When it rains, it pours!

What did we share with folks this week in this Substack?

Bullish TSLA at 137.

Bearish META at 510.

Bullish META at 400.

Bullish MSFT 0.00%↑ at 390.

Bullish GOOG 0.00%↑ at 150.

SOUN 0.00%↑ 3.8 TO 4.3

Several support and resistance levels in Emini, SPY 0.00%↑

One thing I want to be crystal clear on. Actually 2 things.

I do not take any of my levels or ideas lightly. Whatever I share, wrong or right, is based on extreme research and thinking. When you subscribe, you are subscribing to the thought process, not necessarily a bunch of chart patterns which any one with a PC and internet can publish.

There are no guarantees in future that I will be able to continue to share. Ideas depend on market conditions. Conditions depend on volatility. This is a great ER season. Volatility is high. MM are making mistakes which allows for mega caps like TSLA, GOOG and META to have 15-20% moves in one session. This is why I always say - you need to stay focused throughout the year. You can’t turn on and off in ER season and then go dormant for rest of the year. 80% of market moves will happen in 20% of the time in a year. Know this. Convert your membership to annual plans. This not only saves you money, it also commits you for one year, even for the weeks and months like in June when there will be no market moves. These periods are best for learning.

Let us talk about learning now

This morning I shared a TSLA call option at 50 cents which then rallied as high at 6 dollars. Again, I do not believe in sharing content just for sake of it. Most of traders here are senior and experienced traders. They understand the value of setup. Good setups do not come every day, when they do, I share them.

Some new traders have asked me if there is a way to analyze options from a technical perspective.

There is.

Just like you can watch charts on stocks and futures, you can also watch and trade off charts in options.

Now different platforms do it differently but in this case, I am using Think or Swim which I think is the most important technical analysis platform. I only use Think or Swim for my analysis as it is not my main account, but rather for charts and information. Schwab has now bough it and that may ruin it, but we don’t know it yet. We will find out.

The method is fairly simple.

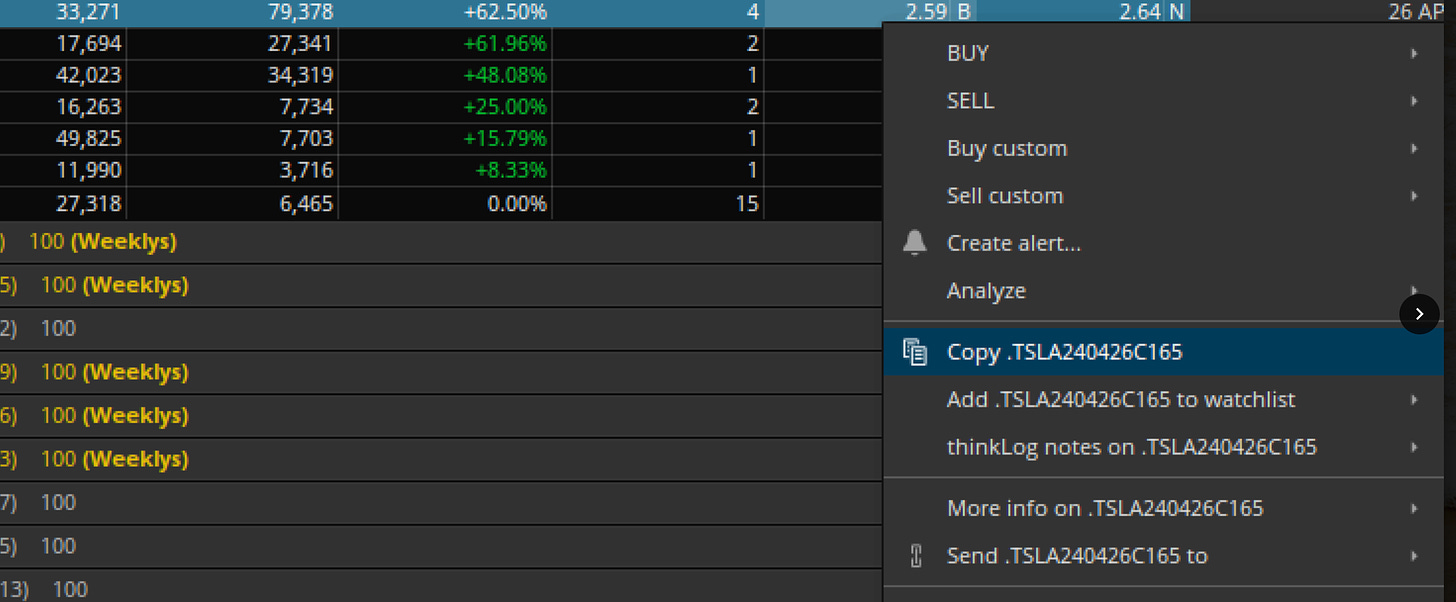

Step 1: You want to go to the Trade tab and key in the symbol. For example TSLA. This will bring the option chain up. Expand the option chain for the expiry you are interested in. Once you are here, you want to Right click on the strike you want to analyze. And then copy the option symbol as shown below in Image A.

Step 2: Once you copy it, then you want to go to the chart tab. In the symbol field, you want to paste this. Or do a Control V and press Enter. See image B below.

Step 3: This is it. Now you can go crazy analyzing this. The chart is real time. You can add volume to it, you can add any of the thousands of indicators to it. You can also trade directly from the chart. On Think or Swim you can also open time and sales and Level 2 (DOM) on the option.

Options are a very different animal than stocks and futures due to the greeks. In general, I steer clear of anything that has a very low Delta. A delta tells you how much the option will move, in relation to the unit move in the underlying. So a TSLA call with a 0.35 Delta means there will be a 0.35 point move in the option price, for every dollar move in the stock. What if your option has a 0.1 delta? If TSLA moves 1 dollar, your option will move up or down by 10 cents. Do you really want such an option even when the price may be very low? It is most likely going to expire worthless.

Hope this was helpful. If it did help, share with other traders. Let them know and let them also get better.

Levels for tomorrow

Core PCE tomorrow. Big release. I usually do not like to do a super formal plan for such PCE or CPI, NFP, FOMC days. But I do have some thoughts on price action.

Forecast is for the PCE to come in at 0.3%. I actually do not really think that this market cares much about a very hot PCE. The reason being, high interest rates do not affect the mega caps as they have cash and no to little debt. Even with a hot PCE, I think dips could be supported.

The issue I see is a weaker than expected PCE. Market will pay attention if we get a very soft PCE. This shows weakness in the economy- and that is going to hurt everyone whether you have debt or not. A very weak PCE number could lead to sell off and I do not want to fight it.

Key level for me tomorrow will be 5130-5155. This is from June emini. We are now 5130.

In general, cash open that then stays above 5155 is a positive sign and could build on gains.

A cash session that remains below 5130 is food for thought. In this instance, I could see us sell down to 5080-5090. I may share a chat update below. Make sure you have the app and notifications are ON.

~ TIC

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Jigsaw. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.