Traders-

A lackluster day for the active trader in me, the morning for most part was a dud with a slow but steady grind lower.

As we approached 4450 orderflow pivot, I saw some action, at one time came pretty close to take out the 4500 level again but faltered. This was pretty much in line with what I expected yesterday at 4510, minus the fact that a) we could not take out 4450 all throughout the cash session b) it was a low volume churn.

Some of the other names did well too, for instance yesterday I noted my Line in Sand (LIS) for Tesla TSLA at $980.

This turned out to be a good level as the market tested this in morning and then did not look back, at one point trading as high as 1040. The Chinese names also did ok. For instance, BABA stock had another nice run today!

Looking ahead, things get a bit murkier from a point of view of calling next 200 + points clearly.

Look I want to be in a position to be able to make the calls like I did at 4100 last week or 4800 earlier in the year every day! These are the hero calls and usually have a good risk to reward ratio that the upside can be as huge as 300-400 points while the downside can be fairly tight, in many cases less than a 100 points.

However when we approach levels like 4500, things are not as straightforward for any kind of longer term prognosis. Look you have folks on the FinTwit probably already calling for end of the world after the action in markets today. And I don’t blame them.

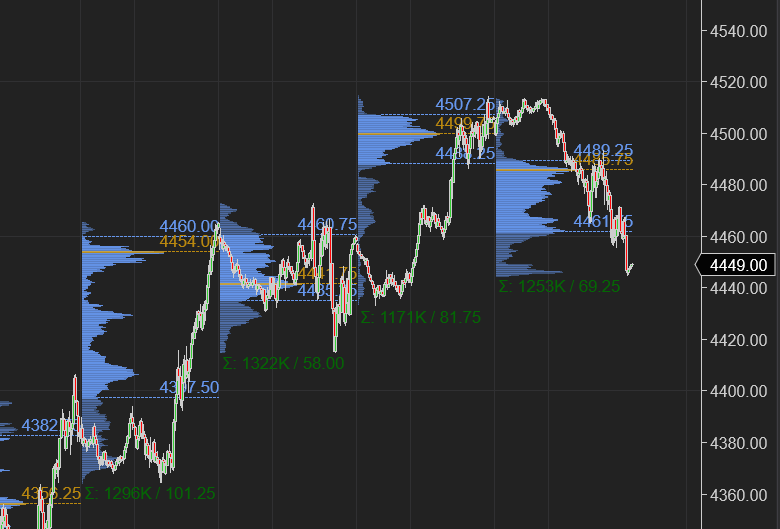

Let us look at a SPY Chart.

Chart A below.

How cool is this chart!

It is in-fact so nice that it is pretty obvious what it is! This is screaming top, triple top, heads and shoulders etc.

A) We have a clean rejection at range high of 450.

B) This used to be an old support that became resistance and that resistance has held.

C) For the technicians this is a dream come true: Triple Top, double TOP. .. in other words this is soo obvious.

And this is what makes it so tricky and difficult for me personally.

At times likes these I like to ask the question, which trade is harder here? Is the sell a harder trade or a buy a harder trade? And I think that answer is obvious. This will be a far easier answer if we were just looking at it from a lens of charts and technicals however since the orderflow looks at many other things, this is not so clear to me yet!

I dont want to dismiss this just because of the technicals or just because of sentiment, but even looking at the tape and the orderflow, I would have to try very hard to find reasons to support this rejection here.

To support the case for 4600 here, I think we can all agree we need a break out of this 4500 key orderflow resistance which also happens to be the range high of 4200-4500.

To support the case for a bigger sell here, I need to answer the sentiment question which I think is predominantly bearish again.

So as always in times like these, I do what works for me, which is not do any thing with longer term ideas which I have the most conviction in , like TSLA and GOOG for instance.

When it comes to shorter term intra day time frames, I will continue to use my levels as well as methodology using the TRIN/TICK, Tic TOP etc. I do NOT have enough visibility into making very high confidence calls right now at this point like “4200 is next or even a 4700 could be next”. Though I would love to.

If anything, I will think the line of least resistance is probably still up, with some caveats in next section around 4450, 4425 etc.

Clarity for me may come after another couple of sessions as the orderflow today was not sufficient. I am hoping by Friday we get a clear sense of the direction rather than staying stuck in these balances.

Looking at the orderflow profile chart B, I think the market still may be balancing before making the next big move, up or down (probably up).

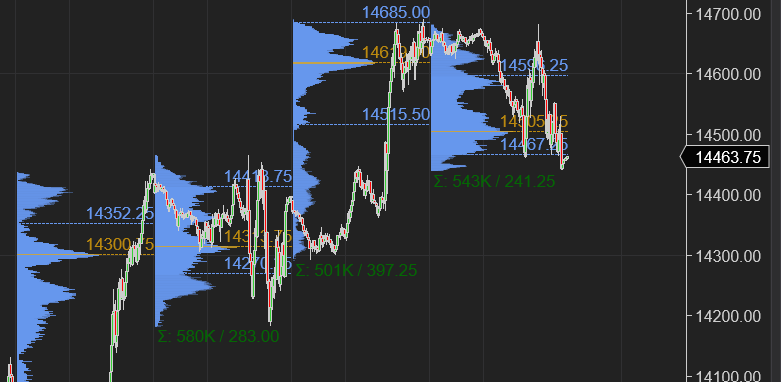

Orderflow Chart C for NQ, shows a stubby profile in which both NQ and Emini shed some fluff from yesterday’s P profile shape which is often an indicator of patient sellers (but not always)..

NQ shows while we remained soft today, the key orderflow level at 14238 was not violated. At least not today.

Some thoughts and levels for tomorrow’s session:

Based on my review of the charts above, context, orderflow and other factors, my key levels for tomorrow will be 4425 and 4450.

Scenario 1: An OPEN or Bidding above 4450 targets recent highs at 4500 and may try to break out of it.

Scenario 2: If we open below 4450 but above 4425, dips into 4425 may be bought for a test of 4500.

Scenario 3: A tertiary scenario for me will be a break of 4425 or an open below 4425 which targets the orderflow level of 4361 for me.

At time of this post, Emini S&P500 last traded 4447.

To summarize:

Though we are at the top of my range high which I shared weeks ago at 4200-4500 , at this moment owing to the fact I have had limited opportunity to monitor the orderflow, my confidence in downside is little shaky. I do think the line of least resistance is up.

Dips, if any, I think may get bought.

I have myself wanted to take some fluff out of S&P500 at 4500 and today’s action may be a step in that direction rather than start of something more serious on downside.

I will validate any levels and scenarios with indicators shared by me earlier like the TRIN, TICK, TT etc. Updates , if any to this plan will be shared in my Telegram AND Twitter.

If you have not already, read the plan from yesterday to be in the know of continuous auction: Daily Plan 3/23

What else will I be watching

TSLA

TSLA, ENPH and PSTG have seen constructive action and the continue to build on that momentum. ENPH shared earlier at 140 is now at 190, PSTG which I have been bullish on since 30 is now slightly shy of 35. So I want to keep an eye on these as I think these may have more room to run despite TSLA losing most of it’s gains today and closing near below 1000. TSLA 1064 level is make or break and a key orderflow level.

Bitcoin

Bitcoin I became bullish on it around 37K a few weeks ago which was a very good level. I then raised my LIS to 40500 which again was holding quite well. Now it is trading around 42500 and I think as long as that LIS holds, may make a move on 45000.

The associated crypto stocks like RIOT are at an important resistance IMO and with a little help from Bitcoin may be able to over come it. Riot is now around 21 and next resistance does not come in till 24/25.

These names are quite sensitive to the overall market, so I think S&P500 4425 matters to them a lot as well.

This is it from me for now. What are your thoughts on the S&P500 market here. Are you bearish or bullish now?

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

Thanks Tic

Not expecting any large moves the remainder of the week.

Thanks Tic! I think we kill theta.