Traders-

While I remained a bear in my weekly plan on Sunday night for the weekly time frame, my main tactical , intraday expectation at start of the week was we could see some sort of rally at start of this week to then to culminate in a sell off on or immediately after the FOMC day on Wednesday and then carve out a low.

Today also in addition to the economic data, additional confusion and fears had been sown with the overnight news cycle of impending Taiwanese invasion by China and some more fear mongering on Putin and what he could do next.

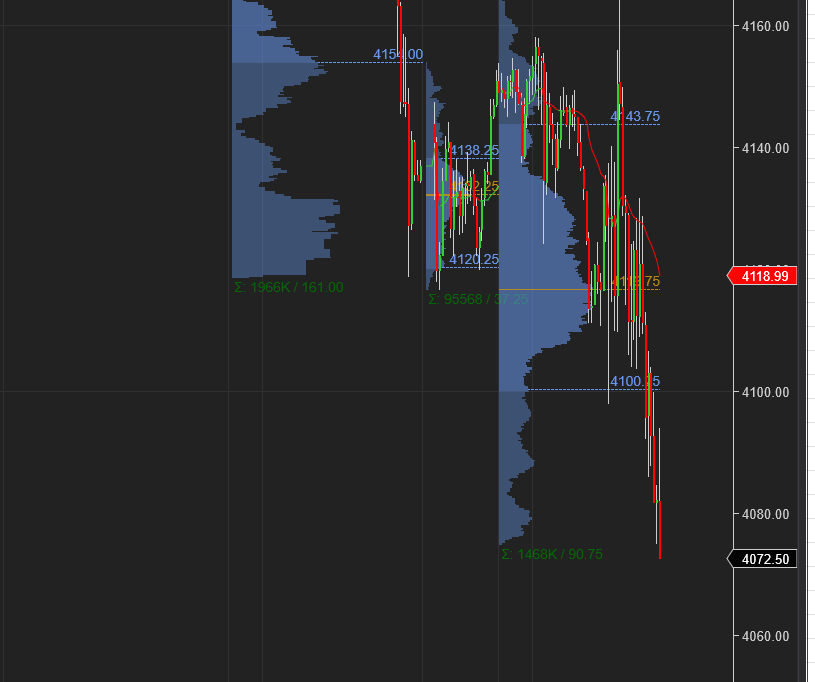

This was a mixed bag today in the sense when the data hit the tape from Manufacturing PMI, I thought I saw bullish activity on the tape at 4130. The open it self today was very choppy with very heavy volume. We did sell down about 20 points off that but then managed to rally all the way up by 40 points to almost 4170.

These highs then could not be held. We could not hold the 4140 KEY LIS on a pullback and then pretty much spent rest of the dat at time of this post below that 4140 number shared last night.

Some other names rallied in the morning - whether that is an AMD, or a NFLX, or OXY. So they had a good start to the day but then kind of wilted down.

What this action underscores for me is I take what the market gives. I cannot expect the action to continue in a straight line in my favor and must be nimble to take whatever I can eke out and break even the rest. This is also a reflection of how much can be shared in this format - once a day post. During the active market hours, the conditions can shift rapidly and it is not possible to share everything that goes on the tape.

We are now very close to my long term target on the downside of 4050. It may actually get tested while I finalize and send out this post. We are now trading around 4070.

This action tells me the market is in a hurry to test these downside targets and that may mean there is room for little more volatility to come. Based on my methodology, I like to validate these levels with the orderflow once we get there and it is not always an automatic buy or sell for me.

I do think the FED/FOMC may cause more volatility on Wednesday and I would be watching these levels shared below to make sense of the market between today now and Wednesday afternoon to determine if the bearish tape comes here at 4050 or at 4200?

What can I make out of this for tomorrow’s levels?

I would think given the action today, the 4070-4076 levels may become important for tomorrow.

I think if we open or bid above 4076, then 4070/4076 may offer support for a retest of 4140 from today. Unless overcome on a Daily time frame (D1) this 4140 may become a new resistance for Emini.

On the downside, an open or offers below 4070 may target 4000 key psychological level.

Emini low of the day at time of this post was 6 handles above my 4050 at 4056.

Ahead of the FOMC, a lot of folks may be expecting and/or positioned for 4000. This number may elude them and disappoint them if we were to open or bid above 4076 tomorrow cash session. For me then, 4200-4250 become better levels to be bearish ahead of the FOMC which could then see one more round of softness before the tape firms up a little bit more.

A quick look at few more things:

For this market to be expecting a very hawkish FED, here are a few personal thoughts on some related tickers..

Crude oil seems to find bidders everytime it tries to go under that 100 dollar mark. Crude oil does not seem to be very confident in FED’s ability to do much about this inflation genie.

Precious metals

Gold and Silver IMO are very manipulated and yet you can see that the downside on these names may be harder to achieve IMO. I think they have been unfairly punished in anticipation of a very hawkish FED.

Dollar chart

Very strong looking chart. But if you look at USDJPY (now 130), it does not share its enthusiasm to break out of this 104 top. A strong dollar not only wrecks havoc in domestic equities, it can crush EM currencies, EM markets, bonds globally.

Will Powell risk a global unrest on Wednesday?

My weekly plan for those who may not have yet read it: Weekly Plan

~ Tic Toc

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

So basically swing long until 4250 approx? & Close before FOMC? Or am I missing something

Bottoms not in yet?