Folks,

Yet another day where Tic TOP indicator got pummeled at the OPEN and traded down to my weekly targets. We had gapped down Sunday and could barely fill that gap at the open before another wave of selling in expensive growth names took broader market down another 100 points.

Yesterday at Globex OPEN I sent multiple warnings about weakness in charts at 4284 and then again at 4271 on my Twitter. I thought NQ being where it was (13500), it ought to take out the recent lows at 13000 and would have taken S&P500 emini with it to 4200 where it was trading in the morning above 4271. Though personally still holding some of these names, I expected this pain and was not surprised at all with the sell as the charts looked really weak at OPEN yesterday night.

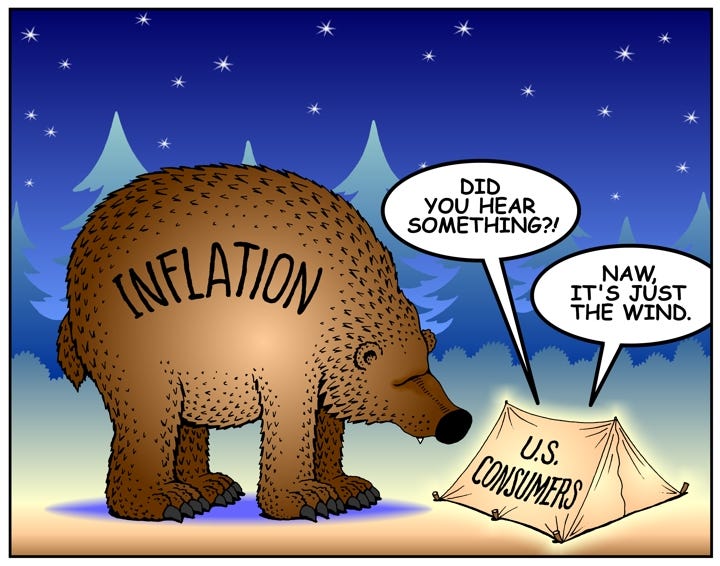

Looking ahead, this market is being driven far more by inflation jitters than any geopolitics at the moment. This is very reminiscent of oil at 150 dollars right before the 2008 crash.

A 150 dollar oil is simply unsustainable and will take the starch out of markets. You look at every single industry - or at-least what is left of it in the US- whether it is those FEDEX and AMZN trucks rolling down or the freight trains or transporters like JBHT, from every day consumer to many large corporations, these energy prices will significantly take a bite out of profits.

This is a FREE preview of my Plan. Subscribe to get 5 similar plans.

You combine this with record high inflation in wages to attract and keep talent, record high food prices, record high rent — all of this points to an economic downturn without much help from the FED and to make it worse, chronically high prices.

Not a pretty situation to be in. While sell off in some of the names like TSLA and FB - which were bloated before their recent downturn make sense given this context, I do not understand why some of the other names like GOOG, MSFT are also meeting the same fate - inflation or deflation, I do not see how it impacts GOOG much. However it is a victim of being part of the tech sector which is being punished indiscriminately at the moment.

While many of my names (shared in this newsletter) continue to do extremely well like NEM, LMT, VALE, some of these other tech names like PLTR, GOOG and AMZN, MSFT are taking on a heavy tone.

Technically some damage has been done to the recent structure today. Specifically, 4271 and then 4234/4251 has been a key Line in Sand (LIS) for me for many weeks now. At one point it looked 4234 will be able to hold the sell today - however it gave up after about an hour.

This is quite a bit of damage and will need to be addressed for bullish narrative to stay alive.

My foremost concern for S&P500 right now is not the war in Ukraine. It is not the hawkish or dovish FED. My # 1 worry right now is the price of gas. These are really extreme numbers. The previous all time high record for US gas was $4.10 .

This record will be broken tomorrow.

When ever energy goes this high, it impacts profits of every thing. Every single sector and industry will be hit. To make the matters worst, I do not see relief in sight. I think our political class is either really oblivious to all of this or they just do not care. May be their heart is not in this to solve it, may be they don’t feel same way about these issues. Regardless, this problem will get worse. And it means it will eat away more at the bottomline and savings of so many.

My Plan for tomorrow:

As alluded earlier, I think a key technical damage has occurred today. While I do think we will trade 4700 again, I think the bulls have a major fight at their hands. This is not a worry they had until last Friday.

That battle will be fought at 4234/4251. Today’s action was mostly driven by commodity price shock and not so much due to the geopolitics, the 4234/4251 still needs to be taken back. And needs to be taken back soon to avoid a rout where we give up 4100 and lose confidence in this market altogether.

If you look at XOM and CVX and oil and grains of the world, they are indeed at insane new highs. However when you look at them from a long term historic perspective, especially oil, these spikes tend to be short lived. Either thru supply or demand destruction, these prices fall and they fall spectacularly. Now will the fall come tomorrow or next month or next quarter, that all boils down to steps being taken today.

Now contrast this with the names like GOOG at 2500 and AMZN at 2700. These are tremendous growth companies where their best days still lie ahead of them, not in rearview. However, for now we are in free fall and logic and common sense unfortunately has taken a back seat to the more urgent issues at hand, like $5 gasoline.

Given this context, I have a couple of scenarios in my mind. As always all scenarios must be validated with Tic TOP indicator and TRIN/TICK. If you have not read about these, drop me a line below and I will share the relevant posts.

OPEN or BIDS above 4234/4251: this may be a bullish scenario which targets recent orderflow pivots at 4271. A D1 close above 4271 then opens the door to 4425 on weekly time frame.

On the flip side, I think as long as we remain below 4234, there may be a tendency to test lower levels at 4165. A break of 4165 in RTH may target 4100. A break in GLOBEX session may be invalidated in morning.

Emini S&P500 last traded 4189.

XLF:

Financial stock armageddon which I called when these sanctions first hit continues. Not only are the usual suspects like PYPL and SQ are selling off , this wave has spread to decent names like V and AXP, BAC.

I think there is some room to run (2-4%).

V traded 192 last. BAC was trading around 39 bucks last. BAC has decent support at 35/36. I think AXP and V also near good support at 180.

Taiwan:

True or not, rumors have caught up with TSM. I think TSM which is now trading about 100 dollars may get sold on any rips with LIS around 110/111.

I think stock could trade sub 90 to decide its next move there.

BAD stocks sink:

While good stocks have trouble staying afloat, the bad ones stink and sink. One such name is Peloton PTON. This stock had a lot of drama last month when they created this M&A rumor and trapped so many retails buying this dud at 37 ! I sent several warnings at that time that there won’t be any M&A at least not at those prints and my target of 22/23 was met. I do think at 23 , PTON is a bit expensive and could be lower at 16/17 zone.

My take on today’s action:

Rough day. But I think the bullish case for 4500-4700 is not yet dead. Positive for me was that the selloff was due to excessive price shock at the pump and not escalating war drums.

Bulls have more work to do this week than they had last week. They need to take back 4234/4251.

Until this happens, there is risk for a test of 4100/4165.

Will be back with more.

Further reading: Weekly Plan and 4271

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user, they own all copyrights to their products.

Great read as always tic you have taught me not to get slaughtered in this market. Just wondering whats the super follow about and how do we join. 😊🙏

Hi Tic..hope all is well, would you give any realtime updates on twitter super follow