Daily Plan 3/2/23

Hello folks -

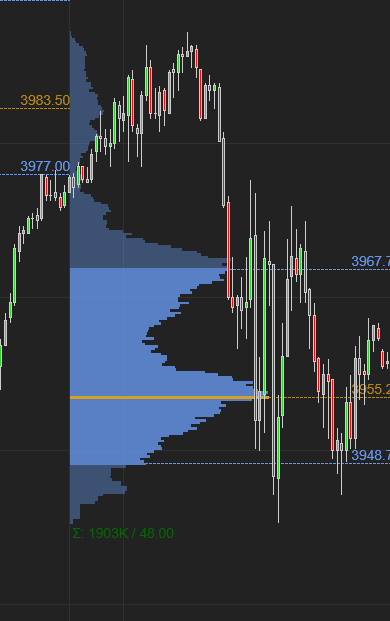

Slow, choppy, about 30 point day today. Somewhat frustrating to trade but contained well within the ranges.

I had shared 2 levels yesterday - both the levels were the High of the Day and Low of the day respectively.

This comes on heels on my levels yesterday which were the High of the day and Low of the Day respectively.

These are Substack exclusive levels - no where have I personally seen such levels able to contain the market on both ends, whether it is a slow or a fast auction. Check the plans from earlier if you don’t believe me ;)

Feel free to share this once a week free post or Subscribe below if you have not already.

If you look at some of the related markets, the tone has been decidedly bullish - whether that is Gold, Euro, Bonds, or even Oil.

However, that enthusiasm has not yet rubbed on the S&P500. This could be due to a variety of reasons but S&P500 generally has been choppy to trade all this year.

To zoom out slightly longer term from day to day levels, I was a bear at 4200 before this 250 point or so sell off. This week 3950 area has been a key level for me and I have called out further bearish raids only if we begin seeing Daily closes below this zone. Mid of the week now almost and so far this has eluded me.

What do we see on the NQ side? Is the picture any different?

Nope. Same balancing that we see in the S&P500.

This is where the levels come in handy - instead of making predictions based on feelings, I can react based on something objective to lean on. There has been a lot of doom and gloom and there has been many a fairytale in last week or two but the fact is both sides have been disappointed as this market remains in a tight range.

I really do not see any resolution to this unless this range breaks.

My key level for tomorrow will be 3950. At time of this post we last traded around 3960.

Scenario 1: A loss of 3950 within the IB with no close above 3950 in the IB will be bearish for me and I think we can trade 3880-3900 in that case.

Scenario 2: The bulls did a good job today defending the LIS from last night, they will have to protect 3950 and avoid IB closure below 3950 to target 4000. In this instance, I think if we open at or above 3970, this level could be supported for continuation into 4000.

There is no major news on the US side but the Eurozone CPI will be important. If the CPI comes in cooler than anticipated, initial impulse may be EURUSD sold off but could be supported after the news event. Elsewhere, the Chinese PMI hints at strong China demand and is supportive of risk-on sentiment.

IB is the first hour of trading when the NYSE opens.

Slightly longer term, I think a) the bears have to break 3950 tomorrow else we could float back up to 4030 area. b) A close then above 4030 could open the doors to 4100.

~ Tic Toc

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.