Hi traders-

Today we finally saw some relief in hemorrhaging in the TSLA stock and we did see some signs albeit baby signs of what I have been saying for a while now- that the stocks like TSLA are oversold, and relative to stocks like AAPL they are oversold quite a bit.

The market voted in favor of this today with a sharp rally in TSLA at time of this post (it is up more than 5% ) and AAPL about 3% to trade near 126.

It will be interesting to see if this sell in AAPL intensifies as I personally think in the short to medium term China reopening could provide some support to this stock, though I think the export demand out of China will be soft as the world grapples with recession up next.

BTW if you have not yet, I recommend you read my weekly plan with some educational content for traders - weekly plan.

As a gentle reminder- I encourage all my readers to start their own substack. It does not have to be finance related - so let your creative juices flow and just begin writing on anything really: travel, business, cooking, hiking, camping, beauty ? Once you do, make sure you drop me a line with a link to your Substack as I would love to read your thoughts :)

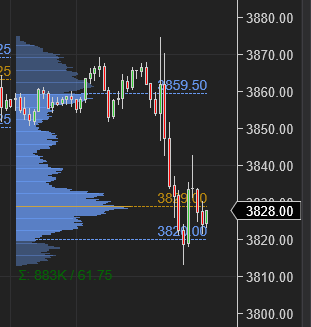

On the emini side today, my main bias was a balance session unless we closed the IB below 3820 or above 3860.

This is what turned out to be the case with the market bouncing between 3820-3860 for most of the day with about an hour to go in this session today.

Chart A shows how anemic the volumes this week really have been - I expect the volume to not pick up until that first week of January and I think that is where we may see some real moves in this market.

My levels for tomorrow

I like to be always upfront with folks with what I see personally as the major drivers behind price action- it does not mean I am right- but I like to share any reasons behind my current thinking and this is no different - I think what is weighing on this market right now is the AAPL stock with it being now below 130 level.

If you look at above long term chart of AAPL, chart C, you can appreciate this is a bearish development of this stock in my view. This is something I have been warning ever since this stock was 180 dollars.

With this weekly close here below 130, I think any rallies on AAPL stock may be sold.

I think there may be some support at 120 but longer term I favor this stock to be below 100. I think this is one of the most expensive stocks in S&P500 and I think it can release some steam by being below 100 dollars.

What are your thoughts about a 2 trillion dollar consumer gadget company in potentially incoming recession?

My key levels tomorrow will be 3820 & 3860.

Scenario 1: if IB close is above 3820 and below 3860, I expect more range bound action here.

Scenario 2: I expect directional trend day if we close the IB below 3820 or an IB above 3860 with targets at 3780 and 3900 respectively.

This is it from me for now. Much more to come, stay tuned!

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Ninja Trader, Think or Swim and/or Jigsaw. I am just an end user with no affiliations with them.

Still think 4050 is in the cards?

Thanks tic. Tic please use chat feature more often as that helps paid subscribers to stay grounded to substack to get updates. Thank you!