Hi friends -

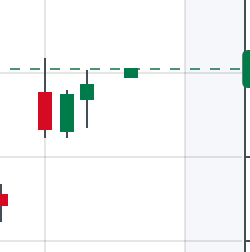

The primary expectation was to see dip supported if 5510 traded.

This was indeed the case but overnight.

The secondary expectation was to see a test of 5550s if we remained above 5534 in cash session. This level was what worked out in the cash session.

Not once. Not twice. But thrice. Strong support at every test. We are now trading like 5555 at time of this post.

See Chart A above.

So what we see is an area of interest has developed at 5528-5534 which is the close of Tuesday and Open of Wednesday.

Due to these reasons this will be my key level for the day tomorrow. PCE tomorrow as well as the first Presidential debate tonight. Get the popcorn out, it will be an interesting session.

Scenario 1: I think if 5528 is tested, this may be supported for a move back to 5550s.

Scenario 2: 5560 has been the resistance for past several sessions, but I think if we open and remain above it tomorrow in cash, I favor a test of 5587.

TSLA

TSLA as well as AMZN are both looking robust, technically. I have had a bullish outlook on these 2 these past couple of weeks. Both at 170 respectively. They are now both near 200.

Let us talk about TSLA. The earnings come out the week of 24th next month.

I expect this to push higher into 210-215 as long as 190 holds. In terms of Options, 7/26, 190 CALL is interesting. Now the call is 16 bucks with a Delta of 0.64. This will change as more time passes, however, if in next week or so, TSLA trades down to 190, and the CALL comes down to 11-12 range, I like it.

However, if more time passes, more than a week, we come closer to the earnings and the call remains deep ITM, I will avoid it.

What I said earlier is in context of volatility that takes us down to 189-190 within next 5-6 days, or less. Minus that, I will share another CALL idea as we approach earnings. But this is what I have on my radar- for now. Stay tuned for more calls.

AMD

Despite the swoon in SOX, I still think there is juice left to be squeeze, even if a few drops, from the likes of AMD and AVGO etc.

On AVGO, I have had a bullish outlook at long at 1550 holds for a test of 1670s or so. It is now 1580.

On AMD, I think we can see 168-169 tested. It is now about 159.

For ultra short aka lotto, if we dip down in general market, the 160 CALL for tomorrow if had around 1 or sub 99 cents looks interesting. Lotto.

~ tic

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Jigsaw. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.