Folks-

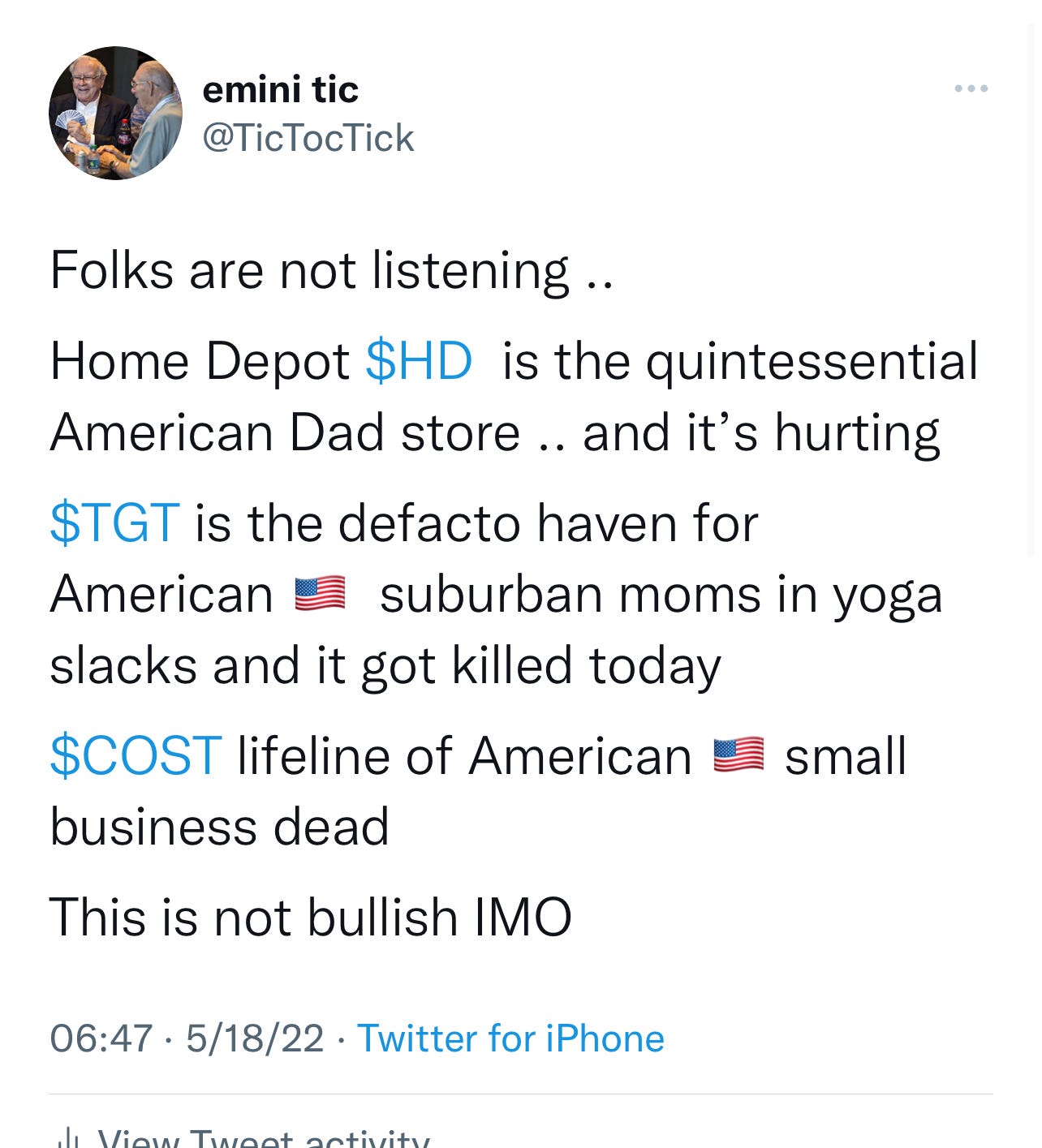

The symbols of American way of life and might are being destroyed one by one, stocks are getting decimated. These moves like the ones in WMT and TGT are 6 sigma moves. Very rare indeed.

Here are a few examples to consider (and I am not even going to go into the fluffy meme and no EPS names):

1. Starting with discretionary spend .. they first came for the $DIS and $NFLX of the world

2. Now they have come for retail. Retail is back bone of American economy, names like TGT, COST and WMT have been destroyed.

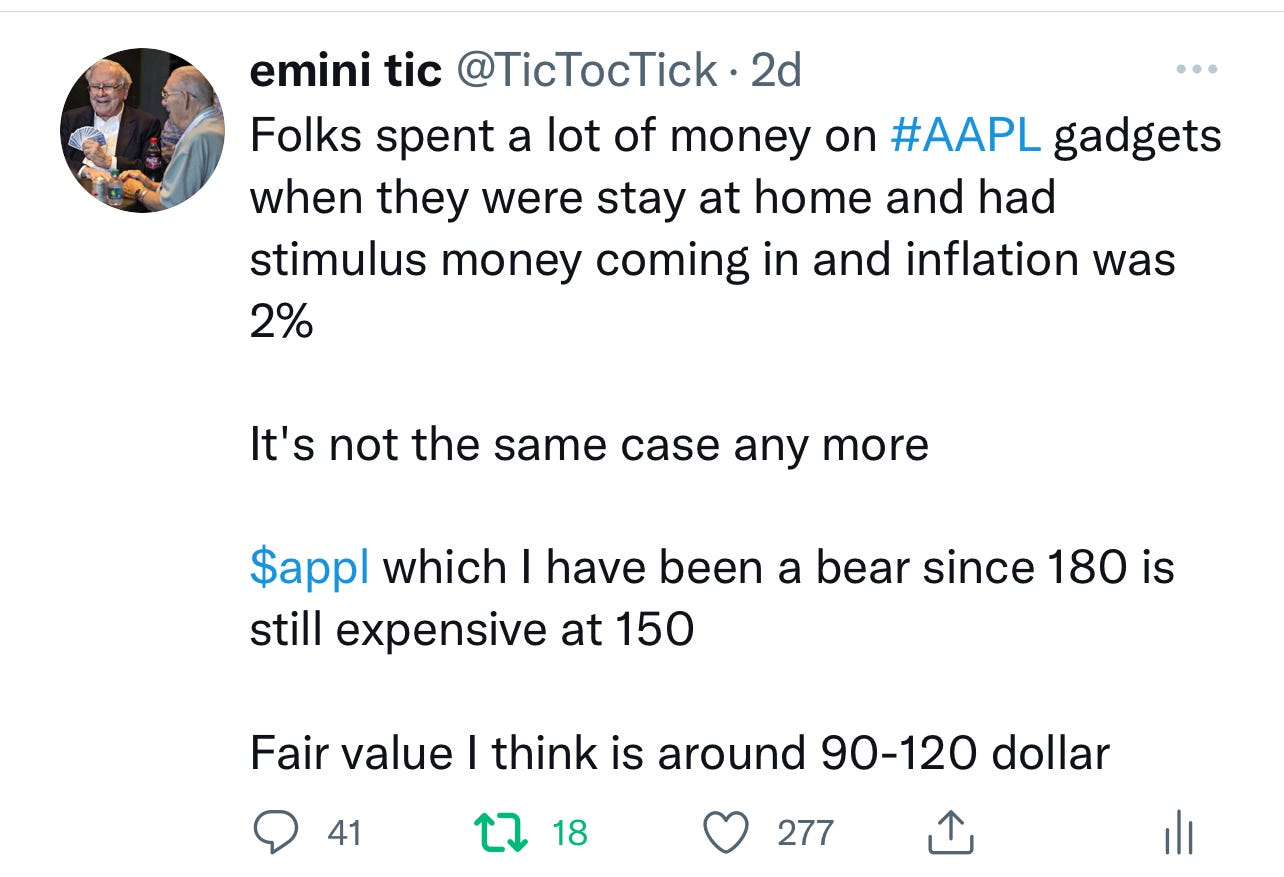

3. The next shoe and may be the last shoe to drop may be AAPL and MSFT. The white collar castles protected with alligator infested deep moats. These are usually the last shoes to drop in a cycle.

I think we will bottom once we see the results are seeing for TGT, WMT and COST repeat for the likes of AAPL.

Will that be today? I doubt it.

It could be later in the Fall this year. Just a guess when they report next Quarter.

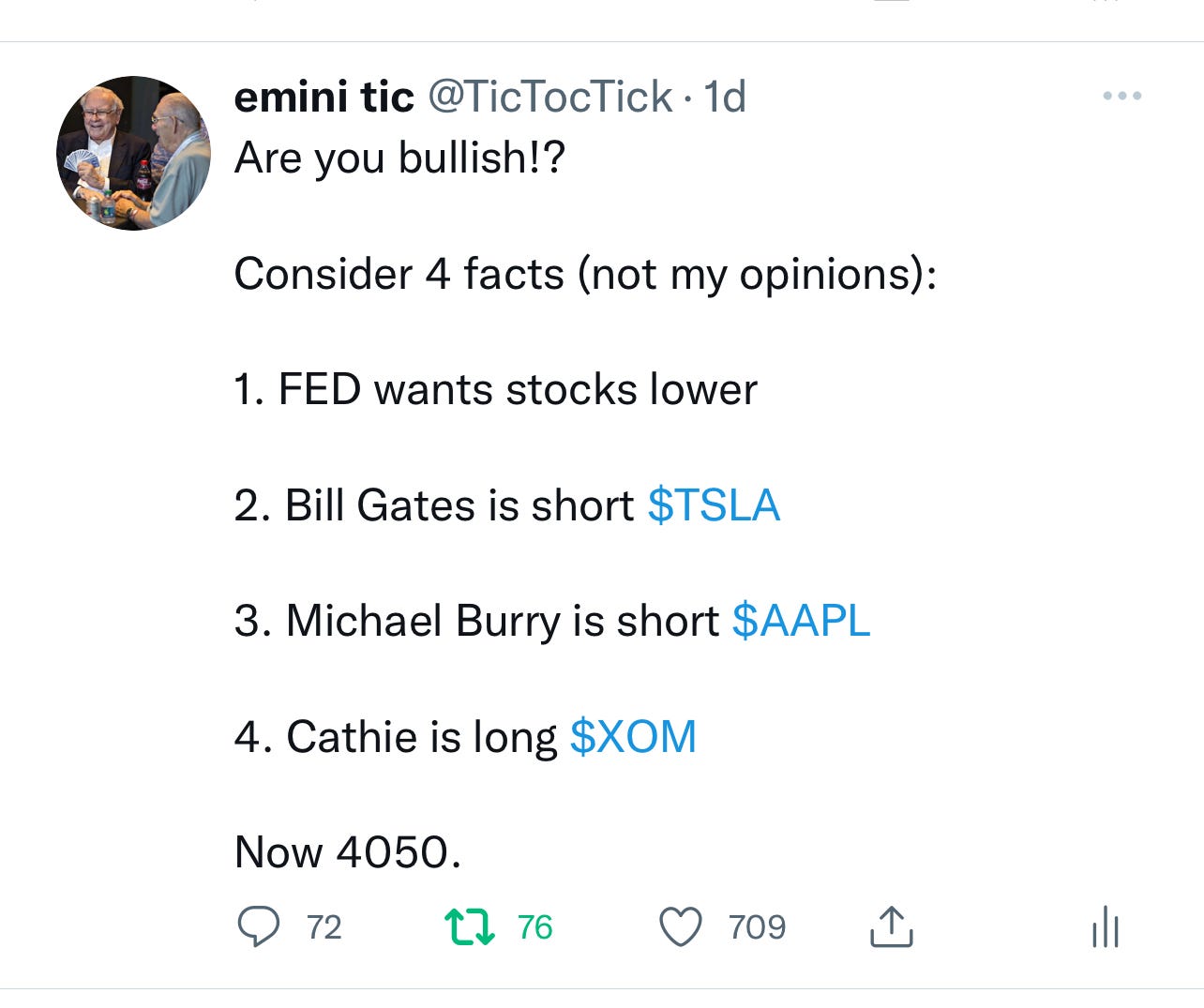

Here is data to support my thesis:

Look at this unfortunate chart in retail ETF.

Transportation FDX

Transport is life blood of America and is now down in the dumps. However not making new lows and this IMO is a plus.

My point is the key American sectors and industries look sickly. This is not the vital signs you want to see if you are a S&P500 bull.

Are there any positives or it is all doom and gloom?

I think with the oil coming down and US dollar softening against the Yen and Euro this is a plus for sure for equities. I am also liking the risk on EURAUD also come down below that key 150.

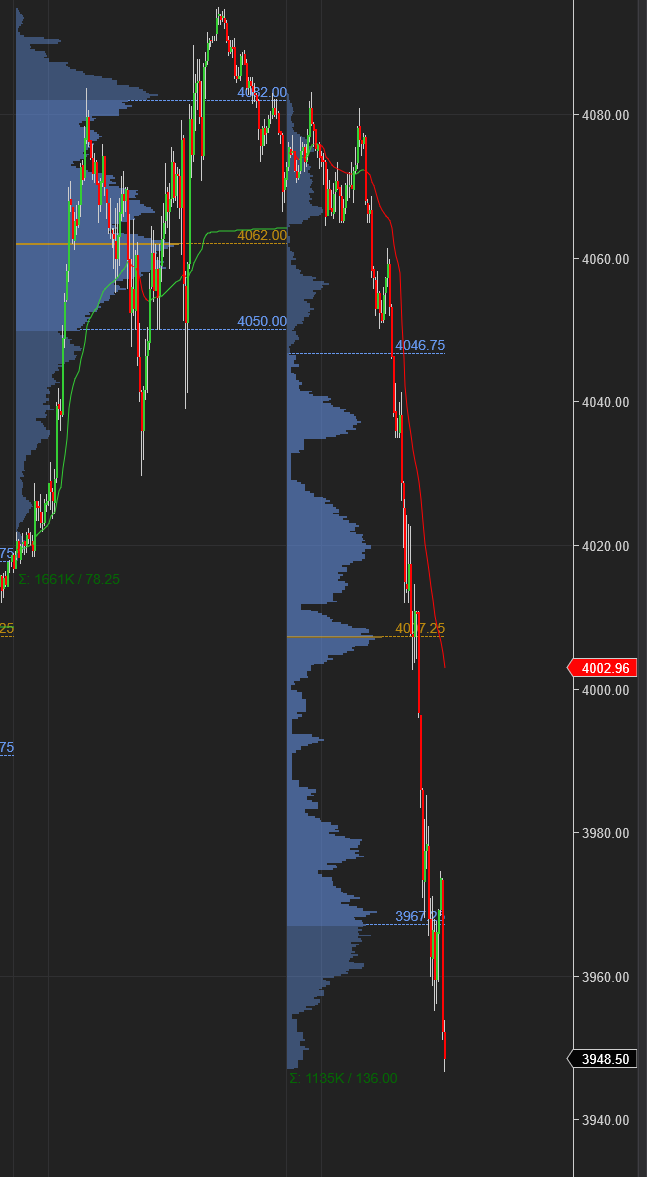

Regarding the action today, I am not going to pat my own back here, I think I have overdone it already today on Twitter. So everyone pretty much knows I was a bear yesterday at the close and once we opened today below that 4060, the sun set and we promptly sold off to 3950. A 100 handles lower within hours.

I shared this and the levels and my thoughts with Substack. You guys were absolutely the very first ones to read about my bias and thoughts. If you would like to get an email the moment it is published, then consider subscribing to my newsletter. It really costs almost noting and it a ways to gate keep serious participants and filter out the noise. I also ask at a very minimum you read all my posts to be in the know of the continuous auction parameters. Especially the weekly post. I know some of you dont read it and you should Here is the link if you have not yet read it… WEEKLY PLAN

I was also bearish on many other names last night in my Substack. TGT, CVX, XOM, JD, BABA, AMD, SE.. almost all of them fell today. No one was safe. Here is the link to the newsletter. Click for Daily

If you like my content, I ask that you share with your folks as I am a word of mouth newsletter with no ads or sponsorship and it helps me reach more traders with message if the tape. Share this post and newsletter. TIA :)

My thoughts and levels for tomorrow:

See the Chart A below. This is the escalator down I was referring last night.

Now most of you already know my thoughts from the weekly plan. We are close to that 3900/3920. I feel late bears to the party need to be nimble. 3900 may be a decent support.

Here are few thoughts and levels:

I expect very emotional trading rest of the week. This may culminate in folks trying to break names like AAPL 140 out of fear, fail and we may rally back up to 144/145.

3920 is the key level for me. I think if we open or remain bid above it, further downside may be harder in short term. We may retrace back to 4050/4100. I expect 3900 as long as we do not close below it on D1 time frame to be a decent support.

If 3900/3920 is broken, then we are looking at a retest of 3850 recent lows. This will mean we are able to break and close below AAPL 140. I will be little surprised if this happens in the short term **fixed this as there was a typo, I meant 3900/3920, not 3920 D1 close**

Emini last traded as low as 3940 at time of this post.

Some of the related markets to watch to confirm or deny this? Gold as long as it holds 1820 is generally good, USDJPY staying below 129 is generally good. Of course AAPL holds 140 is generally positive. Another clue on Friday may be if we carve out an inside week, technically IMO is generally a plus. A close above 4000 between today and Friday will mean we have probably got a good low around 3900 and we could explore 4100, may be even break it. Keep the story alive for 420/430. Read my weekly plan for all about this theory. Here is the link: CLICK ME

On the downside, a loss of 3900 on SPY and a loss of 140 on AAPL IMO can escalate and should be a key event to watch.

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

You are the greatest, not only you provide the best analysis, but at times that we have difficulties to understand what's going on in the market, you post your thoughts and give us direction! Up 400% (I'm not kidding) in my account in 5 weeks, since I registered to your substack), only thanks to YOU! You made it possible! God bless you! George from Greece

Tic, why the confusion with your tweets? I subscribed for clarification...but even more confused bro. Melt-up or sell-off. Trademark symbol? Copyright symbol? Please be clear. Many of your fans are confused.