Hey guys -

The primary expectation today was to see sellers emerge at 4015-4040 area for a push down into 3960s. We actually opened quite near 4015 today as we rallied from overnight open and within first half an hour or so traded up to 4015. It is here that I did not see selling pressure at 4015 and instead thought we could trade 4040 first.

I sent the below Substack note out close to 4000.

Lo and behold we rallied into 4040 within next hour or so. 4040 was also the longer term LIS for me that the bulls needed to overcome. This was indeed a tall order for the bulls today and we started selling off quite aggressively after that, at one point we sold down all the way into 3950 before finding some support to close the session near 3980.

Overall, a good tradeable day on both sides of the ledger.

See below instructions on how to install the chat room. The chat room is free for all subscribers. This is a proprietary chat solution offered by Substack and I do not control any technical aspects of it. I just post. If you have any questions, please reach out to them.

Several of my recent calls shared here in the Stack came to fruition today.

In particular:

We saw a large rally in Gold and GLD. Gold closed above 2000.

We saw major action in Chinese names like BABA and PDD.

Good rallies in INTC.

Before we proceed to the levels for tomorrow, I want to share my personal opinion if the S&P500 market has bottomed here near 3900.

My view is not in context of technical analysis but rather in cognizance of what has been the recent driver of the growth in stock market.

Chart A above shows the performance for last 10 years of the top 100 S&P500 stocks with highest ratio of stock buybacks. This index almost tripled in over 10 years fueled by very easy monetary policy of near zero interest rates and regular bouts of stimulus.

Since the FED reserve was founded over a 100 years ago, the bank has seen 16 Chairs. Powell is now the 16th incarnation of this powerful position in the American economic juggernaut.

Since 2008 bank crisis, the US Central Bank has had 3 chairs - Ben Bernanke, Janet Yellen and now Jerome Powell.

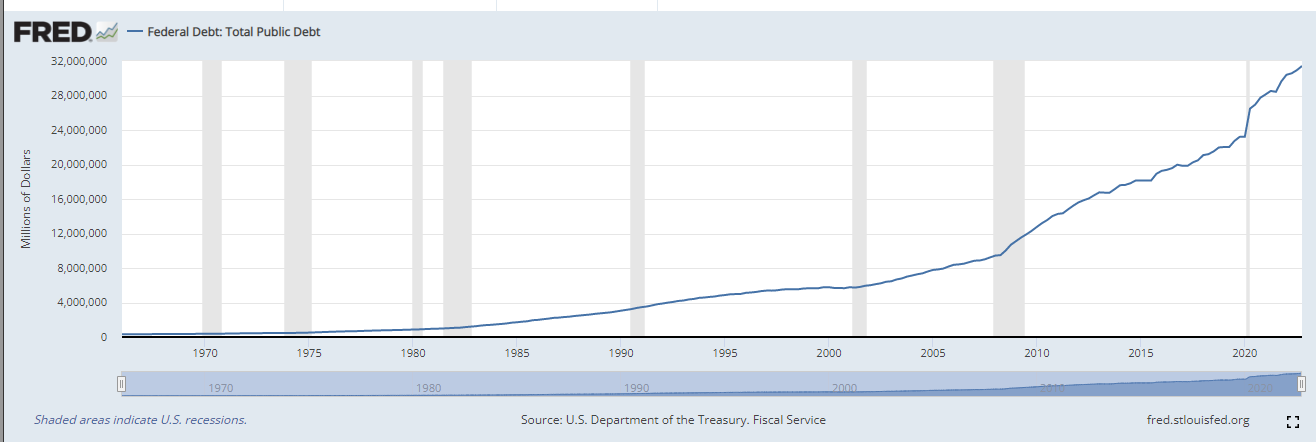

It took the US 100 years to reach to 9 trillion dollars in debt before Bernanke. Since 2008, the US debt has tripled to over 30 trillion dollars within a short span of 15 or so years. See Chart B below.

Why do I bring this up now? Because it may have some clues to where we are headed next.

There are 2 things which are on my mind when it comes to this debt dynamic-