Folks-

A very active day for me albeit choppy. Today’s action was mostly around my key level 4230- I shared this with Substack a couple of days ago and has not been able to be penetrated. Very solid level today and also yesterday.

Today also multiple attempts were made to take this level out- all of them failed. Multiple zippers off 4230, one going almost as low as 50 handles, though there were several smaller ones.

I also did quite well with FB. I was perhaps a handful of folks who were bullish on FB today pre Earnings. I shared 170 level today which was instrumental in FB before that massive move about 40 handles to close around 210 post-market. I will probably take partial profit on this as even though I think stock is quite cheap on my entry, I am still soft on overall market. More on that later.

With FB, I want to commend Mark Zuckerberg and his team to deliver growth despite attempts by AAPL to stifle them. Had the general market not been so soft, I could see a 255-260 print on FB in near future. Now 210.

In other news, what an unmitigated disaster is ARKK turning out to be. ARKK was loading up on TDOC a day before the rout in the stock. The stock lost a third of its value and is now down 80% on YTD . Unfortunately, if ARKK decides to offload this stock, this may further depress it as they own 25% of all float.

The stock is now around 35 dollars. I think if ARKK gets rid of it, I want to be a buyer. This may not be until 25-28 dollars but I am in no hurry.

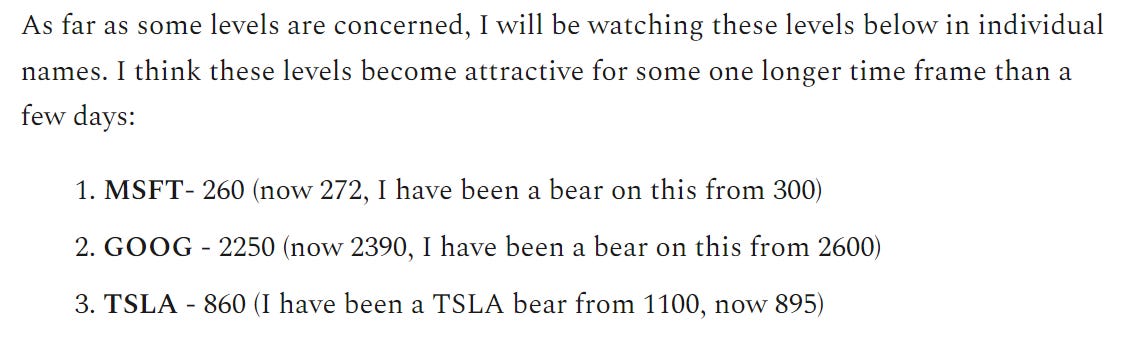

My levels were also very potent for MSFT, TSLA and GOOG.

I shared my levels last night for these 3 in this post: LEVELS POST

The levels I shared turned out to be the exact lows in these 3 names and they enjoyed good rally, all 3 of them today.

Let us now talk about Emini S&P500..

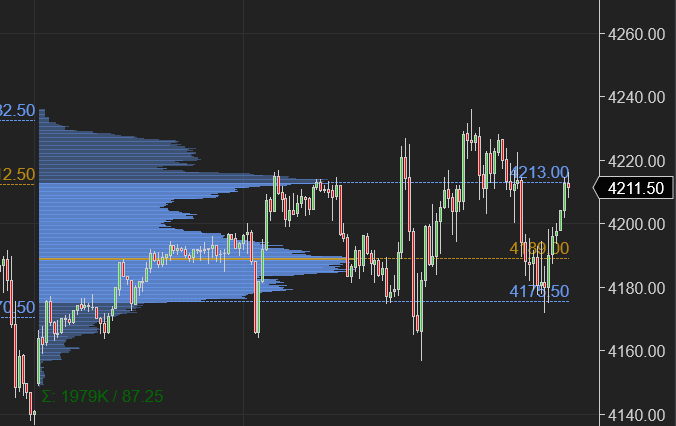

This chart here, I think this chart looks heavy. Y’all can see the battle at 4230 which the bulls tried but were not able to quite take it out.

Personally I am not yet in the camp that seems to think we may have bottomed in SPY. Yes, we are at the range low, I think we may be close to bottoming, but I do not think we are there yet.

I think that number could be 4000-4050. Now 4215. I think we could get there once these earnings are out of our way this week. Once we trade 4050, I think we can retrace up to the recent range highs at 4466-4500.

With this background and context, here are a few of my scenarios for tomorrow:

Unless we close above 4250, I think we may find sellers at 4250 to test what is out there at the ON Lows from tonight at 4150.

If we manage to open or bid above 4250, I think we could test what is out there at 4300 before finding sellers. Now 4215.

Tomorrow, there is significant earnings from AAPL and AMZN.

Let us first talk about AAPL. The issue as I see with AAPL tomorrow is two fold. I think regardless of the EPS and revenue numbers, AAPL will find it hard to reward those buying short term calls.

First off, I do not think the guidance will be stellar, even if there are stellar profits. Do note that AAPL did not give any guidance last quarter either due to covid uncertainties. Let us see if that changes this time. About 50% of AAPL vendors are based in Shanghai. So probably not.

Then consider the fact that traditionally, AAPL does not rally hard after earnings, even if the earnings are amazing. So I can rule out being buyer of AAPL here at these levels (closed at 159 today) in short term. I also think the call premiums will be simply obscene and I can get better prices if I waited a day after the ER.

Now that leaves me with 14X on the downside. I personally think this level if trades could be a good level for me to consider AAPL.

AAPL charts are actually not that bad. This gives credence to my 140-142 potential buy point for a trip back to 166-170.

Now regardless of the earnings, and may be even if Tim Cook pulls a magical rabbit out of his logistic and supply chain genius, I personally think if AAPL rallied after earnings, it will find sellers. I think the money is going to flow from these stocks like AAPL and GOOG into TSLA. TSLA is right now the only mega cap which I like for long haul. I am a little pessimist on AMZN, AAPL, GOOG, MSFT as well. If I had to hold one stock for the next 5 years out of these- it will be TSLA. Just my 2 cents.

Now I get this that AAPL has never missed earnings and that they have this much cash and what not. However the market never looks at the past and the market is right now looking at where the puck is going to be not where it has been.

Now as far as Amazon AMZN is concerned, I think the technical charts look weak to me. It is up above 2825 after hours though on back of strong FB numbers.

I do not like AMZN here at these levels and I think any rallies may get sold. I will be more keen on it if it were a bit lower around 2470-2500 may be.

These two earnings are major make or break for the S&P500. Are you bearish or bullish on AAPL and AMZN tomorrow?

To summarize, I think we are now close to a swing low in the S&P500 and that number may be 4000-4050. I think we get there after this week’s earnings and may start a swing move up from there to 4466-4500.

This is it from me for now. Be back with more later.

~ Tic Toc

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

Im an amateur and not particularly bright so bear with me and my confusion and would love discussion from anyone. Guidance on apple most likely wont be stellar but what about facebooks guidance was? /wasnt that one of their lowest revenues since IPO? Paypal as well took off AH but their guidance seemed...not good to say the least. Are they rallying because they are already much lower from their highs?

Tic - I am so frustrated! I don’t know what you mean half the time !!!!!! I read your emails and understand those but then get on Twitter and you say something different or criptic. What am I missing??