Folks-

What a giant, monumental miss - both on part of participants’ expectations of the FOMC AND Chairman Powell’s communications. The latter may have very well been deliberate and not so unintentional.

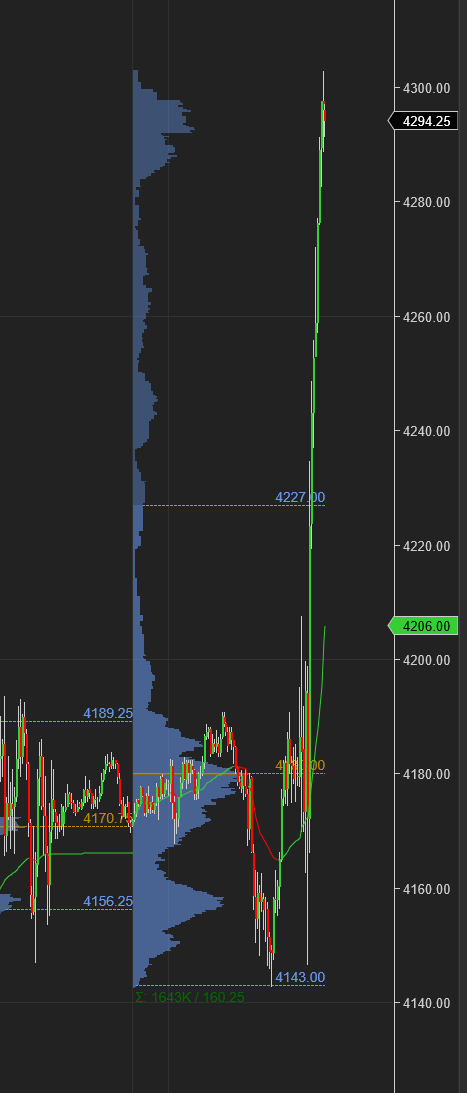

Per my plan, I was bearish and I expected the market to sell off at 4200-4250 levels. I expected 4100 to break. 4200 level did hold the market for most part of the day (see chart A below). However, there was a key point during Powell’s presser that ignited the fuse under S&P500 and made it rally about 3 % within an hour causing this face ripper.

This key part was the question about the 75 Basis Point hikes. S&P500 had been nicely selling off prior to this off 4200 but the moment this was asked, Powell’s answer came across as some one who is now set on a series of 50 basis point hikes for rest of the Summer. Why would you answer this as such a dovish? Only reason is quite obvious.

The market was not counting on this. It expected a far more hawkish FED.

I think the real damage came from Powell wittingly or unknowingly saying the FED neutral rate is going to be about 3%. Well, we are already there! The bond market is already reflecting those rates and this came across as an admission by the FED that they are done with this tightening and are actually now going to start QE. This was a very dovish statement.

Now while the news headlines will read the “FED raised by 50 Basis points”, the market action actually is equivalent of a 50 Basis point cut. Why would you effectively cut rates if you are serious about all this? Only reason I can think of is the FED trying to engineer a “so called soft landing” and this pump today into 4300 may be an act in their playbook when they attempt this “soft landing” .

I do not know for sure if this was intended. I do think the opening remarks by Powell were very hawkish and I think this was all a ploy to pump the market , giving major , systemically important players more rope to distribute, get out of their longs.

The pumps however now keep getting shallower and shallower. I do not trust the market action today. I am looking at TLT and thinking well the bonds do not seem to buy this move in equities.

The gold market, BTW which I shared my bullish bias at that 1852, had a very good move, I pretty much called the low tick in Gold at 1852 and is now trading 1885. I think Gold becomes important in coming few days. If I see it trade down below 1870 again, I think that will be a sign this move was just a head fake. Conversely, I will think the move may have legs if Gold starts trading above 1900/1910.

I have been bullish on Oil off that 97/98 as well and it had a very good day today, going up to almost 109 today.

Personally for me, for investor Tic, the price action today means nothing in terms of how I have been investing since Fall- which means the price action today alone does not mean I am going to warm up to the mega caps like AAPL (now 166) or a GOOG (now almost 2500) or the Russel type stocks. Not at all. I will need more information and more data, may be observe a couple of more auctions this week to see if this thing has legs.

Remember, on March 16th we had a similar move in equities after the FOMC. Nasdaq was up more than 3%. But that did not hold at all in days and weeks to come and we sold off. These levels, while about a 120 points higher than yesterday close are not something we have not seen in last few days. This 4300-4360 area is a well known level and not very surprising we closed here after those misperceived Powell comments.

My plan called for this kind of volatility yesterday. My levels did ok for first half of the day . 4140, 4200 were both very good levels for most of the session until that last minute rocket out of Powell’s perceived miscommunication.

Here is my plan from today if you have not reviewed it already: Daily Plan 5/4 '22

Personally I was doing well BEFORE the FOMC and got caught up and bruised on that move out of 4200. I did manage to claw back but was not a great day for me personally due to that last one hour’s action.

So looking forward tomorrow and beyond:

I see no change to my bias despite this daily close above 4200 today as the close was influenced by what Powell said not due to his actions. He has no other choice as he risks equities falling apart otherwise.

I think this market remains in a downtrend. The pumps are getting shallower. I would think in days and weeks ahead we will a test of 4100, break it and test new lows afterwards.

For tomorrow, my key levels here will be 4265 and 4320. I think this market, as long as it remains between these two levels may balance here before breaking lower shortly afterwards to test 4100. The close today was 4300.

To summarize, the market close today at 4300 does not change my longer term view that the S&P500 is in a downtrend and may test that 4000/4050 after all before it carves out a low. The market was oversold technically and it has rallied into resistance at 4300. I am not changing my investment philosophy and will continue to share whatever I see in my screeners with folks. I don’t see any need to change my levels or trading bias and will continue to share these levels for intraday with folks. Subscribe below for upto 5 similar posts a week.

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

If you have less than 10 years of order flow, trading during FOMC should have been a no go. Your better off throwing 50k on black at shitty casino.

Thank you Tic. I agree with you and shorted heavy at 4300 level.