Daily Plan 4/4/23

Traders-

The primary levels shared in the chat this AM were 4156 and 4110, both of which contained the day’s session. While we could not trade as low as 4110 in the RTH (cash) session, we came close to it, missing this level barely by 15 points or so. The high of the day was 4157, barely a few ticks above 4156. If you have not yet installed the app, do so now to get the chat updates when they are published.

On an admin side note, I will be executing another price increase soon. This should not impact anyone who does not re-subscribe. This is a good time to subscribe now before higher prices kick in.

Also, do not forget to read the Weekly Plan below with my views on longer-term auctions (a year or so out):

In terms of news flow, tomorrow will be a light day. In fact, there is not much news flow risk until Friday with the non-farm payrolls (NFP).

The main news flow event in the US today was the Manufacturing PMIs which showed a contraction in activity and pricing. This was somehow initially construed as good as the markets rallied about 20 points from the open, only to sell back below the open and then settle at 4150 towards the end of the day.

In other developments…

Over the weekend, OPEC and its friends decided to cut oil output by about 3.7% of the daily capacity. This had an immediate impact on oil, causing the commodity to open above $81 on Sunday night when futures started trading. I have been saying for some time, even at as low as $65 last month that it is hard to rule out $90-100 oil again. This could translate to gasoline at $5 or more. As a result of this move, the oil stocks in general had a good day, with XOM rallying over 5%. XOM is now up about 20% from the OrderFlow level of $100 to close near 120 today.

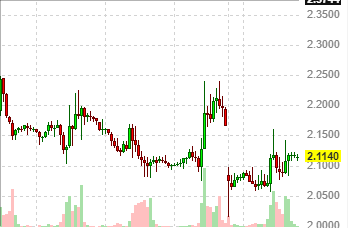

While oil has been enjoying good returns, its cousin in Natural gas languishes. It is a far cry from $10 only last year, now trading near the $2 mark.

I think Natural gas is either at or close to decent support and could later in the year make a move higher toward $4 zone as long as we hold the $1.5 area which could be decent support.

These moves - if they pan out so in the energy sector could keep the fuse lit under inflation. However, for now, it all seems to be hunky-dory.

My take on this whole energy uptick -

If this thing is real, we should see support under oil now for around 75 bucks which will be my new LIS on Oil. If 75 gives up, I will question OPEC ability and pricing power.

Now, if I am an S&P500 bull here due to a ‘strong economy’, I need to be cognizant of the fact that if the consumer and economy remain strong, so will the energy sector. And if Energy remains strong, another thing that remains strong is inflation.

Given current cost-cutting by the big tech, if as a bull I am counting on strong guidance from these head honchos in Q1 earnings, remember, it will be hard for these CEO to paint a rosy picture for the future when you are also laying off thousands and cutting down on staplers and toilet paper. It may come across as deeply hypocritical also.

I want to watch this whole XLE sector closely for next week or so. If these prices are going to hold in oil, I am afraid higher CPI is not too far behind.

In smaller bank space, I do think FRC could have a decent long term future

The first republic chart is below.

FRC is now about 14 bucks. I do think this could trade back above 26-30 longer term as long as it holds that 9-10 area.

As far as big tech is concerned, really not a big fan of the US-based Big tech.

If you look internationally, especially UK and Europe, some of the names like SAP could have more juice to squeeze.

SAP as a legacy ERP software maker, could benefit from companies not deciding to implement newer projects and instead renewing their existing SAP contracts. ERP projects can be notoriously hard and costly to implement and SAP could benefit from this. It is now around $125.

BP would be in a similar place.

It has rallied about 20% again from my level. I think it looks good for a move into 50 and beyond. 30-32 remains a key LIS for me on BP.

I like these European larger caps far better than the US based on which I think are bloated. Now if we begin to see a sustained rally in the energy sector and a stabilization in financials, I think this could be a negative for these bloated tech stocks - an XLE rally and an XLK rally at the same time can not coexist and one of them is likely to lose.

ZIM

Another one of OrderFlow's names, ZIM had an amazing quarter, up about 35%.

I think $18-20 remains a key LIS on this name and could trade up to 30 bucks as long as it holds.

My key levels for tomorrow

On the emini side, I did not see anything major on the tape. My key level for tomorrow will be 4110 on the downside and 4160s on the upside.

There is a long-term trend line here in the vicinity. If you were super bearish at 3800s and are only a newly minted bull here so close to 4200, there may be a) technical risk due to the trendline, b) even risk from the NFP on Friday.

Scenario 1: for a trend day, I think I need to see an IB close above 4160 or below 4110.

Scenario 2: Absent that, I think we could remain rangebound between these two levels.

More updates, if any could be published in the chat room below.

~ Tic Toc

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.