Traders-

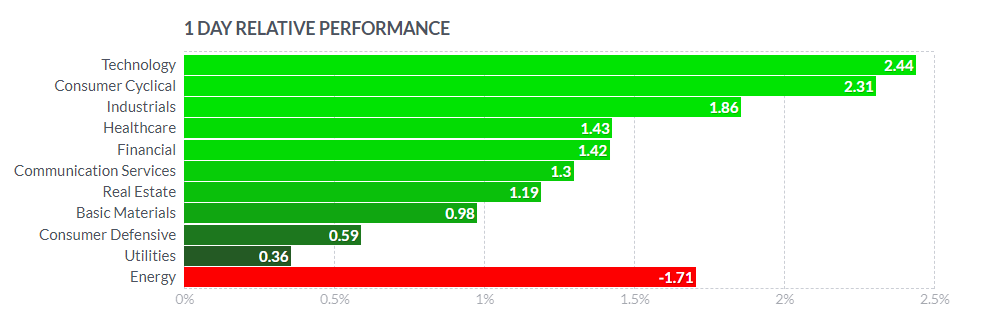

Today was an awesome day for overall breadth as almost all sectors with the exception of XLE staged an impressive rally. This has sort of become a theme of late- broader market likes it when XLE craters, and rallies when XLK rallies. XLK is the king of momentum and there is no S&P500 without the XLK.

Overnight news of de-escalation in Ukraine-Russia conflict helped propel S&P500 to trade almost 80 handles off yesterday’s close.

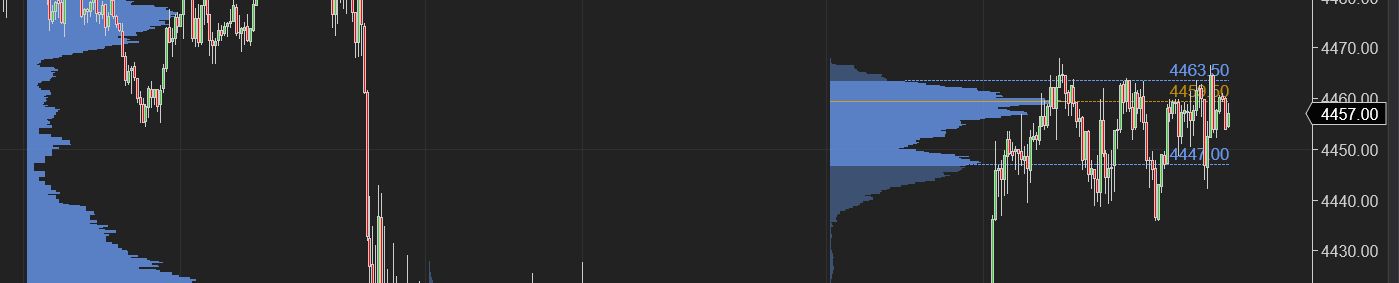

Personally for me , the primary expectation was if we opened below 4408 /4426 we will find sellers. My secondary expectation was that if we opened above 4426 we may trade 4452/4458. We did open at 4441 and secondary thesis is the one that played out with highs of the day around 4465, unable to quite take out the overnight highs.

Here is the link to yesterday’s trade plan: Yesterday's Plan

On the weekly time frame, my expectation was that 4350 will offer some support and will be hard to break. I also thought 4450-4500 offer resistance. So far the week is on track to be as expected. However if we start closing above 4500-4536 this week, that will be quite interesting. Read this higher time frame weekly plan first to understand the 10000 feet context along with other markets and MOPEX considerations: Weekly Plan

It was not strictly a good tradeable momentum day for me as I noticed only 600K lots traded as of this post. The current volatility has been lesser than my minimum threshold for intraday trades. The rally seemed forced, almost fake.

The good thing about 4426 LIS was I was not automatically looking to short the pop in the morning. It kept me on the right side of market. I did spend some time observing orderflow at the open before finding 4456 as a decent level for any bearish bets for me given risk to reward. After mid morning I remained bearish all day, with any rallies into 4456 getting sold. We closed the day very near 4456.

In mid morning I thought a break of 4456 may get S&P500 going on the downside. That level break was what caused some volatility in mid day, infact 4456 was a very key level for rest of the day. Break of this level briefly led us trading down to test 4435. At time of this post it has now retraced back to 4456 and trading above it at 4460.

In the last hour of trading, we had the President speak about Ukraine-Russia conflict. The speech again caused some volatility and my 4456 level played a key role for a few zippers. To the admin’s credit, they have done a decent job showing strength on this issue which is what the other party understands (very well), though I think some of the messaging could be better. I think next couple of days are crucial. I think we have not seen the end of this saga, we will soon find out.

Looking ahead at tomorrow, for this rally to last, it is going to come down to these stocks below IMO and their corresponding prints:

TSLA: has to open and remain above 920

MSFT: needs to open remain bid above 300

AAPL: opens and remains bid above 172

The reason for this is to confirm if this bounce today has legs or is just a dead-cat bounce. XOM on it’s part is down about 4 dollars off its highs- suggesting the main trend may be far from broken.

I personally think S&P500 market is right now in a bearish market in intermediate term on it’s way to test its lower bracket at 4200, and unless we start seeing some D1 closes above 4500-4536, I do not see that opinion change any time soon.

Now make no mistake this is a longer term bias and would not stop me from being bullish to neutral on an intraday basis. Especially on a day like today, with excellent breadth, do I think there could be a smaller time frame counter trends develop to the longer term bearish main trend? Absolutely.

BTW if you do not wanna miss out on my thoughts on these smaller and longer term trends in several markets, feel free to join my substack by entering your email below. A lot of content is available publicly and is 100% free (with few exceptions for pro stuff).

From yesterday’s trade plan, Triton TRTN had a very good day today, rising 10% to close above 68 today. I think this can have legs. Some of the other names shared this week like CMC and APTS both had very good day today. I actually like the airlines as well in which I was bullish on AAL at 17 which today crossed 19 dollars. I think it may have some juice left for it to test 21/22.

Here is the link to yesterday’s trade plan: Yesterday's Plan

Now obviously individual stocks depend quite a bit on the general market. What I did not like in general market was it’s inability to take out the overnight highs at 4468, despite many chances- I think this level plays a key role tomorrow.

On the +side, what I did like was that S&P500 Emini is finding balance here between the LVN from bi-nodal day we had on Friday. This was my key concern from Friday close and yesterday and I thought if this happened, this may risk bearish bets. It is happening now and I think we would be rallying even harder had we been able to take out that ON high above 4456 today.

So what am I watching tomorrow in emini?

Well, as I said , I think 4468 is going to be key. On top of that I need these 3 names to do well, as previously mentioned.

TSLA: has to open and remain above 920

MSFT: needs to open remain bid above 300

AAPL: opens and remains bid above 172

My MAIN price scenarios for tomorrow:

Scenario A: we open or bid above 4468 with Tic TOP making new highs, strong reading of 2/3. This is my bullish scenario with targets at 4496.

Scenario B: open or offers below 4440. This is going to be my bearish scenario with targets at recent lows 4403-4408.

Scenario C: An open between 4440 and 4468 is potentially a balanced trading scenario in IB followed by a likelihood in the PM that we attempt a breakout of 4468, fail and trade all the way down into 4380.

S&P500 Emini is now trading 4460 at time of this post.

What else?

Despite the rally in XLK today, I am not really finding a lot of compelling plays in Big Tech. I find these valuations extreme, given everything else. May be that changes next week , I don’t know. A lot of mid cap stocks I shared earlier in cyclicals, industrials, even financials continue to do very well. Whether that is a Tyson, LMT (which released some steam today), VALE, FCX, NEM, AXP etc.

A lot of these names are shared in my weekly newsletter under the Investor Tic section as they tend to be longer term . Stay tuned for more names in my upcoming posts.

Some of these tech names did quite well but they were mostly smaller caps like ASAN. This was shared by me at 62 but I was expecting much lower prices in it around 53 bucks. However, it took off from 62, last trading at 73. The good part it is on my list still and if it dips again, I may pull the trigger at 60/62 .

Booking dot com, BKNG, which I shared at 2400 had another good day closing around 2635. I think these travel stocks along with airline stocks look quite good. There is lot of pent-up demand for these services.

Not a big fan of Sin stocks in general, but I did add Phillis Morris to my WL (PM) as a potential dip buying candidate. It has very strong technical. It is at 110 right now, if the general market dips, I think I can get it around 103/104. My targets on PM will be 130/134.

This is it from me for now. Feel free to HMU if you have any questions.

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user, they own all copyrights to their products.

"A fake Rally", I was thinking that as well. Could not put my finger on it. Weekly plan is working. Thank You.

Scenario C is looking more likely during PM. Still early tho.

Also IB = initial balance, correct?