Hey traders-

Yet another day when the market chugs along to the upside with various analysts now calling for start of a new bull market in the Nasdaq and the S&P500. The market is up about 17% Year to Date and I think that calls for a new bull market depending on who you ask.

Tonight I will share my opinion on if there is more pain ahead for the bears.

With the auction today, some of the names shared by me earlier in the year have risen quite a bit and in many cases outperformed the general market.

A few to name:

RBLX up from about 28 to 40.

META up from 120 to almost 200.

SQ from 60 to about 90.

CCL from about 7 to 12.

PLTR from about 6 to 9.

The full list can be seen here below. I am not sharing the list here as some of them still could have juice left and this list was for the premium users.

Speaking of the premium users, I have been testing a 2-5 day short term options strategy which will be shared with Substack users for no cost. This would have let me spot the short term moves in names like LCID and TEAM to name a few. It is not fully baked yet in terms of presentation and delivery but stay tuned for more. Subscribe below to receive these in your inbox!

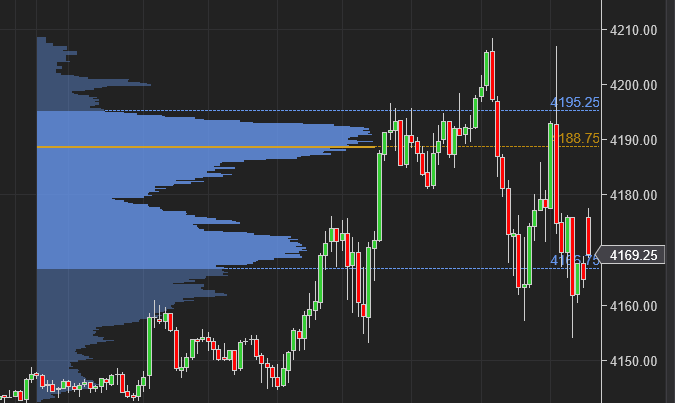

From my short term levels from last night’s plan, we saw good 2 way intraday action at 4170 and 4200 today. Though I have expected resistance to come in for the longer term auctions between 4060 and 4200, any sell off has not had traction - it does not stick for long and my call has taken some heat.

There are very specific reasons I am not yet in the new all time high camp yet which I shared last night.

So why is the sell off not sticking and we keep rallying?

While at end of the day, the price action is the ultimate truth and there are no post mortems in trading, I do have some theories-

There is just a lot of cash on the sidelines. There is about 5 trillion dollars on the sideline. I am myself guilty as charged of having money in the brokerage waiting for lower prices. Some of this money is chasing this market here (not mine!) adding fuel to this rally.

Market correctly calculates that the worst of FED hawkishness is past us.

From my perspective, it does not matter if the FED is hawkish any longer or not- I do think the current 4-5% interest rates globally will lead to profit erosion for a lot of these mega caps in coming few quarters and those PE ratios still look high for me.

There is also a question of with so less unemployment, there is little appetite for any further easing by the Central banks. Shrining corporate profits and shrinking FED balance sheet is not very appealing for the risk on appetite in my view.

At end of the day every one has different goals and I respect that. My own goal is to buy long term assets like SCHD, VTI, AAPL of the world at lower prices. If we get there it is fine. If we do not get there, I am quite happy with the yields I am getting on my cash - this is my personal situation. I am not the one to question any one else’s goals and objectives what they want to do with their own money. However, I will continue to share my own personal views and how I see these auctions across a multiple markets with folks in form of this personal blog.

Is there more pain for the bears?

If the auction were to close tomorrow at these levels, below 4170, I think we have seen the highs of this counter trend rally.

At time of this blog, we last traded around4170.

My key level for tomorrow will be 4170.

As a bear I want to see that Weekly close here below 4170 tomorrow. I think if we do, I have good confidence that we could resume downtrend again.

If however we close above 4170 tomorrow, I think we could take another swipe at that 4200 key level. This I think is kind of key and if we close at 4180-4185 I think that is kind of still in margin of error but I do not want to see any thing beyond that in terms of weekly close.

If we hold this resistance around 4170-4200 on the SPY Emini side, look at the ARKK action here!

I think 45-46 on ARKK could be a good resistance if SPY were to run lower here, targets 35-36 IMO.

I think this was the action the bears wanted to see and I think they got it here today as long as they do not close the Day above 4170 tomorrow which will void my view. Tomorrow from risk event perspective we have the NFP which comes about an hour before the cash session open - if this comes in too strong, it may keep pressure on the Emini S&P500 for rest of the session.

Some other markets also look potentially constructive here

Gold for instance if can be kept below 1930-1936 area could help the bear cause.

Dollar had a good day which we had called for a couple days ago. I think Dollar could remain supported at 101 area.

From time to time I always share the markets I like to watch to keep a pulse on the S&P500 Emini

I will keep an eye out on AAPL. This gap around 146 was filled after hours. I think if we keep below 146-147 then the bears may have an upper hand in the session tomorrow.

This is it from me for now. Be back later with a weekly time frame post. Make sure you share and press the like buttons for visibility on Substack and other platforms to reach more traders like your self.

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.