Folks -

My primary bias from yesterday and Friday auction was bearish below 4130. We sold overnight from around 4100 to open the cash session below 4060. This was a trend downside day with about 60 handles lost from the open to close the Cash session near 4000. Below if the link to the plan if you have not already read it.

Some of the other names that did well were bearish bias on NSC from 235 to sell down below 225. I think as we approach some of these levels near 220, these could become decent levels for a railroad like NSC which are very few of the in the US anyways. There are actually only about 5 Class 1 railroads in the US and CA combined, and NSC is one of them. The barrier to entry is very high, I will say it is impossible in this day and age and a lot of railroads are Federally protected. I will be watching the tape for signs of support in NSC as it approaches some of these levels near 220.

Saw some good action on the bear side in BA which I first became bear near 220 and the stock today sold down into 205.

BABA was another name which I soured on at 100 with LIS at 105 and it traded down into 95 today with the 5 dollar move equal to my original LIS at 105.

For something like AAPL, which has absolutely not been able to go above my 156 LIS, we saw about 8 dollars shaved off the stock. AAPL is facing quite a few issues. They have tried to wean themselves away from China mainland based supply chain and explored some options in South Asia like India. These are major changes, trying to reverse decades of trends and will not be easy flip. It could take years. I see AAPL run into a lot of headwinds. I think AAPL remains one of the most vulnerable S&P500 stocks and I do not think it gets attractive for me until we begin seeing some prints below 120, ideally around 100. Now 150.

Saw good action in recession stock WMT which looks constructive if we are going to get into deeper slowdown.

Not only did WMT did well compared to the general market, we also saw a 10% sell off almost in Auto Nation AN and a gain of about 2% in CPB soups.

From the weekly plan, we also saw good action on the downside today in the homebuilders and the home builder stocks like XHB, HD, TOL, LEN etc

My blurb about that 70-71 on XHB still applies and should keep pressure on the general market I think unless this is overcome.

So we can see that even though the general market has been a snooze fest , there are still various moves shared by OrderFlow both on the up and down side pretty much every weekly plan.

Saw some good sell off in AMD. Where does this sell off come at? Orderflow levels near 85.

BTW on admin side note, few folks were not able to get in before the price hikes or were not onboard with this blog being bearish at 4200. Now at 4000, here is a one time special offer to get back in at far lower prices. Valid today!

This is a very nuanced story in few of the names like HD for instance. You have something like HD with relatively low valuations plunge 7-8% on a day like today, this does not generate a lot of confidence. What HD has going for it though is that a large majority of the home owners are at sub 5% rate and may not be selling their homes for longer. This may mean more remodeling and upgrades required over time. However on the downside, the housing market has many headwinds and rates is just one of them. I think on HD 307-310 could present resistance if visited. Now 295.

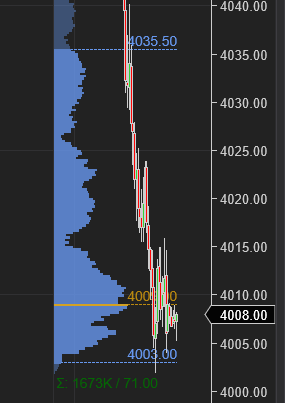

Circling back to the Emini S&P500, we saw a weak bounce at end of the day near 4000 weekly level for about 15 or so handles. While the sell off was slow paced, it was steady and this was the biggest down day in over 2 months.

Personally I think this could go a couple of ways.

We could see a couple of days of balancing here before breaking lower.

We could head higher back into resistance at 4100- IF we begin seeing some D1 (daily) closes here above 4030-4040 area.

In that sense, 4040 will be an important level to keep an eye on.

Scenario 1: I expect range bound action between 3985 to 4030/4040 .

Scenario 2: For a trend day, I will want to see some intraday closes above 4050 or below 3980. For intraday session, I like to use 30 min to an hour time frame to confirm or validate the levels.

At time of this post, we last traded near 4000. With this close today, we are now about 200 dollars off the 4200 level which I shared as resistance over 3 weeks ago!

These moves can always take a while to shape out, but the important fact is that we merely traded about 8 dollars above this 4200 resistance before crashing over 200 for longer time frames. This move is about a third of the way now to 3600 - with barely 8 points of trading above this key level with several failures to break out of it. Powered by OrderFlow and shared with traders like your self.

From a key events perspective, FOMC will be released at 1 PM CST. If you are a longer term reader of this blog, you will recall in Fall last year, the market was buying dips into any hawkish announcements or pronouncements from this FED. This trend I think has now reversed as we can see at multiple failures at 4200 that any dovish data are being sold upon any rips. I will not pay a lot of attention to FOMC technically unless we begin to see that close come in above 4050 for example.

~ Tic Toc

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.

Thank you Tic 🤩

Thank you for finally letting us know what you mean by intraday session close.