Gaps are important clues in auction market theory. But let us first talk about some recent options calls here in the Stack.

DJT Call was shared by me around 1.25 a few days ago which exploded to around 7 this week.

NVDA call shared yesterday around 1 dollar also almost tripled today, trading high of about 3.6. Subscribers get futures levels, stocks themes, bonds, oil, gold, and options ideas. All in one.

Now let us go back to the gap thing.

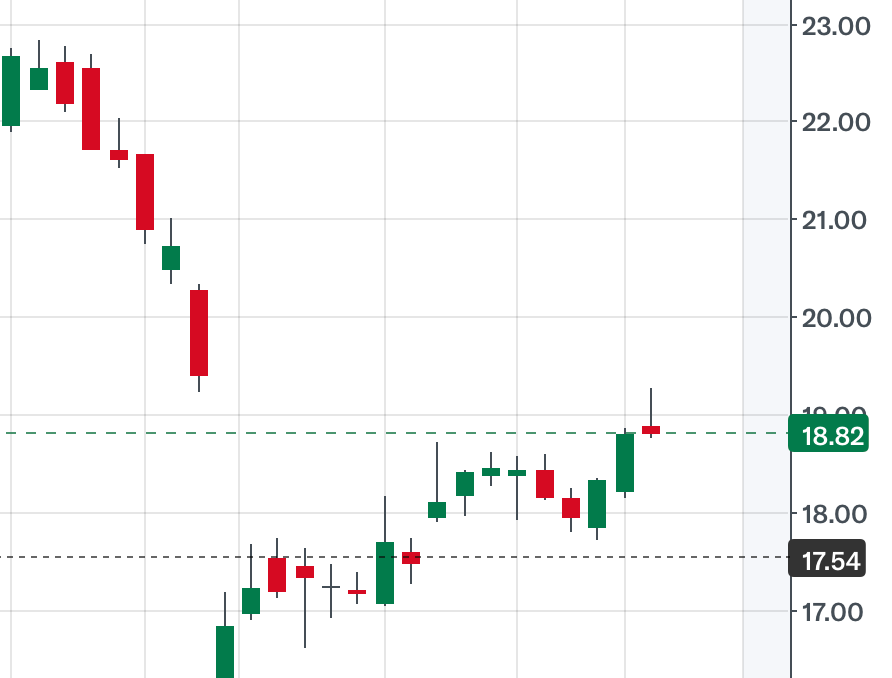

Remember I am sharing this as an educational post on how I view market action. Look at S chart below.

What did S do? It filled the gap and rejected the gap. But look at the volume on rejection.

Super low.

What can this potentially foretell. This may be a signal that as long as the 17-18 area hold on S, it may try and revert back to top of the range near 23. It is 18 and change now.

Levels for tomorrow

It is now Wednesday and the emini has remained between the two levels I shared on Saturday night, highlighting the potency of levels.

Another thing to note is that I think the rally in NVDA was very robust from 118 to 227 or so today, yet we did not see a strong impact on price of the CALL I shared, Yes it did rally 3X, but it could have been 4-5X and it demonstrates the greeks are a little weaker than what I would like.

For tomorrow recent highs near 5560, and recent lows near 5510 remain in play for me. We are now about 5538.

Scenario 1: We could see resistance near 5560, unless overcome for a move down to 5530s.

Scenario 2: We could see support near 5497-5510 unless overcome for a move back to 5530.

CVNA

CVNA got a nice pop today. I have been bullish at 100-110 on CVNA and expected target of 130. It is now about 130.

With CVNA, keep in mind the prior month high is around 130. I think if 130-136 can hold as resistance, we may see another leg lower into 110 or so on CVNA. This is purely technical thought process ahead of its recent highs. They do not report until 17th of July so not reading much into the price action until then.

~ TIC

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Jigsaw. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.