Folks-

Slightly different format today as it is the CPI day tomorrow and due to anticipated large price movement, the scenarios may not be the best tool to visualize the market or manage risk due to this volatility.

Overall, today’s action as was yesterday’s action did nothing to change my weekly time frame view which was shared on Sunday. Here is the link if you have not yet read it: weekly plan.

The session indeed was very choppy to trade. I shared the 3850 level in the AM which played an important role. However, the level broke in last one hour and we traded down into 3800 , dips into which were bought to close back around 3825.

As of today, the market has remained subdued below 3950 ahead of the CPI as mentioned in my weekly notes.This is lull before the storm and things are going to look quite different in a day or so.

Chart A: Daily Auction was inconclusive for me, however I thought it slightly favored the bulls.

This is a FREE preview of my daily newsletter. Subscribe below to receive a copy every day.

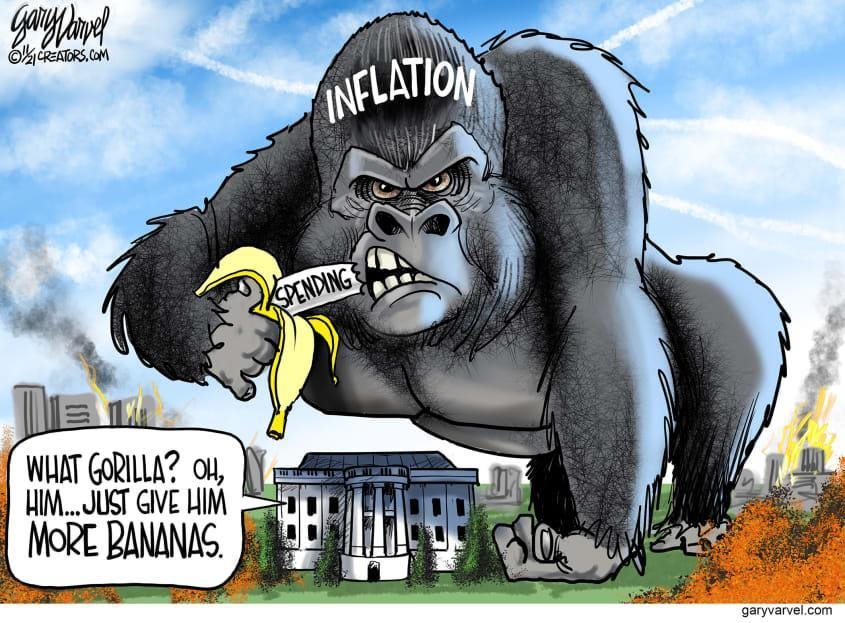

To understand the complexity and the challenge that the US and global central bankers have is to look at this two headed monster of high inflation and slowing growth. For a large importer like the US who pretty much imports everything its consumer based economy consumes, you have to look at it’s currency (the USD) and understand that in a high inflation environment like we are right now, a strong USD blunts some of the effect of this inflation.

Developing economies with their EM currencies are not so lucky as their currencies keep getting weaker and weaker and the USD keeps getting stronger.

While the USD strength shields the Americans some what from even higher inflation, when the US dollar gets too high, presumably due to the market thinking the FED will continue to tighten even more, the domestic economic engine like Capex, credit and lending start slowing down. Asset prices start climbing down, folks reduce or stop spending which lowers the economic output thereby leading to economic recessions. Further, it puts an enormous pressure on developing countries which are dealing with their own high inflation but must pay for pretty much everything they import in US dollars. This puts pressure on the global financial system where defaults by developing countries can create large sell offs in global equities.

So there is this tug of war between economy and inflation and they both kind of feed on each other. The FED in all this, being the FED of the world, must not only work on inflation back home, while at the same time they also need to juggle the domestic economy lest it fall into recession. At the same time, they need to do something to alleviate the strong US Dollar and the pressure it is putting on the global banking. A tall order indeed!

In previous recessions, the FED could reverse its course from being hawkish to start easing again and it will not impact the inflation side of the equation much because inflation has been just so low in the US for so many decades. This is not the case in 2022- if they give up the fight on inflation or if the market realized the FED is just pretending to fight the inflation- it will lead to a crash in the US dollar and along with it will come even higher inflation. It will increase the demand more, even when the supply chains still remain under pressure (case in point - look at the Chinese lockdowns). So FED is really in a lose-lose situation.

I wanted to share this brief blurb about the challenges faced by this FED because it drives some of my thinking and hypothesis about where this market may be headed next and why I have said what I said.

This leads me to my view of tomorrow. While I have no price based scenarios for tomorrow as I think the actual CPI print will take a precedence over any pre set scenarios for the session tomorrow, I do want to share a couple of CPI outcomes:

Stronger than expected CPI: this is the case where we end up with a print of 9% or more YOY. I will be quite curious in this instance to find out how it happened as I think the CPI should come in as expected or even lower than expected but not too lower. The headline impact of this 9% + CPI may be a sharp sell off. Remember by the time the Chicago cash session, NYSE open at 830 am, the brunt of this move will already have been absorbed by the futures market as the CPI comes in an hour before the open. As I said, this will probably mean we open a significant gap lower in the cash session at 3750 or lower. I will personally like to let the dust settle in this instance but I do think dips if come into 3700 may get bought for a trip back to 3790/3800 as the market digests what this means for the FED next due to the factors I listed above. This may correspond to 11580/11600 on the NQ, 660 on names like TSLA.

Expected or weaker than expected print: this is the scenario which I think could go down. We could come in as expected or may be a 0.1 or 0.2 lower than expected and I think this is what causes that rally into 3950 as I have been anticipating from a weekly time frame perspective. A strong impulse move could then even take us as high as 4000.

Scenario 1 is obviously very bleak in terms of what it means for the economy and markets however, I would think even if we get a weaker than expected print, the rallies may be shallow. Let us say over the course of next 2-3 months we come down from a peak of 8.6 % CPI to 7-7.5% CPI and settle there. What does this really mean and how is it good for anyone? We had 8.6% inflation and now we have a chronic 7%. Neither is good.

This is not a win for any one! If we come off a point or half, this does not mean we have won this battle against this historic inflation!

This is where I think once the market realizes the options staring at us and at the FED that it sells off and grinds lower to my lower targets for the year.

To summarize: while I do not have set price based scenarios for tomorrow due to anticipated volatility, my current thinking is that a stronger than expected CPI will probably lead to 3700-3750. If so, I think 3800 could provide an intraday resistance

While I have no clue where the CPI will land, I personally favor a scenario where the CPI comes in inline with expectations and the market takes it as a victory lap and rallies to 3950-4000 where longer term sellers may reengage. I could see some momentum names like TSLA trade recent highs like 760-770 in this scenario (now 690). I could see Bitcoin also make an attempt at rally to 22500/2400 before faltering again.

Ultimately neither of these CPI outcomes will change my longer term views which is that we are in a downtrend grinding down with formation of these ranges which I have been sharing with folks. Once the orderflow based scanners think the bottom is in, I will be sharing some names which I like 👍

Updates if any to this will be provided later in the cash session tomorrow along with my personal take on the CPI numbers.

Remember, DAL reports tomorrow. I deliberately did not share any thoughts on this airlines play because I want to see how DAL goes. Whichever way DAL goes, I think AAL, UAL etc will also follow suite when they report next. One thing about airlines is they did not make profit when the planes were packed full and the gas was cheaper, they were price gauging, so I will be curious if that has changed now. DAL last traded 31 and change.

This is it from me for now. Before I sign off, I do want to reiterate a couple of things. First one being that this newsletter is not a signal service. If I offered a signal service, it will be very exclusive and will not be priced at 29 bucks. This newsletter is just me sharing my thoughts and levels with folks as I prepare for the session ahead. My scenarios on balance tend to be correct but at end of the day should not be considered as a signal service. This is simply my journal to share with folks on how I prep for the session and which levels I will be watching.

Speaking of my thoughts, I make my best effort to share in an open manner and I don’t take any of these levels lightly. However, I do not claim that any of these levels or ideas are accurate or going to work, but I can vouch that I have put as much effort as anyone could into it whether right or wrong - to that end, the comments section is to allow folks to ask meaningful and relevant questions, related to the subject at hand. The comments section is not for personal grievances against me or other subscribers. Please keep it professional and encourage other traders like your self to have conversations around order flow and trading.

Have a great day and best of luck for tomorrow 🤗

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

I think the FED has to remain hawkish, but they have another tool to ease the soaring dollar, FOREX currency swaps. Plot the USD/CAD and you will see a near -1.0 correlation to SPY.... coincidence.. I think not. Look at the FRED asset database on currency assets over the week of June 30-July 7, and you will see the asset balance sheet of currency swaps increased quite a bit. So under the radar, the FED provides liquidity to GBP, CAN, and other friendly nations through the currency swaps. I think its pretty sneaky.

Tic, thanks for all the work you put into this and for sharing you valuable thoughts to the group. I do not always interpret things correctly but that’s on me never you. I saw a lot of people bitching today because they wanted or expected a certain outcome at 3851. I wanted a different outcome as well but I also have eyes, and stop losses etc etc. if they lost anything it’s on them, not you.

You sir, are great! Never change and THANK YOU!