market continues to make new highs.

Core PCE has stopped going down and it is likely that we have seen the CPI/PCE lows this month and we could see another uptick shortly. If you look at the energy prices and housing costs, you may be forgiven to think this way.

Look folks these are not my opinions. These facts can be verified independently. You do not have to agree with me and that should not stop me from sharing my views on this topic.

For those of you who have followed me longer than a couple of years know I was bearish at 3300 before we sold off to 2300 and then I was bullish for most of 2020 and 2021. I have no issue being bullish or bearish depending on how I read the bigger picture. A lot of guys also assume that the only way to show bearishness is to be in short time frame puts. This is actually not true and it is definitely not true in my context.

In my situation, in intraday, as an Intraday Tic trader, I can be bearish and bullish at the same time, multiple times same day. I can be bullish 5 times and bearish 6 times in same session. So there is that.

Now as far as longer time frames go, my views are that cash is a type of option as well. I have accounts which are 100% in stocks right now , I have accounts which are like 3% in stocks and rest in cash and I have accounts for intraday only. I am trying to say there is not a single way to approach this. Our styles and our situations can be extremely different.

Now I am going to say something which is 100% my personal opinion. This is I think what will happen but again, it does not mean that I am short term bear. I will share my views again when I am short term bearish (days to weeks out).

I think that as Powell said, the effects of this 5-5.5% interest rate policy in the US are yet to be felt. I agree with him that inflation can still go up again.

The problem is that you have a very unique problem in the West now. If the central banks stop hawkishness, it will drive up prices of energy in particular, a lot higher. You have Western political scene which is extremely anti fossil fuels. Combine that with any let up in Central Bank tightening and you see 100+ oil again. $100 WTI Oil alone can add 1-2% points to the CPI. So there is that.

Then on the housing side, you have very tight supply. New homes can not be built fast enough and that is why we are seeing an uptick again in home prices.

I personally think the housing prices will drop once more supply comes to market which will likely be in 2024. This I think will coincide with an uptick in unemployment rate to 4-5% .

Now you have a myriad of essential services - health insurance, home insurance, medical procedural cost. These all are on an upswing. They add up! They take away whatever little disinflation we see in cheap foreign made goods.

This is primarily why I think the value sector is relatively cheaper when compared to the growth area. BTW if you have not already subscribe to me and help me share my thoughts every day with readers like your self.

I mean think about it- with GDP down, with employment still high, how open is the FED to print some more trillion in QE without some sort of crisis first?

I think if we see housing inventory built up again to October November levels nationally which was about 2-3X the size of current inventory, I think that is the better time for home buyers as well as S&P500 comes into more favorable levels for me for long term buy and hold rather than day to day trading.

These are obviously the negative factors. The S&P500 is going up and can continue to go up due to the fact that the mega caps have been quite strong of late on positive side but the current bouts of earnings reports have been lackluster.

So what will be my confirmation that the market has turned?

What I said above is a macro thesis. Macro can be wrong for a while before things turn in its favor. For me personally, I need to see technical levels confirm the macro thesis.

I said this before and I will say this again. I need to see Tic Top levels make lower lows. Right now they are making higher highs.

What does it mean?

I need to see market take out and remain below levels like 4490. I need to see my own weekly plans with weekly levels which are making lower lows.

This is very natural for seasoned traders but may not make much sense for some one super new. However, higher high and lower low are very potent technical indicators and should not be ignored. These levels then can become resistance which I can then lean against.

So really to sum it up, I would not read much into what Powell said today. It is really all opinions, like you and I have.

What I will focus is on these things primarily -

The interest rates in the US are now almost 6%! If you look at the 10 year, it is headed to 4-4.5 % to stay there for a year or more! This is day and night from it being 0% just a little over a year ago!

The fact that Powell asserted no more QE. Or not one any time soon! As well as his view that there is no recession imminent which may mean he has not yet even thought about thinking about cutting rates. Hope this time he has thought right. QE is the life blood of bull markets in the West. We need perpetual QE else the markets can collapse under weight of QT.

So for me, this leaves me longer term wanting to see lower levels in the general market where I will buy. I have a lot of time and I am not in a hurry. I think we will see one large upswing due to the QE and stimulus hangover but it will come after we retest some of the lower levels first. I will share when I see such levels which appeal to me in a variety of names like TSLA 0.00%↑ AAPL 0.00%↑ SPY 0.00%↑ QQQ 0.00%↑ etc . But it will be exclusive to subscribers here. So join the Stack now!

What I said above is a macro thesis. Macro can be wrong for a while before things turn in its favor. For me personally, I need to see technical levels confirm the macro thesis. I always confirm my bias with price action and price action needs me to see lower lows on the tic top levels (like 4490).

My levels for tomorrow

I will leverage the GDP print tomorrow.

It will come out before cash open.

Scenario 1: If the GDP comes in weaker than expected, I want to lean on bullish side if the emini S&P500 remains above 4580 to target 4610.

Scenario 2: If the GDP comes in strong and the emini is below 4580, I may be bearish expecting a test of 4550.

This I thought was the lowest volume FOMC as well as the smallest range FOMC in months and months that I recall! Around 1 million lots traded today which is a far cry from about 2 million average FOMC day!

In other ideas, folks, we saw another good sell off in TSLA OFF MY levels and also off NVDA off my levels. Both levels shared here in the Stack.

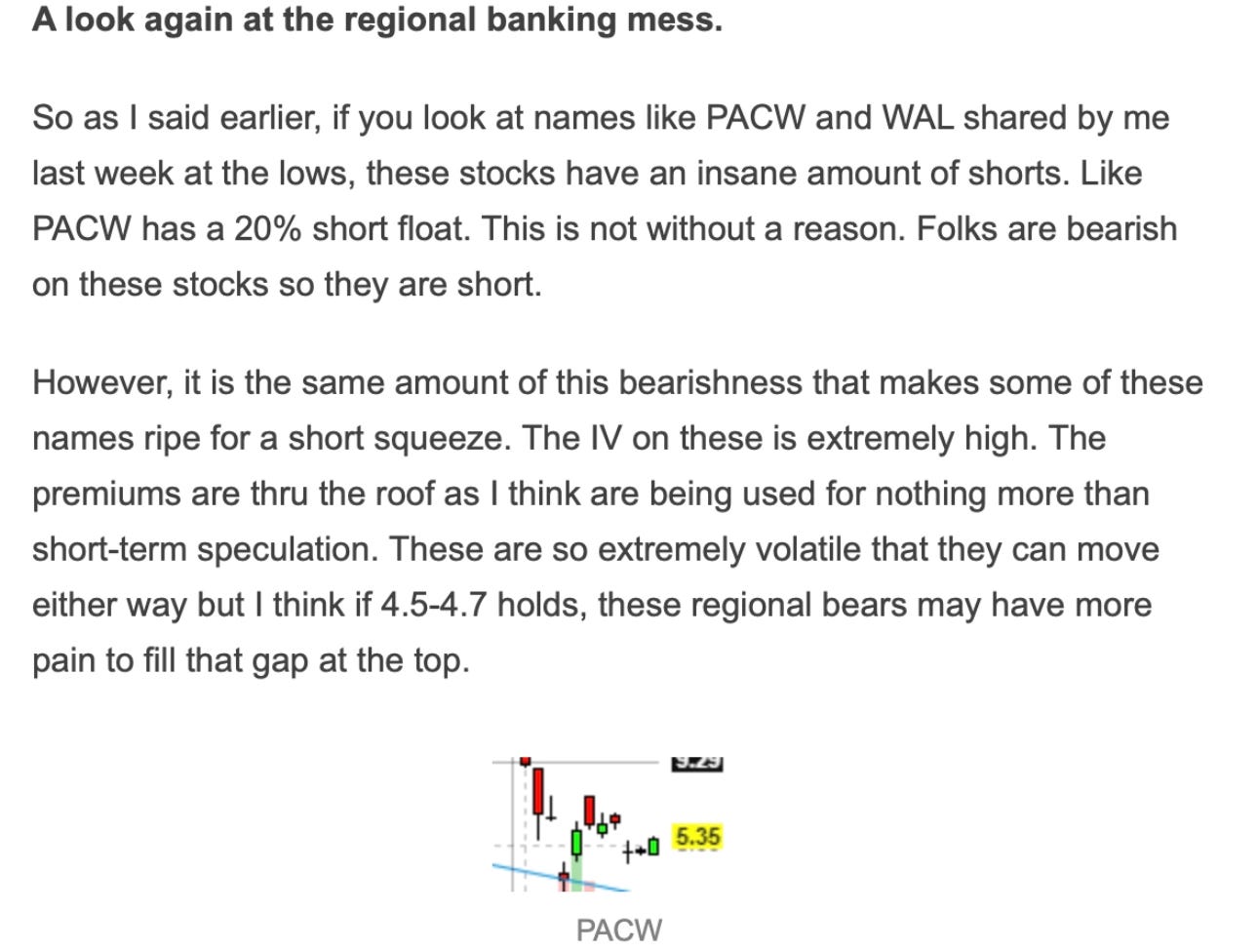

What else I like?

As I said I like value more than anything else.

For example, I shared UNH at 450 and it is now 510. WMT shared by me around 130 is now 160. These Chinese stocks also still kind of look ok. I think my BABA LIS is now 90-92. It is now near 97. Again this NIO was shared by me around 10 before it doubled to 20 and I think it looks good around 16.

However, I think longer term if the FED and the likes of ECB have lost the plot, then Gold looks very appealing to me. I was a bull on it at 1600 last year when all said 1200. It is now near 2000 again. I was bull on it again at 1900. I think there is some resistance at 2200 but if that gives up, we could trade 3000+ on Gold.

On the crude oil side, I think if we begin chipping away at 82 dollar area, we could be in an escalation of the CPI situation. I was perhaps one of the only few oil bulls at 66-67 area and here we are now at 80 (WTI). I think if 75-76 holds, we could test 82 and that is an extremely important area for oil. I already see gas prices tick up nationally on average despite slow down in freight traffic, rates and demands. Not a good combo! Please again read my note about the levels and how they play in macro!

Below is another good example of my recent calls. This has since doubled. Doubled! Shared about 12 weeks ago with Stack peoples.

~ Tic

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Jigsaw. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal and personal opinions.