Daily Plan 2/10/23

Happy Friday Traders !

Let us dive into the intermediate and shorter term auction structure and what clues we may be able to glean from this action.

Readers know that on the weekly time frames, I have been bearish on this market and my key levels this week were 4200 and 4070. I have attached the weekly plan below for any one interested.

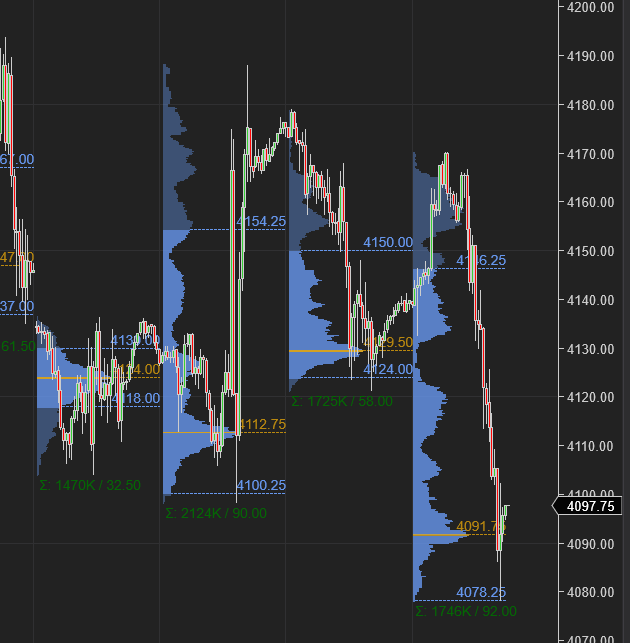

As of the close today, we saw multiple failures at 4200 this week and once we did break 4100, we saw the bounce come in at 4070, to close the session near 4100. In fact the close was at 4097.

The move today from a longer time frame perspective was not unexpected- in my Tuesday plan after Powell comments into 4200, I had highlighted this marked wanted to do a 3rd probe into 4100 and we saw that happen today.

Drilling down into the intraday auction- the session high today was exactly 4170. Not a tick above it.

However, as we sold down into 4140 level, I expected this level to hold for a move back into 4170.

This did not happen. We got a weak bounce off 4140 which was good barely for 15 handles and then we sold down some more. In fact we sold down all the way down into 4070 - before that last hour bounce.

With this, I do want to reiterate how I look at this market intraday - if I am a bull at 4140 intraday, I am not still a bull when we are trading down 15-20, 30 handles. Max risk or LIS that I am willing to take on intraday time frames is 10-15% of the intraday average ATR ( the range of the session). So if it is 60 points, then that is 6-9 points.

On an admin side note, I will be increasing the price again and any one who subscribes before that will not be impacted.

Now with that out of the way, I do want to reiterate that the longer term view I have on this market and some of the levels I have been talking about last week or two have not changed. You can read all about those in the link below.

I have myself been bearish on longer time frames with my weekly LIS at 4200 and there has been absolutely no trading above this level all week with all attempts at rally fail.

However, I have also been aware of the challenge this market has had going down below this 4100 level - today was a start but did not get to go much below 4070 which is yet another important level.

With the CPI on next Thursday , unless we get some closes here below 4100, we could remain range bound some more.

S&P500 levels were not the only thing that has been able to halt this market’s advance above 4200 but also some of the other names that I have been bearish on.

For instance, Bitcoin shed about 1500 dollars from my levels. CMG had a nice sell off. GOOG also sold off nicely off my levels. In CCJ, on a day like today, we saw a 5% upside day! MRK rallied from near 100 to over 107. BP stock is now up from 30 to about 40 and I think could have juice left. NOC up from 430 to 460. All shared with folks here in the Stack.

Due to these factors and related markets, I think the bears still do not have the all clear to resume that massive downtrend that many of us are expecting and may be some of us really wanting it badly.

For instance, look at TLT. It closed at 104 and change today. I personally think the market sell off will come but I think it will come below TLT 104.

For tomorrow, my key levels will be 4050 and 4120.

Scenario 1: Dips into 4050 could be bought for a retest of 4100.

Scenario 2: Rallies into 4115-4120 could be sold for a retracement back into 4080.

For directional moves, I think we will need an intraday close above 4120 or below 4050.

Longer term, I will touch more upon this in weekly note but please reread the weekly note. I think unless we begin making some daily closes here below 4100, we could retest 4200. Now 4090. I have been bearish on longer time frames of the 4200 level - however the challenge for this market will be to stay down below this 4100. It has been a spring board for a week or so now, we have had this 3rd probe which I had anticipated on Tuesday , but the action at the lows and related markets suggest we could see that 4200 unless we remain below this 4100 on the Daily time frames now. Similar story in SPY below.

Chart B below. Bears want some more closes here below 407 area- else we could want to retest 420 one more time to see what is out there.

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.