Daily Plan 3/16/23

Folks-

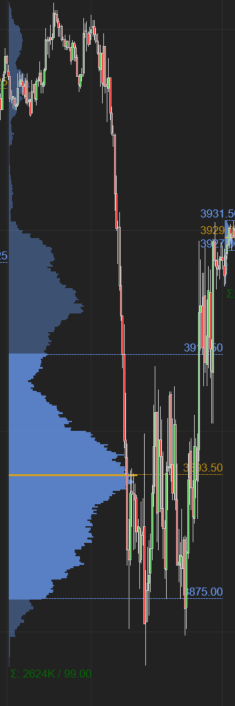

This was a picture perfect day for the levels with an expectation that this could be a range bound day with key levels at 3870 AND 3970.

The range was perfect in the sense that it contained both the low of the day (LOD) and the high of the day (HOD)= not only for the overnight (Globex) session but the cash session (RTH) as well.

Contrast these levels with some one who is coming to the session unprepared with no idea of what the key levels are – with so much bearish bias online right now, it is easy to get caught in that so close to 3870. Or get bullish in a range bound market at the range high. At end of the day, the reality was we sold down from 3970 into 3870 and then rallied from 3870, back into 3930 .

Some of the range bound action in S&P500 has been aided by the underlying auction in VIX itself – which has held the below levels for over 2 days now. The chat is free for all subscribers but you must turn the notifications on to receive these.

My levels for tomorrow

The main rationale for my levels for tomorrow is the fact that the VIX did find some decent support today despite the late rally in S&P500.

I personally think if VIX continues to hold this 26-27 range, it may pose headwinds for S&P500. It is now trading near 26.

My key level for tomorrow will be 3930. At time of this post we last traded 3930.

From key events, tomorrow we have the ECB rate decision as well as the ECB conference, a few minutes before the US open.

Scenario 1: As long as we open and remain offered below 3930, we could see a test of 3870.

Scenario 2: A break of 3870 could target 3830.

In particular, I think there is interesting OrderFlow near 3870. I think if this level is revisited tomorrow, it could break.

This is an intermediate term balancing auction and we could still see a failed break attempt in this auction only to close back within the balance area- this I think could be a stronger bullish signal for me personally if this happens in next week or so. See my weekly plan below for my thoughts on auction near 3800s. As anticipated by me over Sunday afternoon, these dips have been supported on balance but so far the resistance also has held.

On the oil side, the $70 level has finally broken. I think Oil has natural tailwinds, however, the market right now is very technically driven.

I see personally oil remain under some pressure below 70 but could be supported near 63-65. I think Oil will do well if/when it takes back 70 handle. It is trading near 68 right now (WTI).

This is it from me for now, have a great day.

~ Tic

For definitions of IB, Value Area High, Value Area lows etc, see the below posts.

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.