Folks-

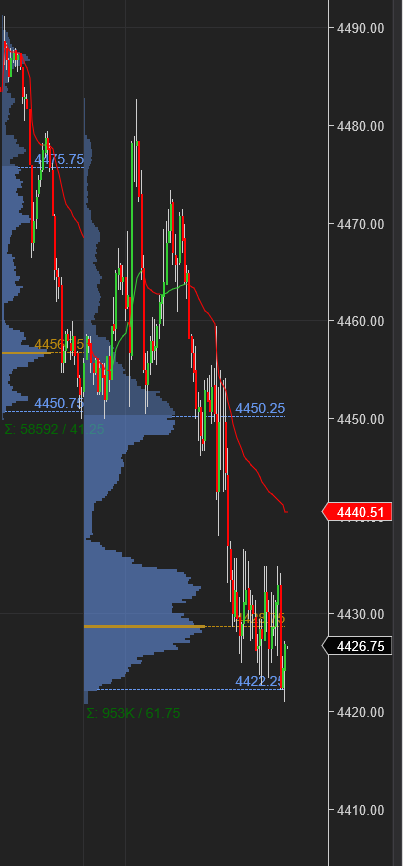

Yet again I was right in keeping bearish bias today per scenario 1 from yesterday as we opened below 4466 and kept the bearish pressure all day until I sent my tweets around 4424 that I did not see 4400 trade, atleast not today.

After that tweet, we did not quite take out 4420 and bounced around it a bit at time of this post.

Here is my plan from yesterday if you wish to check it. Weekly Plan.

Today is also the last day to get a 1 day trial to check out my post for free. Feel free to share this post with any one who may be interested in this weekly post. OFFER expires tonight.

Today was a pretty good breadth day where almost all sectors got clobbered.

This does not portend well for the days ahead IMO. With a key caveat which I will share briefly.

The implications of this day are major and they are not pretty. We are looking at a major major sell event if what I am about to say comes about. Now 4420.

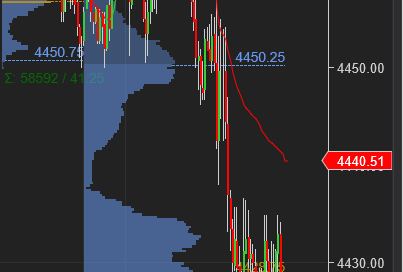

Chart A Intraday EMini below..

Tomorrow is the CPI day.

I think there may be some overhang and the market may have an impulse move due to this CPI.

However, I expect this impulse may be down into 4390-4403. But it may get bought IMHO.

The implications of this NOT being bought are enormous as I expect a large scale volatility event if it is not. Any D1/W1 close below 4403 IMO will probably OPEN the door to 4200.

Therefore keeping this in mind and looking at the technical context, I am now leaning little bullish for a retest of recent highs at 4560. Here are my levels:

Scenario 1: If we open or bid above 4403 in cash session tomorrow, I want to lean bullish for a retest of 4466 in intraday time frame,

Scenario 2: Open or offers below 4403 may lead to volatility and targets 4360.

Emini trades around 4420 at time of this post. 4560 is where the next steps may be decided. To get there we need to overcome 4466 and also watch out below that there is no close below 4403. Ideally I want to see NQ trade above 14238 early in day.

Little early plan as I need to head out at close.

Enjoy and stay safe! Share this plan if you would like to reach out to more traders like your self.

~ Tic Toc

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

Tic - Good to know that you are "Little bullish now". Are you bullish on Gold as well? Thanks!

Thanks for the early intel.