Folks-

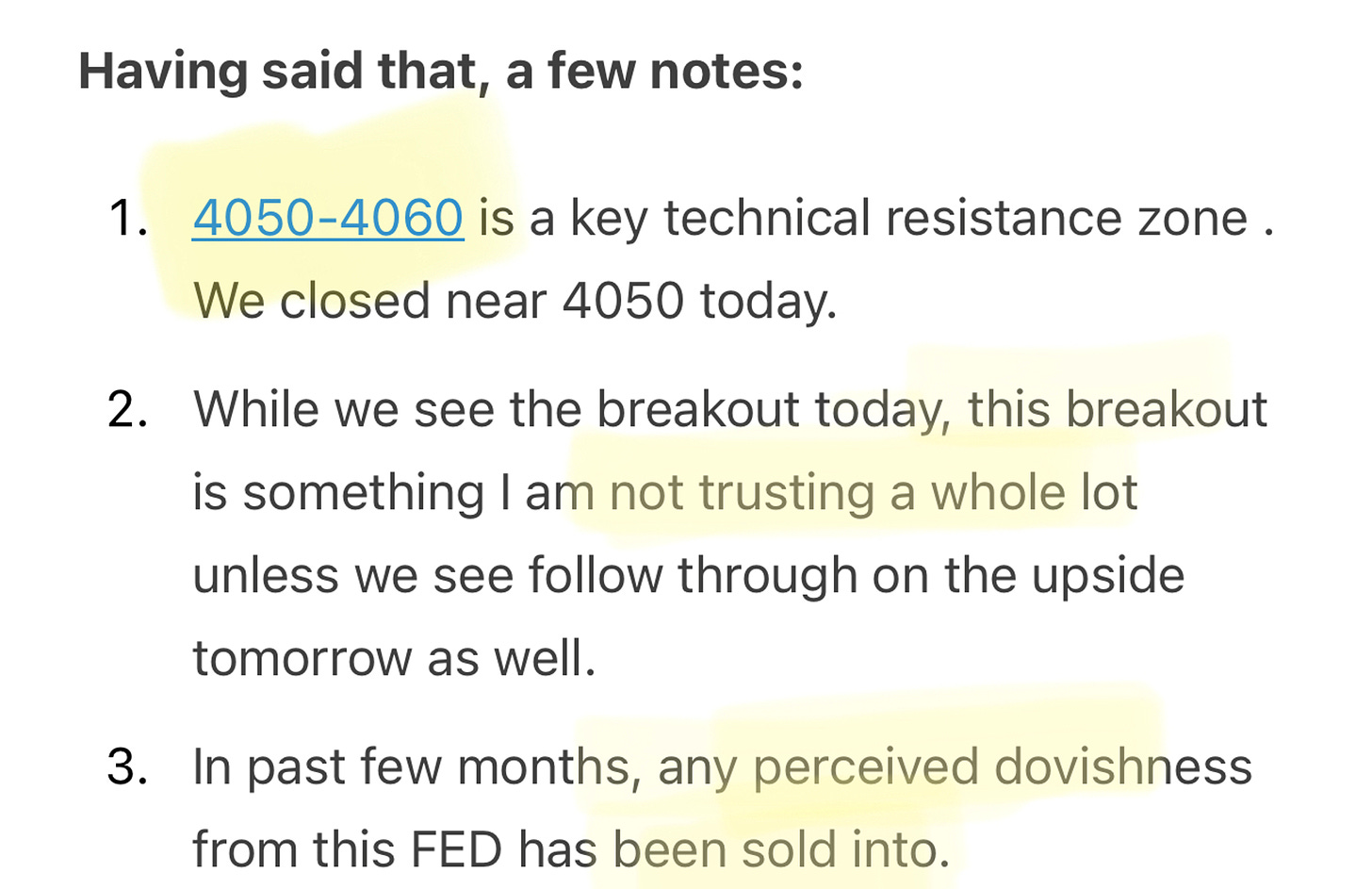

While I did not have a super formal plan from last night, I had expected resistance to come in at 4060 area and this breakout to fumble. See below.

This level was the high of the day before a 100+ dollar sell off later after Powell remarks.

Not only was this almost the high of the day (HOD), as soon as the FED minutes came out, I sent the below update on my Twitter sharing my worry that this was not a dovish, but a hawkish statement. See below.

The events today highlight the fact that techncials alone can be dicey unless supported by the macro, fundamentals and OrderFlow.

Understandably, a lot of participants were super bullish today, many even calling for a FED pause. I was not one of them (thank god! ) and I had expected a 25 BPS rate hike today, which we ultimately got. I am being cognizant of this that a lot of folks got caught wrong footed. On my part, to help with this I am offering below one time discount, valid only today. This is to promote awareness about OrderFlow , a world without technical indicators. If you know some one who will be interested, feel free to share the newsletter.

Note that all my levels are based on Emini S&P500 and can be easily converted to other derivatives like SPX.

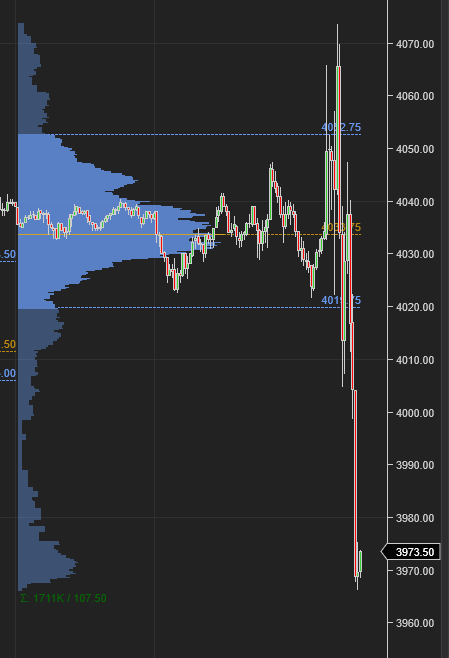

Chart A shows that the price has moved lower but the value has not. More on this later.

My take on the FED

As stated earlier, I expected a 25 BPS which was initially construed as bullish before selling off later in the day. This was a very balanced and common sense statement by Chairman Powell. He has said that they may tighten if needed and removed language around ongoing rate hikes.

His reasons? He states that if the bank crisis leads to tighter lending standards, it will have the effect of throttling down the real economy and credit , which means that will take care of FED goals. I do not necessarily agree with this but the intended message was taken well by these markets.

What really spooked every one was two things : a) a majority had been counting on a rate cut this year , which I have vehemently said will not happen this year. Powell today poured cold water on those rate cut bets in no uncertain terms. b) The FED governors have actually raised the terminal rate projections next year by about a quarter of a percentage. This really took the starch out of the market.

My personal take? I agree with Powell that the bank lending will tighten a lot. It already is getting hard to get a loan on favorable terms. I covered this in my weekly plan below. Click the link if you have not already read it yet. Where I disagree is that I think there will now not be any more rate hikes by this bank. FED is done hiking and may begin cutting. I think the conditions could deteriorate quite a bit in next 4-6 weeks which may mean we do not see any more rate hikes and the FED funds rate top out here at 5% in my opinion (IMO).

What else worked today?

A few of recent names shared here did very well:

MSFT rally from 270 to 280

Gold strong rally into 1980 again

Oil rally above $71 from $65.

We also saw about a 1000 dollar sell off in Bitcoin off OrderFlow levels which timed well with the stability in smaller regional banking mess.

My levels for tomorrow

My key level tomorrow will be 4015/4020.

Scenario 1: If this level is visited, it could act as resistance for a move back down towards 3960s.

Scenario 2: An IB close below 3960 could indicate bearish continuation into 3911-3920.

Any updates to this plan may be shared via the chat room below. Install the app and make sure you turn on the notifications.

We last traded 3970 at time of this blog post.

IB is the first hour of trading when NYSE opens at 930 AM EST.

Read my post below from last night to know my thoughts here longer term about new range formation. I do think the bulls have it harder for them to sneak up as long as we remain perched below this whole 4020-4050 area here. In general this is a key area and the bears have so far done a great job here.

The effects of such tightening begins to be felt a year or so into the tightening cycle and we are now only beginning to see it take hold. For a market to bottom, we need to see a fairly panicked FED. In some cases it can be 4-6 months after FED cuts rates for the first time that we begin to see market start a bottoming process. Are we there yet? This I think remains a fairly confident FED.

What else I will be watching

I think higher for longer rates , with the Chairman refusing to cut rates this year at all will make it harder for heavily indebted companies to refinance debt.

When you look at names like CVNA, I do not see how the business model they have can survive given the triple whammy that is about to hit them.

It is about 9 dollars now but I think it may remain under pressure to test sub 5 with LIS near $10.

I will place CCL also in the same boat. I was a bull earlier on this but now near 9, I think they have a lot of headwinds.

This is it from me for now.

Have an amazing session, folks. Share this post if you like my posts and help grow the OrderFlow

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.