Traders-

My weekly plan called for bearish close on Friday at 4620. Sunday night we opened at 4620. The high of the session was 4620, not an inch more. The 4620 level has stayed high this week as well at the time of this publication.

This is a link to my Weekly Plan with my levels and thinking: Tic Toc Weekly Thought

This AM around 5 AM I sent this orderflow update with updated levels. At time of this post, both my targets just hit for a little over +30.

My levels are in Section B. Section A describes my current understanding of what is driving these markets as well as my longer term expectations. Scroll down to Section B which is more tactical trading, if you are in a hurry.

A) What is driving the markets right now?

Profit taking ahead of perceived volatility.

Omicron fears.

Rug pull from stimulus

While we have no control over how or when any one wants to take his or her profits, we do have some math to predict at what point the Omicron fears may subside. Or confirm the worst of the fears!

That date is the first or second week of January.

The variant is much milder but is up to 70 times more virulent. Even if the virus spares the young and the healthy with no or little symptoms, it may still end up overwhelming the hospital system with those who are not in such a good shape and have other comorbidities. The hospital surge based on the current incubation and virulence rates may (or may not) come by January 10/15th. So this is some of the math adding to uncertainty for the markets.

Technically, the market is at a point where it must hold these lows. We have the prior monthly lows from November. We are very close to those. Once these lows get taken out, we start testing other order flow levels. In particularly I am concerned if we close below 4500 this week, sub 4300 becomes a magnet for S&P500. Once we start trading these 4400 prints, I think the market regime shifts from Buy the Dips (BTFD) to Sell the Rips (STFR!) .. Some traders and algos probably already have adapted to do this! Yet again, I am not in this camp right now. For me, sustained S&P500 selling begins once we start closing below 4500s at the weekly time frames. For now I do have the resistance levels marked above 4600. But I am not fully committed bear yet. All else remains equal, FED rate will be 2.25% at end of 2023. S&P500 has sold off almost 5 % already to chase the FED rate of 2 percent, 2 years down the road, which may or may not even happen!

Markets are also in mourning phase for the loss of stimulus. Remember this was substantial stimulus, if you have 2-3 kids, you were looking at almost 10 grand a year! That is a lot of money. So there is that, however I think once market comes out of this mourning phase, it will realize the loss of stimulus is probably a good thing for the inflation question and may lead to FED easing. We will see, too early to tell. At least the yields agree with me.

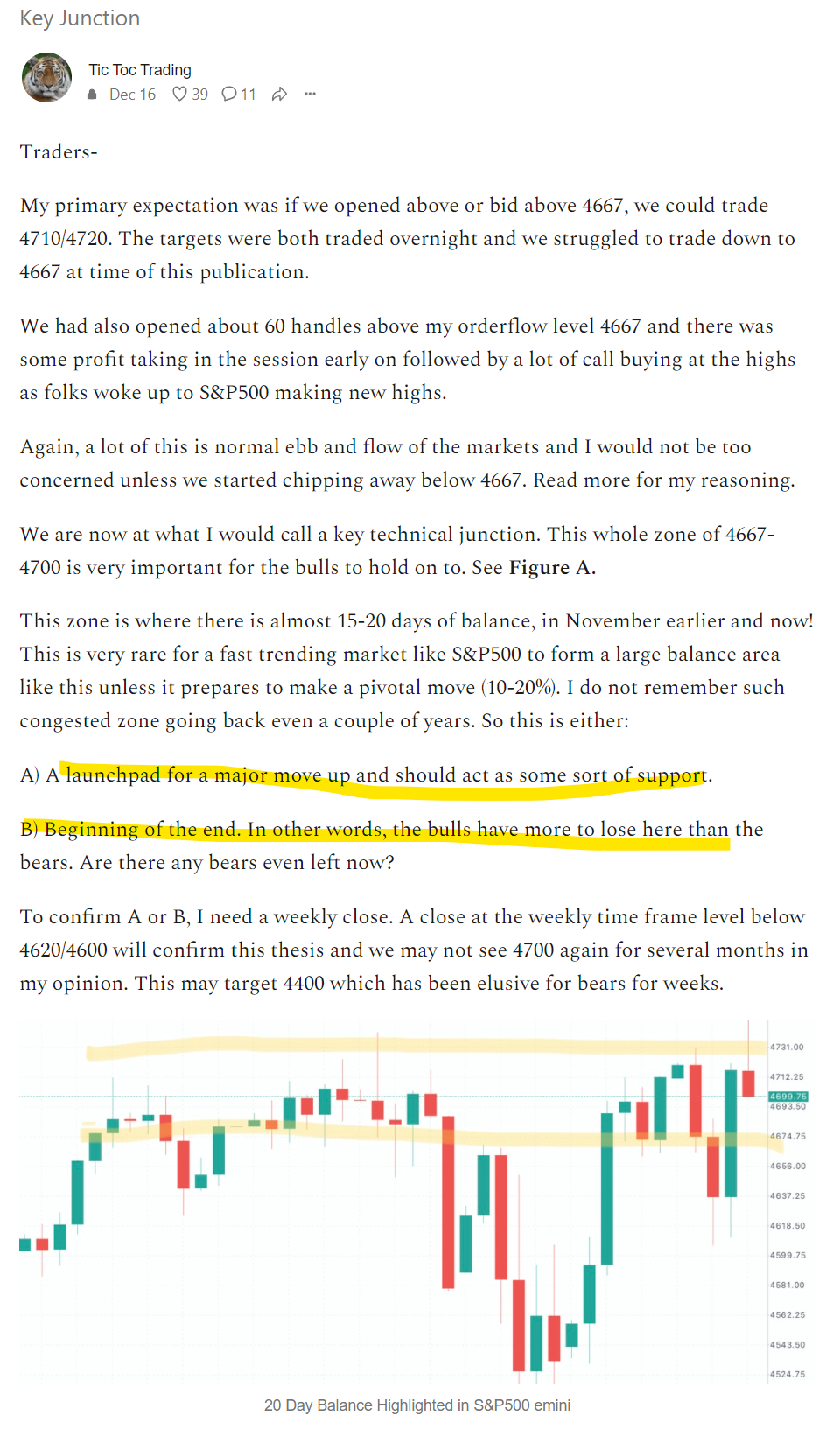

These order flow levels are potent, even if we choose to close our eyes and ignore them. Here (Figure A) is what I had to say about 4667/4700 and the volume shelf forming there. In hindsight, this level provided too much for S&P500 to overcome. Now trading about 200 handles lower.

B) With this context and background, here’s My Plan and Levels for Tomorrow:

My LIS is the RTH session open today at 4553.

As long as we open or offer below 4553 tomorrow, I want to remain bearish and look for sells. My target will be 4496 order flow level.

If we manage to open above 4553 or bid above 4553, I will lean slightly bullish in this case and look for dips above 4553, targets will be Friday’s order flow levels 4620-4622.

Fundamentally, I am not yet in the camp of a longer term bearish market. I think the market still has room to run up-to 4800/4850. However for that to happen, a lot of technical damage has to be resolved. At the time of this post my RTH levels of 4525 just traded.

I write almost every day, Monday thru Friday to my subscribers. If you like my post and want to get an email whenever I publish something, make sure you subscribe!

For the subscribers, I am wrapping up a couple of educational posts which should be released fairly soon for holiday reading!

Have a great day and stay safe!

~ Tic

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms.

thank you Tic !

Thank you so very much Tic!