Traders—

What a day! Last night majority of the folks I interacted with were bearish, so close to that 4360 order flow level. I was bullish at the close around 4390. Overnight the low of session was about 4390. My first target 4430 was achieved in first half of the RTH session. I am amazed by consistent ability of so many folks to get bulled up at major tops and become so gloomy at major lows.

Welcome to yet another Daily plan. Remember Friday is a holiday for the equities in the US and there wont be any trade plan tomorrow. AM I bullish here at the close now or I have now become bearish?

My stock $TSLA did very well today, rising again from that 980 level to about 1010. TSLA has a been a very good leading indicator for the QQQ and SPY of late. Today’s action reinforces my belief of support here near 4400.

TESLA IMO now needs to clear that 1064 level. Once it does, I think I will set my eyes on a test of 1200 again.

Few of my other FAV names like NEM made new highs again today. See if you believe FED is going to be very hawkish, you need Gold to sell off. Gold is now up another 80 dollars or so off my 1920, this does not seem to show a hawkish FED going forward. I think Gold is leading other stocks to rally as well as more and more people realize FED is trapped between hiking and recession. With a rally on TLT, we get a stamp of approval from the bonds etc as well.

My nuclear energy stock CCJ again made new highs today. CCJ seems to be strong.

I was surprised at the strength in ARKK today. While a day’s action does not change longer term trends in a zippy , a couple of back to back days like this today may infuse some life in Cathie’s flailing enterprise. Look at Chart A below. Is it beginning of a bottom process (technically)? I think so. Now about 61 dollars.

Lok at this commendable attempt by AMD to escape the jaws of 94 level and reclaim this 98/99 handle. This portends well for equities, if AMD were to take back 99, bid above 100 for a move back into 110. AMD is one stock I have liked a lot from 18 dollars or so in 2018, due to Lisa’s leadership. Very strong, no nonsense CEO.

Today may have been the very first signs that the speculative stocks which were in dump like ARKK may be coming back. I do not know why. May be it is the algos, may be it is some sort of seasonality or some large fund operating, however if this is true, then some of the names that have been working from last one year or so, may take a back seat in coming weeks and months. I will be closely watching next couple of sessions if ARKK and ARKK type fluff stocks get legs. As I said one or two days is not enough in overall scheme of things and warrants more due diligence.

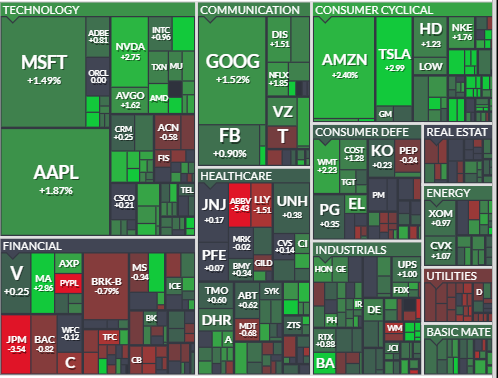

Broad breadth rally on NYSE today. Image C h/t Finviz

Putting this together for a few levels and thoughts for tomorrow:

I expect to see more build up on this day tomorrow with potentially push into next week as well.

My expectation from last couple of session has been that the dips may be bought. I believe we may want to test what is there at 4500 before next large move. This was covered in my weekly plan as well on Sunday where I thought dips may get bought into 4400. See my weekly plan below.

Folks should read all weekly plans as they lay the foundation of my longer term views. Daily plans are just more tactical around the weekly main theme. No plans should be missed to stay in loop for continuous auction.

Chart D EMini Daily

Chart D shows prior value has been regained. Dips have been bought.

Scenario 1: If we open or bid above 4425, I think we may target recent highs at 4466.

Scenario 2: If we open or offer below 4425, this may lead to a retest of 4400. I will be not overtly concerned as long as 4386 holds. However if 4386 folds, we may test 4360. Greater bearish action IMO will not be unleashed as long as 4360 stands IMO.

At time of this post emini last traded 4433.

JPM earnings sucked big time today. And stock gapped down into 126 as expected by me. Stock was then bid up into 129 however gave back its gains.

As long as 126 holds, I expect this to consolidate and make a move to test what is out there at 134. Chart E.

This is it from me for now. I may be bac on Sunday. Have a great long weekend. Share my POST and plans with other folks like your self, especially those who are interested in message of tape reading and naked price action.

Subscribe below to get 5-6 plans like this every week.

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

is your tweet about being bearish sarcastic? orrrr...

thank you Tic! Have a great Easter / He has Risen celebration this weekend 🙏