Daily Plan 1/25/23

Hey traders-

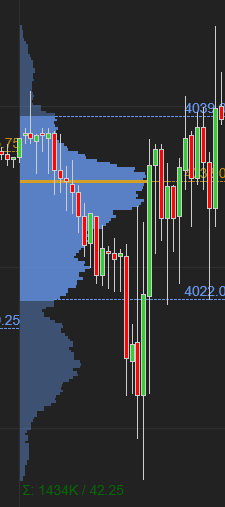

From last night’s plan, my call was that we could remain supported at 4000/4015 today in the cash session. Link attached below.

This was a good call as the market tried to take out 4000, failed miserably before rallying back into almost 4050.

This is around here, 2 hours into the open that I sent a Substack Chat for subscribers that we may have a hard time taking out 4040 and we could fall back into 4000.

While that 4000 did not come (in the session today), we did remain subdued below 4040 all day long.

There was a glimmer of hope post MSFT earnings that the level may be taken out, but no , no such luck as after brief excitement, all the gains were given back.

Speaking of the gains, during the cash session today, I had called for bearish action in Microsoft stock after the earnings- Microsoft did rally quite a bit from my levels after the ER, but since then has been subdued again below 240 area- a sharp drop from around 252 when I reiterated my bearishness on this stock. This whole 245-250 area is instrumental in MSFT. I think unless we begin seeing a few closes here above it, we could fall back below 230.

Will cover some Microsoft over the weekend along with AAPL and GOOG- Stay tuned.

Some folks have asked for a roll back in the prices as they did not get enough heads up before price increases - while I will not be able to do that, feel free to use the link below for a one off discount valid for one day.

My levels for tomorrow

For my longer term views on this market, check out the post below.

And this one as well.

Now, we have from news perspective the Canadian Rates tomorrow as well as the hotter than expected Australian inflation numbers that came our earlier this evening.

The dollar weakness story as mentioned last night is still a story.

So while I think these names like MSFT and AAPL remain bloated, it does not mean there are not enough folks buying into these names here at these levels for whatever reason. This is perhaps akin to TSLA at 330-350 when there was still a lot of rigor in TSLA a few months before it crashed to 100 dollar almost, losing about 70% of it’s value.

Today I think was perhaps one of the first few signs in the cracks appearing in recent counter trend rally.

With this said, my key levels for tomorrow will be 4000-4015.

Scenario 1: I think if we remain bid above 4000, we could see an attempt made at 4060, the break of which could target 4100.

Scenario 2: What the bears want is an IB close below 4000 which confirms my observation and we could target 3950 and below.

At time of this post we last traded near 4015. If the bears do not get a few closes here below 4000, this may shape up to be a failed breakout situation towards 4060-4100 area.

Updates will be shared in the chat room below.

~ Tic Toc

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them. The data, quotes and information used in this blog is from publicly available sources and could be outdated or outright wrong - I do not guarantee accuracy of this information.