Folks -

Was a slow day today for most part except that rally in last couple of hours at time of this post. Per that plan from last night, we opened above 4000 with VIX below 23, at one point trading down below 22.

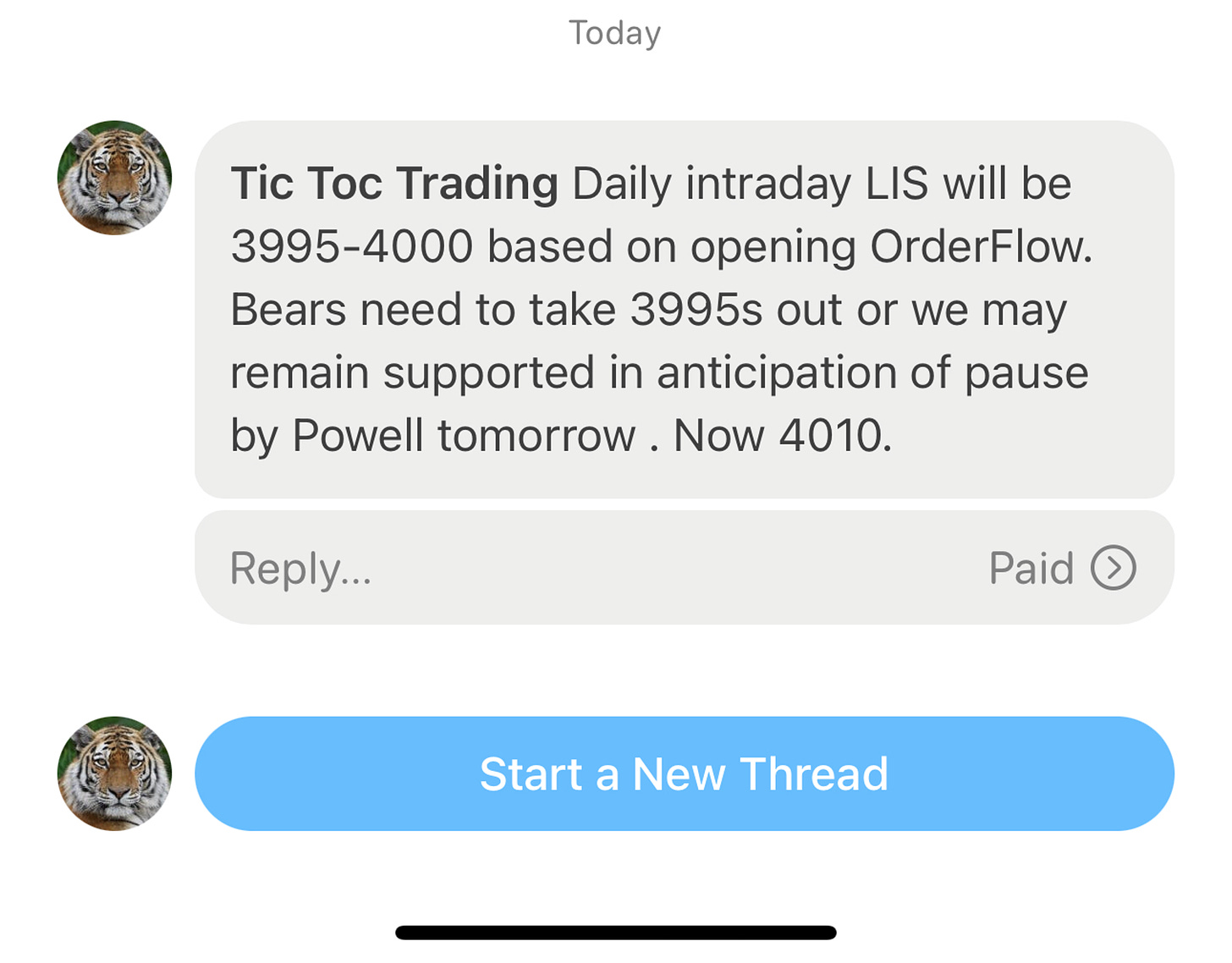

It is here around 4000, I sent my Substack chat update where I saw support come in at 4000. This was in fact a good support level and we rallied from here to 4040 (at time of this post for a total of about 40 dollars). These chats & levels are exclusive for all Substack subscribers and are included at no extra cost at this time, but you must be on the app and turn on the notifications for these chats. What do you think about this format of delivery? 4000 today and that 3960 from yesterday - with very little activity below these OrderFlow levels. Similar updates from chat rooms cost hundreds of dollars every week, shared here for a fraction of cost (about a dollar a day).

Not only was this a good level, we also saw some great moves from the weekly plan names, like KRE, regional banking index.

I do think the regional banking turmoil is behind us but the larger bank question still looms. The issue with these bigger, too big to fail banks is that of leverage. When 2008 GFC happened, some of these banks had as much as 300 to 1 leverage. This was cut down after a taxpayer funded bailout, and in some cases now sits at 30 to 40 to the dollar. While this is significantly lower from 2008 levels, it is still very high. How many of us have that kind of leverage on any one idea?

So I think these banks will come under more scrutiny from the lawmakers - some of these banks are more prone to these risks than others. The latest shoe that dropped was Credit Suisse. One of the largest European banks.

The Swiss government changed the laws overnight to allow for Credit Suisse to be sold to it’s bigger rival UBS, creating a behemoth with about 5 trillion dollars in assets.

This would normally have been ok, except that the way this was executed reeks of desperation. Many smaller investors got burned too. Normally when a company like this is sold off, the bond holders are often protected while the common shareholders lose. In this case, it was the opposite. Credit Suisse offered these contingent bonds called Additional Tier 1 (AT1 in short) which offer higher yields but often are riskier. Not only these bonds had takers in sovereigns like Saudi Arabs, but several smaller individual investors in Asia and beyond. These investors all got burned holding these bonds which at one point were trading 1 cent to the dollar before going to 0.

These episodes at end of the day show to me that this is desperation, this is driven by panic and will longer term shape the perception of these markets as negatively - would you want to continue to do business with any entity that changes it’s laws at whims?

FED dilemma

So with the FOMC tomorrow, there is about a 70% chance of a 25 BPS hike and about a 30% chance of no rate hike (a pause). This is up slightly from last week.