Folks-

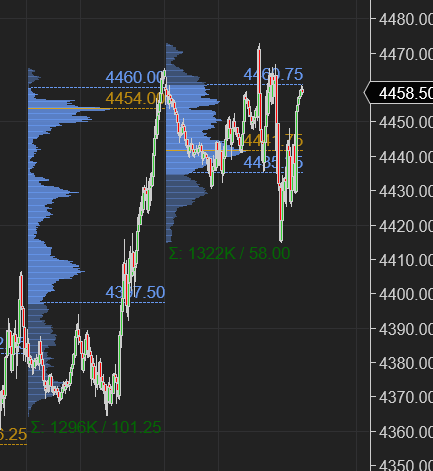

Fairly expected start to the week as dips into 4425 were bought and a little bit of fluff from Emini S&P500 taken out. Textbook balance day as shown in Chart A below.

I have attached a link to the Weekly Plan from yesterday for new readers: My Weekly Thoughts

As far as today, I did not expect much fireworks. I did think bears had their work cut out to take out at 4425 if they intend to sell lower into 4300. They failed miserably at it.

On the upside, levels from Friday were in play and for most part capped the rally. High of the day was 4474.

Few of my other ideas from yesterday also had very good performance today.

These were:

OXY which at one point rose as much as 8% from Friday close. I shared this amongst Crude oil in my weekly newsletter. Oil had another huge day today but it meant pain for the airline stocks which shed a lot .

I was also quite bullish on TSLA at Friday close around 900 which did not disappoint today.

I was not too impressed with FB and PYPL and thought they ought to find some resistance at 216 which turned out to be very close to high of the day before selling off below 210.

Few of my older names like VALE, ADM , LMT were also quire remarkable today.

Potash had a massive day jumping about 20% today to close at 84. I think this may have some more juice left.

With a jump in the ten year yields, the home builder stocks took a tumble. XHB the homebuilder index has been stuck in a tight range for a while between 66/72.

Every week I post about 5 similar newsletters as well as orderflow education for my Substack subscribers. Subscribe below to get an email from me the moment it is published.

I expected Powell to come in a little more hawkish than he was last week and this is what he ended up doing with support for hikes greater than 25BPS during his testimony today.

He will be back on Wednesday so I expect short term volatility when he speaks again. Other than this there was no major news event to cause any major moves in S&P500. Oil remains well bid. Geopolitics continues to be tragic and unpredictable. Inflation sees no sign of abatement. So a lot of this I believe is priced in at the moment.

Technically, there was not much to write home about as the market ranged and balanced in a narrow zone. Relatively speaking.

I think as we go though rest of the week, this whole zone of 4425-4474 becomes quite important. For tomorrow, my LIS is 4450 for the cash session.

Here are few thoughts:

I think as long we open and/or remain offered below the LIS, we will see some pressure on emini for a test of 4425. A break of this opens door to lower levels at 4300.

If we open or bid above 4450 then I think we may try and test 4500.

At time of this post, Emini S&P500 last traded 4454.

I think the main issue with Emini S&P500 here is technical as we are so close to the range top of 4200-4500. If Emini can hold out 4425 another day, that I think will be an impressive feat. But given current context and technicals, that level may come under some pressure.

I actually also don’t like how weak $EURUSD has been. I think this remains a mystery to me and for equity to hold, EURUSD needs to do better.

On a side note, here is a chart of MULN. This seems to be getting all the press now a days in liquidity starved penny stock world. This is a 100 million dollar cap stock, so yet very much a penny stock.

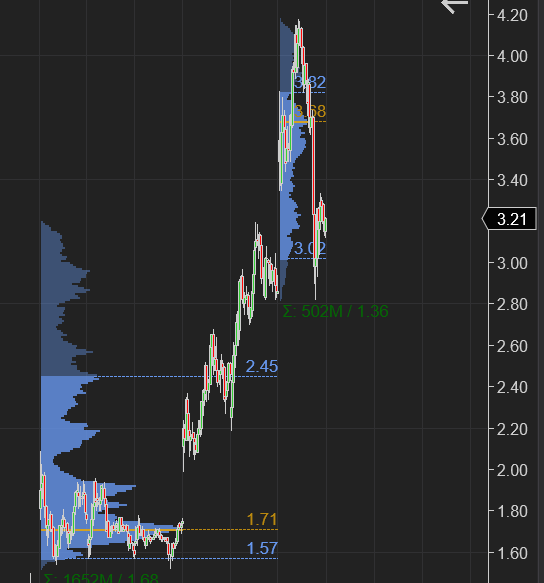

Bitcoin which I have my LIS now at 40500 keeps flirting with this line. I think once/if it breaks 40500, it gets to test that 32000/33000 area to determine its next steps.

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

Your 4425 level today was killer!

Thank you Tic! What’s your take on cyber security stocks?