Traders-

Look at this level and call from the plan last night folks.

Now look at the overnight high and the intraday high today. Barely a few ticks above my level, before a 50 point sell off in the Emini index. This level of accuracy and preciseness is quite rare and I am happy to be able to share such levels with folks almost daily.

Now if you notice, when we opened the Globex session last night at 5, there was a very brisk rally. The rally continued up until this level and then stalled as if it hit a brick wall.

Levels for tomorrow

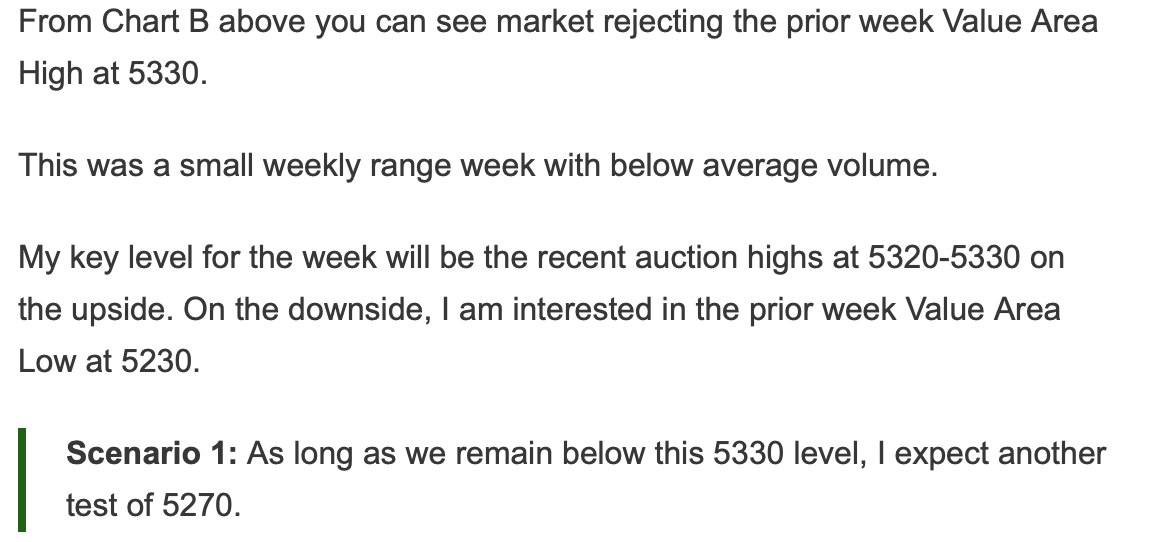

Today was a bank holiday for a lot of Central banks and as a result volume was a bit low.

Now this level I shared almost 2 weeks ago remains a key level for me. With volume coming in tomorrow, I am hoping we break out of this rut.

Scenario 1: If we are able to break 5270 and remain below it, I expect a test of 5230/5240s. I think we could see support come in at these levels for a retest of 5270. At time of this post we are last trading around 5295.

Scenario 2: This whole zone between 5270 to 5300 is a bit of gray area for me at the moment. I think if we remain between these 2 levels, we could see more balancing unless we break out and close above 5300 or break below and close under 5270. Refer to the weekly plan about significance of 5230 area.

~ tic

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of Ninja Trader, FinViz, Think or Swim, and/or Jigsaw. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.